Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up!

|

| "The IRA saved me $103 in Part D OOP!" |

The Biden administration is rightly broadcasting the out-of-pocket savings that the Inflation Reduction Act will yield to enrollees in Medicare Part D prescription drug plans. That said, the headline claim in the White House fact sheet turned my head:

New data shows nearly 19 million seniors and other Medicare beneficiaries will save an estimated $400 per year in prescription drug costs because of President Biden’s out-of-pocket spending cap

Thanks to President Biden’s Inflation Reduction Act, out-of-pocket spending on prescription drugs at the pharmacy will be capped at $2,000 per year for Medicare Part D enrollees starting in 2025. Today, the Department of Health and Human Services (HHS) released data showing that 18.7 million (or 1 in 3) seniors and people with disabilities who are enrolled in Part D plans will save, on average, $400 per year when the $2,000 cap and other Inflation Reduction Act provisions go into effect in 2025. And some enrollees will save even more: 1.9 million enrollees with the highest drug costs will save an average of $2,500 per year starting in 2025. Overall, the law’s Part D benefits provisions will reduce enrollee out-of-pocket spending by about $7.4 billion annually.

Is there a pithy way to say that averages smooth out a lot of variation? Savings from the IRA’s changes to Part D are (appropriately) weighted toward a few million enrollees with really heavy out-of-pocket exposure.

The IRA delivers a powerful benefit to Part D enrollees whose out-of-pocket spending under current law would exceed $2,000. That’s probably about 3 million enrollees.* Its strongest benefit goes to those who would have entered the “catastrophic coverage phase” under current law, which in 2022 occurred when an enrollee (if not eligible for a Low Income Subsidy, or LIS) had spent just shy of $3,000 out-of-pocket. In the catastrophic phase, an enrollee pays 5% of the remaining cost of the drug until year’s end. According to the ASPE brief, about 1.1 million current enrollees would pay more than $3,000 (roughly the catastrophic threshold) in 2025 under current law. The IRA also caps enrollee insulin payments at $35/month, and ASPE estimates that 230,000 insulin users will save $1,000 in 2025 thanks to the IRA. The new law also eliminates co-pays for vaccines recommended under Medicare coverage rules, and it extends the full LIS benefit to enrollees who previously received a partial LIS benefit.In short, the IRA delivers a very substantial benefit to a number of enrollees in the low single-digit millions. So whence the 18.7 million beneficiaries deriving an average benefit of $400? Let’s look at the breakdown in the HHS ASPE brief that provides the analysis..

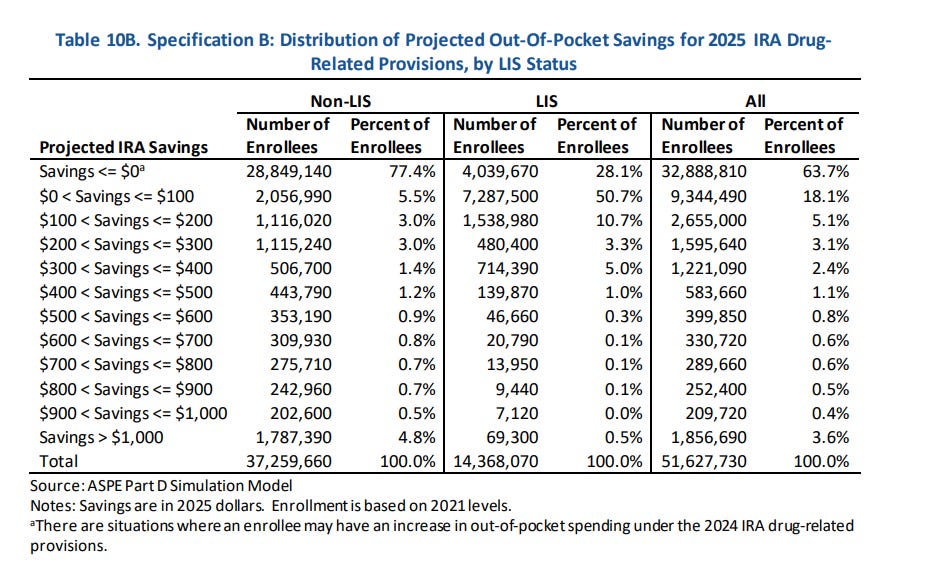

A note re the table below (p. 23 in the ASPE brief): The LIS category refers to Low Income Subsidy recipients (28% of Pard D enrollees), who paid an average of just of just $52 out of pocket in 2022. The aforementioned partial LIS beneficiaries, however, currently pay 15% coinsurance up to the catastrophic threshold, and the IRA will remove that exposure in 2024.**

Of 18.7 million estimated beneficiaries of the IRA changes, almost exactly half receive estimated savings of less than $100. While by ASPE’s estimate the IRA delivers an average (mean) benefit of a bit under $400 to 18.7 million enrollees, the median benefit is slightly over $100. The new law delivers more than $400 to just shy of 4 million people, and more than $900 to about 2 million, per ASPE’s estimates. For those who do save more than $1,000, the average benefit is about $2,500. For the highest-paying 10% — about 186,000 enrollees— the average savings exceed $4,000.

I don’t mean to minimize the Part D benefits created by the IRA. The change in law delivers major financial benefits to millions, life-altering benefits to hundreds of thousands whose medical conditions require the most expensive drugs — and a vital risk management benefit to all of us, as an uncapped drug benefit can ultimately afflict almost anyone with major financial exposure.

I do think, though, that touting the averages in the way the administration does gives a somewhat distorted picture.

—

* 3 million-plus enrollees with out-of-pocket exposure exceeding $2,000 is my estimate. ASPE specifies that 1.1 million non-LIS enrollees would exceed the catastrophic cap under current law. A bit less than 2/3 of enrollees who hit the cap annually are LIS enrollees (who mostly pay very little — other payers assume their OOP costs). Under the IRA, the brief states that the total number (LIS and non-LIS) who reach the catastrophic cap — lowered by the IRA to $2,000 — would rise from 3.8 million under current law to 9.5 million — an increase of 5.6 million whose OOP costs would range between $2,000 (the cap they’re exceeding) to about $3,300 (the cap under current law in 2025). Of those, a bit more than a third, around 2 million, are likely non-LIS, with another 1.1 million incurring costs exceeding the current-law cap.

** Thanks to Juliette Cubanski at KFF for pointing out to me where the big savings for some LIS enrollees come from.

No comments:

Post a Comment