Subscribe to xpostfactoid

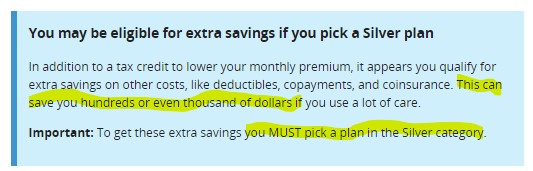

The message above, provided to shoppers on HealthCare.gov who estimate low incomes, isn't enough to keep a significant number of low-income enrollees out of bronze plans.

My last post focused on the stubborn persistence of significant bronze plan selection among low-income enrollees in the ACA marketplace in 2022, despite the fact that premium subsidy increases provided by the American Rescue Plan Act made the benchmark silver plan with strong Cost Sharing Reduction free to enrollees with incomes up to 150% FPL, and much cheaper than in previous years for those with incomes in the 150-200% FPL range.

Among enrollees with income between 100% and 150% FPL, 14% -- more than 600,000 -- selected bronze plans for 2022. While bronze plan selection at incomes in the 100-150% range did tick down a bit from the prior year, it remained higher than in any year prior to 2021.

President Biden's January 28, 2021 Executive Order 14009, “Strengthening Medicaid and the Affordable Care Act," declares, "it is the policy of my Administration to protect and strengthen Medicaid and the ACA and to make high-quality healthcare accessible and affordable for every American." Bronze plans obtained by people with income below 150% FPL do not advance that policy.

Bronze plan single-person deductibles average over $7,000, compared to under $150 for silver plans as enhanced by the CSR provided to enrollees with incomes up to 150% FPL. Annual out-of-pocket maximums in bronze plans generally exceed $8,000,* compared to an average of $1,208 in silver plans.

600,000 bronze plan enrollees below the 150% FPL threshold is almost 600,000 too many.

CMS has given itself a tool to reduce this underinsured population. Last July it finalized, and this month it implemented, a rule creating "monthly special enrollment period" for enrollees with incomes up to 150% FPL -- effectively establishing continuous year-round enrollment for the lowest-income marketplace applicants. The rule not only allows the uninsured to enroll outside the annual Open Enrollment Period; it also allows current enrollees with income up to 150% FPL to switch to a silver plan.