Subscribe (free) to xpostfactoid

Kudos to health insurance analyst and advocate Stan Dorn and actuary Greg Fann for selling the New Mexico Office of the Superintendent of Insurance on strict silver loading in advance of Open Enrollment for 2022.

In brief, the Superintendent required marketplace insurers to price silver plans on a par with platinum, since silver plans, thanks to Cost Sharing Reduction (CSR) subsidies, do have platinum-equivalent actuarial value for enrollees with incomes up to 200% FPL. The directive is meant to be a self-fulfilling prophecy: if gold plans are cheaper than silver plans -- and in New Mexico in 2022, gold plans were 10% cheaper on average -- no one with income over 200% FPL should buy silver plans, which have a lower AV than gold plans. In that case, the average AV for silver plan enrollees will indeed be platinum equivalent.

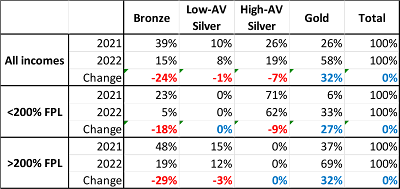

New Mexico didn't quite get there, but came close. In Health Affairs this week, Stan Dorn analyzed the results, spotlighting a massive decrease in enrollment in bronze plans, which have deductibles averaging more than $7,000:

Dorn argues forcefully that New Mexico's pricing directive should be adopted nationally, explaining in detail the flaws in CMS's risk adjustment formula for marketplace plans that favors silver plans, incentivizing insurers to underprice them, and urging a fix.

All that said, while metal level selection at incomes above 200% FPL in New Mexico is an unbridled triumph, there's a caveat to the drop in bronze plan enrollment at incomes below 200% FPL (the middle row above). Bronze plan takeup at low incomes would have dropped significantly in any case -- and did drop nationally -- because the Open Enrollment Period for 2022 was the first (and possibly the only) OEP in which the premium subsidy enhancements provided by the American Rescue Plan were in effect. Those subsidy boosts made benchmark silver coverage free at incomes up to 150% FPL and available for 0-2% of income for enrollees in the 150-200% FPL range. In HealthCare.gov states, bronze plan selection dropped by 2 percentage points in the 100-150% FPL income range and by 8 percentage points at 150-200% FPL from OEP 2021 to OEP 2022.

The bronze selection decrease at low incomes in New Mexico was much sharper. But far too many enrollees at income below 200% FPL switched into gold plans rather than silver, which have far lower out-of-pocket costs than gold plans at incomes below 200% FPL. This is no knock on New Mexico pricing practices, but rather on presentation flaws on the newly minted state exchange, BeWellNM. The New Mexico exchange does not emphasize the availability of CSR at low incomes. The display, uniquely among ACA exchanges, buries the annual out-of-pocket maximum for each plan (you have to go two clicks in from the top-line display for each plan to find the OOP max) -- and OOP max is where the silver advantage is sharpest, topping out at $2,900 for high-CSR silver compared to $8,700 for gold.

Worst, the site has a malfunctioning total cost estimation tool, which apparently uses the unsubsidized premium to estimate "costs in a bad year," completely obscuring silver plans OOP max advantage. (I described these flaws and their effects, with screenshots, in this post.)

The result: silver plan selection at incomes below 200% FPL was just 62% in New Mexico in 2022, compared to 81.5% nationally and 80% in the thirteen state-based exchanges that enroll people with incomes under 200% FPL and provide metal level choices broken out by income. (Those totals are based on my calculations from CMS's Public Use Files and omit the 1.6% of enrollees with income below 100% FPL).

The 5% bronze selection in New Mexico at incomes below 200% FPL is a sterling accomplishment. But most of the 33% of enrollees in that income bracket who selected gold plans should be in silver. For some, getting a cheaper gold plan from a desired insurer might be worth the extra out-of-pocket exposure, which might be in the $5,000-6,000 range (as discussed here). But most would be better off in silver.

ACA metal level structure is confusing, as bronze, gold and platinum actuarial value is fixed at all incomes whereas as silver plans come with no less than four different AVs, depending on income. The fact that silver plans can be worth more than gold -- as they are for slightly more than half of marketplace enrollees -- is deeply counterintuitive. Display matters. For enrollees with income under 200% FPL, silver plans should be displayed at the top of results. OOP maxes should always be clearly visible, and defined via mouseover. The availability of CSR and its impact should be heavily signposted.

Gold plans should be consistently cheaper than silver plans nationally, as Dorn argues (and as David Anderson and I have also done). If metal levels are priced as in New Mexico, plans with an AV of at least 80% (gold) should be available at a premium at or below the benchmark against which subsidies are set. To maximize the value available, however, decision support on most exchanges also needs to be improved.

Update from Stan Dorn (click through for essential gif):

...In yet another brilliant, creative NM policy innovation, they are labeling all high-AV products as “turquoise,” a favorite NM color that will easily signal the highest value options for each consumer

Subscribe (free) to xpostfactoid