Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up!

|

| Let us lead you |

When full enrollment data for the ACA marketplace in 2023 came out last spring, I expressed concern that the percentage of low-income enrollees forgoing strong Cost Sharing Reduction (CSR) subsidies, which are available only with silver plans, had risen to an all-time high. This in spite of the fact that since March 2021, the two cheapest silver plans in a given marketplace have been available for zero premium for enrollees with income up to 150% of the Federal Poverty Level, and for no more than 2% of income for enrollees with income in the 150-200% FPL range.

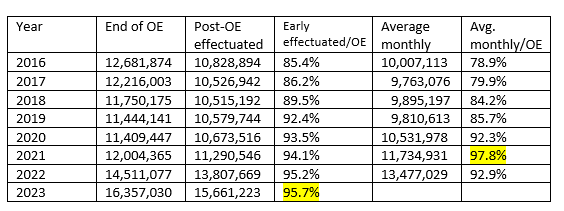

The table below shows metal level selection at the two income levels at which “strong” CSR is available in every year since 2017, the peak year for silver plan selection. (A weak version of CSR is available in the 200-250% FPL.)

CSR raises the actuarial value of a silver plan from a baseline of 70% (with no CSR) to 94% at incomes up to 150% FPL and to 87% at incomes in the 150-200% FPL range. Most low-income enrollees who forgo silver plans choose bronze plans, with an AV of 60%; a small but rising number choose gold, with AV of 80% (in about 10 states, gold plans can be cheaper than silver plans).

Virtually the only reason to pass up CSR at incomes up to 150% FPL is if the enrollee wants a more expensive insurer’s silver plan — i.e., in most cases, one with a more robust provider network — and finds it unaffordable. In June, I posited that the percentage of low-income enrollees choosing metal levels other than silver may be rising because of increasing prevalence in the ACA marketplace of ultra-narrow networks. That is, more enrollees may be forgoing CSR with eyes wide open.

Another possible cause of lower CSR takeup may be sheer confusion, as the number of plans on offer in most markets has proliferated to a ridiculous extent, only slightly trimmed back in 2024, thanks to a modest new curb on the number of plans an insurer may offer at each metal level.

In the Open Enrollment Period for 2024, officially kicking off next Wednesday (Nov. 1), we may get some clues as to the extent to which bronze selection at low incomes is due to inadvertence. For 2024, in the 32 states using the federal exchange, HealthCare.gov, CMS has undertaken* to push some low-income bronze plan enrollees into CSR silver:

New for PY 2024, the Marketplace has updated the automatic re-enrollment process to help more consumers take advantage of cost savings. Specifically, the Marketplace will automatically re-enroll certain income-based cost-sharing reduction (CSR)-eligible enrollees who would otherwise be automatically re-enrolled in a Bronze plan into a Silver plan. This automatic re-enrollment will apply only for consumers who do not make an active plan selection on or before the deadline for January 1 coverage, and only if a Silver plan is available in the same product type, with the same provider network, and with a monthly premium after premium tax credits that is no greater than that of the Bronze plan into which they would otherwise be automatically re-enrolled.

Those in “dominated” bronze plans who log on and re-enroll actively “will see the Silver plan highlighted in the online shopping experience if they return to HealthCare.gov on or before December 15 to review their options.” So there are two layers to this effort: a cross-walk (with opt-out) for those who remain passive, and a strong nudge for those who log on and newly assess available plans.

State exchanges may implement the CSR crosswalk if they so choose. Covered California did so beginning in plan year 2022, and Massachusetts auto-enrolled some enrollees in ConnectorCare (silver plans further enhanced by supplemental state subsidies) in 2023.

How many enrollees may be affected by the CSR cross-walk?

For a silver plan premium to be “no greater than” that of the bronze plan from which the enrollee will be switched out, the silver plan must be available for zero premium, as is the case for the two cheapest silver plans in every marketplace for enrollees with income up to 150% FPL. In a few cases, the cheapest plan in a given market may be zero premium at incomes above 150% FPL, and enrollees in a bronze plan from the same insurer with the same network may be auto-switched. For the most part, however, the new policy affects enrollees with income below 150% FPL.

In 2023, of the 5.6 million OEP enrollees in HealthCare.gov states with income in the 100-150% FPL range,** 1.1 million selected bronze or gold plans. Among re-enrollees (as opposed to new enrollees) in that income range, 3.0 million enrolled actively and 1.0 million were auto re-enrolled. For the three quarters of re-enrollees who actively re-enroll, a sharp prompt will push them toward silver if a silver plan from the same insurer with the same network is available at zero premium.

