Subscribe to xpostfactoid

A core Democratic party campaign promise was to "build on" the Affordable Care Act -- which at a minimum means making coverage obtained in the ACA marketplace far more affordable. The party now has the narrowest possible majority in the Senate, along with a narrowed majority in the House, and the presidency. To what extent will they deliver, and by what means?

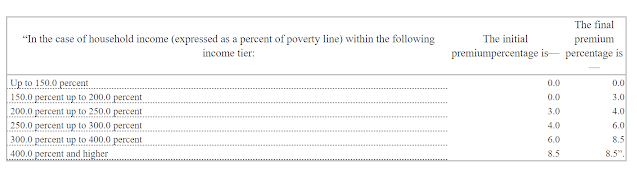

As noted in the last two posts, the current mainstream Democratic proposal, as expressed in the Affordable Care Enhancement Act that passed the House last June, includes generous boosts to ACA marketplace subsidies at every income level, capping premiums for a benchmark silver plan at a maximum of 8.5% of income, no matter how high the income. Those "enhancements" may well get watered down in legislation that must pass via reconciliation with zero defections from the most conservative party members.

Whether in place of or to complement legislation, the Biden administration can take regulatory action on multiple fronts that would have a major impact on the coverage that marketplace enrollees get for their money. Stan Dorn and Frederick Isasi of Families USA recently proposed some half-dozen regulatory measures to improve affordability, along with other steps to streamline enrollment and expand eligibility.

Here I want to focus on one arcane-sounding proposal, described briefly in the Families USA package, that could radically (or not so radically) increase the value of coverage at each of the ACA's metal levels. Those levels are set by "actuarial value" (AV), the percentage of the average enrollee's yearly costs that a plan is designed to cover, as determined by a formula promulgated by a division of CMS. By statute, plans in the ACA marketplace conform (with some wiggle room) to four AV levels: bronze (60% AV), silver (70% AV), gold (80% AV) and platinum (90% AV).

Revaluing AV

The regulatory action in question, conceived by health insurance professional Gabriel McGlamery and healthcare policy researcher David Anderson, is to change the basis by which the AV of plans at the ACA metal levels is calculated by excluding enrollees with predictably high costs from the calculation. Doing so would raise effective AV at each metal level.