Subscribe to xpostfactoid

Update through 9/2 here

Update, 8/19: See this post for a somewhat cleaner comparison through July, reconciling states' different schedules for tallying and methods of labeling a given month.

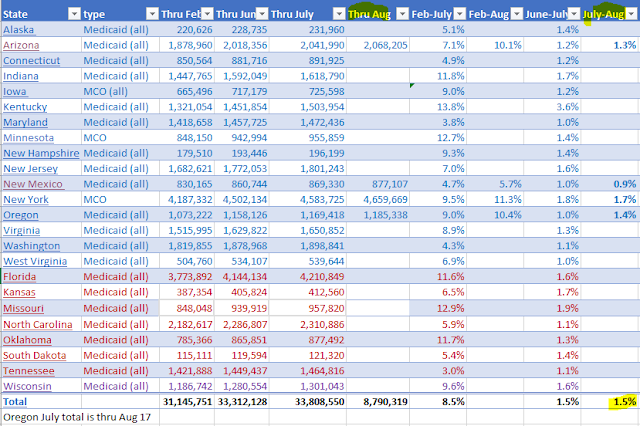

Update, 8/15: Illinois Medicaid enrollment surged 6.4% from June to July and is up almost 10% since May. Enrollment in Indiana is up 11.8% since February. Of the twelve expansion states below that have reported enrollment in all or most Medicaid programs through July (excluding tallies for expansion population only), the average increase since February is 9.2%.

---

It's time for a fresh post on pandemic Medicaid enrollment, instead of piling updates on my

prior snapshot. While I'm focused primarily on states that enacted the ACA Medicaid expansion, I've started to also track nonexpansion states and will keep adding them as I find data. I have a bunch of URLs to pick through, thanks to a very helpful

overview of enrollment in 33 states through May and June by Chris Frenier, Sayeh S. Nikpay, and Ezra Golberstein.

To review some basic context: the Urban Institute

forecast that nationally just shy of half* of those who lose access to employer-sponsored insurance will enroll in Medicaid if severe unemployment lasts for "several months to a year." At 15% unemployment, Urban projects that between 8.2 million and 14.3 million people will enroll in Medicaid, an increase of 11%--20% over total enrollment in early 2020, or 16%--28% over the total of enrollees under age 65. While the current national unemployment rate has dipped officially to 10%, it's likely to spike again as our public health failures lead to renewed shutdowns and our legislative failures result in cutoffs or sharp reductions in relief benefits.

Note that some of the the tallies below are for the ACA Medicaid expansion only -- that is, adults with incomes under 138% of the Federal Poverty Level. The federal government pays 90% of the cost for enrollees rendered eligible by the expansion. It's not surprising that the expansion population tallies reflect faster growth, since a large percentage of the nation's children were enrolled in Medicaid or CHIP pre-pandemic, enrollees over age 65 are in Medicare and usually not reliant on employer-sponsored insurance, and those eligible for disability Medicaid are also likelier to have been enrolled pre-pandemic.

Medicaid enrollment in 26 states, February - August 2020