In 2023, the total number of re-enrollees in HealthCare.gov states (9.2 million) was about 90% of the enrollment total for 2022 (10.3 million). We might therefore expect some million non-silver current enrollees with income under 150% FPL to re-enroll (many of them will have enrolled after OEP for 2023, as marketplace turnover is constant, and enrollment is available year-round for those with incomes up to 150% FPL). The wild card is how many of those bronze or gold plan enrollees are in plans from insurers that offered the cheapest and second-cheapest silver plans in their area — and with the same network as the bronze plan the enrollee chose.

We’ve been here before

Covered California, the largest of the state exchanges, enacted the crosswalk to CSR silver in 2022, estimating*** that 32,000 bronze plan enrollees could get a $1/month silver plan from the same insurer (no plans in CA were $0 premium at that time). I looked at the results in April 2022. Silver plan takeup at incomes below 150% FPL ticked up modestly, by about 3 percentage points from 2021 — and that in the year when silver plans became free at incomes up to 150% FPL. In California in February 2022, 16,990 subsidized enrollees out of a total of 258160 with income in the 138-150% FPL range (6.6%) selected bronze plans. In June 2021, the nearest date for which I can find a comparison, 20,270 subsidized enrollees out of 215,490 with income up from 150-200% FPL (9.4%) were enrolled in bronze. In 2023, bronze selection among the subsidized crept back up to 7.9% (19,080 out of 241,350).

At the time of that estimate, in June 2021, only about 28,000 bronze plan enrollees enrolled via Covered California (including those with income under 138% FPL) had incomes under 150% FPL. I presume the analysis found that a considerable number of the 85,550 subsidized bronze plan enrollees in the 150-200% FPL income bracket could also get a free silver plan — possible, as there has been a wide price spread between cheapest and second-cheapest silver in some California rating areas in some years. From 2021 to 2022, the percentage of subsidized enrollees in the 150-200% FPL income bracket in California who selected bronze plans dropped from 19.1% to 15.2%, and held steady in 2023 at 15.1%. Again, though, subsidized silver plan premiums dropped dramatically from 2021 to 2022, thanks to the subsidy enhancements in the American Rescue Plan Act.

Effects may be stronger in HealthCare.gov states, as a much higher percentage of enrollees have income below 150% FPL, thanks to the nonexpansion states. Also, I don’t believe that Covered California implemented the heightened prompt to choose CSR silver for those who actively re-enroll. On the other hand, Covered California’s shopping tool does “default to silver” — that is, show silver plans at the top of the list of available plans — when silver plans are available for zero premium.

Do brokers need a prompt?

When assessing the possible impact of the CSR crosswalk (and strong nudge for active enrollees), it’s important to keep in mind that most ACA marketplace enrollees do not act alone, and many enrolled in the HealthCare.gov system never look at a HealthCare.gov screen. 71% of active re-enrollees in HealthCare.gov states were assisted by brokers or nonprofit enrollment assisters in 2023, as well as 58% in California and 76% in New York. A large majority of brokers use commercial e-broker platforms (enabled for “Direct Enrollment” or “Enhanced Direct Enrollment”), not the HealthCare.gov interface. HealthSherpa, the largest e-broker, alone accounted for 35% of enrollments in the HealthCare.gov system in 2023. The e-brokers are required, however, to follow form with HealthCare.gov in the CSR crosswalk, and to provide the enhanced “nudge'“ toward silver for active re-enrollees.*** Whether a significant number of brokers need such prompts to avoid placing their clients in dominated plans is an interesting question.

- - -

* A crosswalk to silver from dominated plans was proposed in a 2021 article by David M. Anderson, Petra W. Rasmussen and Coleman Drake.

** In the ten states that have not yet enacted the ACA Medicaid expansion (soon to be nine, as NC is expanding on Dec. 1), all of which use HealthCare.gov, eligibility for ACA marketplace subsidies begins at 100% FPL. In states that have enacted the expansion, eligibility begins at 138% FPL; below that threshold, enrollees are eligible for Medicaid. A large majority of enrollees with income below 150% FPL are in the nonexpansion states, most of them in Florida and Texas.

138,000 enrollees in HealthCare.gov states in 2023 had incomes below 100% FPL. Legally present noncitizens subject to the 5-year federal bar on Medicaid eligibility are eligible for marketplace subsidies even if their income is below 100% FPL. I have left enrollees with income below 100% FPL out of the HealthCare.gov calculations above because a fairly large percentage are subsidy-ineligible.

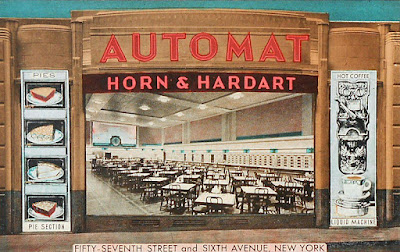

*** HealthSherpa, which like many platforms will foreground silver plans for user eligible for strong CSR, provides this screen for such enrollees if they opt for another metal level:

.jpg)