Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up!

CMS just dropped its Effectuated Enrollment Early 2023 Snapshot and Full Year 2022 Average — a document I’ve been eagerly awaiting.

To my eye, the main takeaway is that in the second full year of enrollment after the American Rescue Plan Act (ARPA) boosted ACA marketplace subsidies, retention and off-season enrollment remain impressive. That’s reflected in average monthly enrollment for 2022 as well as early effectuated enrollment for 2023.

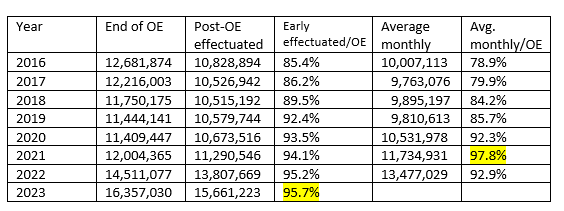

Year-over-year, from 2022 to 2023, early effectuated enrollment (enrollment as of the first month when premiums were due for all who selected plans during the Open Enrollment Period, or OEP) increased by 13.4% — more than the 12.7% year-over-year increase in plan selections during OEP, as the percentage of OEP plan selectors who effectuated enrollment reached an all-time high. That increase in retention of OEP signups continues a long-term trend.

The table below shows the ratios of early effectuated enrollment and average monthly enrollment to OEP signups since 2016.

ACA Marketplace Retention, 2016-2023

Back in 2016 — the marketplace’s peak enrollment year before ARPA (and Covid) changed the calculus — the snapshot of early effectuated (paid-up) enrollment was just 85% of the total for plan selections as of the end of OEP, compared to 96% in 2023. The improved effectuation rate puts adds new perspective to enrollment growth in the post-ARPA era. While plan selections in OEP are 29% higher in 2023 than in 2016, early effectuated enrollment is 45% higher (almost 5 million higher). Average monthly enrollment will likely follow suit.

On-exchange enrollment gains since ARPA enactment need to be considered in light of a collapse in off-exchange ACA enrollment that occurred in the wake of steep premium increases in 2017 and 2018. Off-exchange enrollment dropped from 5.1 million in Q1 2016 to 2.0 million in Q1 2019, according to Kaiser Family Foundation estimates. 2023 is the first year since 2016 in which it can be stated with confidence that enrollment in ACA-compliant individual market plans is at an all-time high.

Retention improved steadily through the Trump years — probably because reduced advertising and outreach, coupled with a shortened OEP, filtered out more marginal enrollees — as did, perhaps, the zeroing out of the individual mandate penalty in 2019.

Also contributing: Silver loading — the pricing of the value of Cost Sharing Reduction (CSR) subsidies directly into silver plans, which began in 2018 after Trump cut off separate reimbursement of insurers for CSR (see note below). Silver loading sharply increased the number of enrollees paying zero premium. To drop a zero-premium plan, you have to take positive action.

In March 2021, ARPA put free or near-free enrollment on steroids, making benchmark silver plans free at incomes up to 150% FPL and reducing their cost at every higher income level. As of the end of OEP for 2023, 4.5 million enrollees with income up to 150% FPL, for whom the two lowest-cost silver plans are free, had accessed silver plans (though some are paying premiums for more expensive silver plans). Many millions more accessed free bronze plans. 35% of all enrollees as of the end of OEP 2023 selected plans with premiums of $10/month or less. Among those who effectuated enrollment, that would come to about 5.5 million.

One possible contributor to the continued high ratio in 2022 of average monthly enrollment to end-of-OEP enrollment is the rule, enacted in early 2022, allowing enrollees with income up to 150% FPL to enroll year-round. The ratio of average monthly enrollment to end-of-OEP enrollment was extraordinarily high in 2021 because of an emergency Special Enrollment Period, overlapping with enactment in March 2021 of the ARPA subsidy boosts, that effectively created a second OEP from February through August (with some variation in state-based marketplaces). The SEP attracted 2.1 million enrollments in that time frame, an extraordinary one-time surge. It’s worth noting that the ratio of average monthly to end-of-OEP enrollment in 2022 dipped only modestly below the 2021 unicorn.

The ratio of average monthly enrollment to initial OEP plan selections may also prove to be very high, as a result to the end of the 3-year pause in Medicaid disenrollments. The Medicaid “unwinding,” which some states began in April, is setting off multiple alarm bells, as some states are gleefully kicking people off Medicaid as fast as they can process them. Medicaid disenrollment does trigger a SEP for marketplace enrollment, and some states at least are working hard to effect a warm handoff from Medicaid to marketplace.

One other point worth noting: Enrollment in plans with Cost Sharing Reduction (CSR) increased at a lower rate year-over-year, 11%, than overall enrollment, which increased by 13%, and enrollment with premium subsidies, which increased by 15%. That is, the percentage of enrollees who accessed CSR, available to low-income enrollees who selected silver plans, diminished, while bronze plan enrollment has increased. This post and this post explore potential explanations for this drop in takeup of the valuable CRS benefit.

—

Silver loading is an ACA marketplace pricing practice that began in 2018, the first plan year after Trump cut off direct reimbursement of insurers for the value of Cost Sharing Reduction (CSR) subsidies, which attach to silver plans only. The cutoff induced most states to direct insurers to price CSR into silver plan premiums only. Since ACA premium subsidies are set to a silver plan benchmark, premium subsidies rose along with silver plan premiums, creating relative bargains in bronze and gold plans. Silver loading made zero-premium bronze plans widely available at incomes up to (and beyond) 200% FPL.

Postscript. Back in 2014, as marketplace signups surged toward the end of an extended OEP, recovering from the initial disastrous launch of HealthCare.gov, ACA antagonists (and Republican House members) pointedly noted that signing up for coverage during OEP did not entail effectuating enrollment: “But how many have paid?” was a major trolling theme. Charles Gaba, who engaged heavily in that 2014 infowar, recounts it today while processing the effectuated enrollment snapshot. Charles also digs into the nuances of what early effectuated enrollment signifies (it may include a bit of post-OEP SEP enrollment) and differences among states.

No comments:

Post a Comment