Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up!

CMS just dropped its Effectuated Enrollment Early 2023 Snapshot and Full Year 2022 Average — a document I’ve been eagerly awaiting.

To my eye, the main takeaway is that in the second full year of enrollment after the American Rescue Plan Act (ARPA) boosted ACA marketplace subsidies, retention and off-season enrollment remain impressive. That’s reflected in average monthly enrollment for 2022 as well as early effectuated enrollment for 2023.

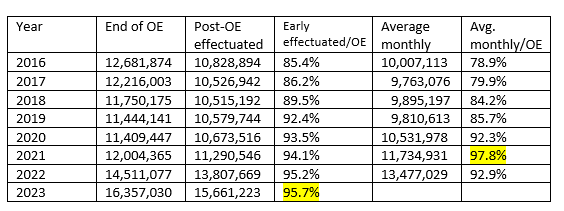

Year-over-year, from 2022 to 2023, early effectuated enrollment (enrollment as of the first month when premiums were due for all who selected plans during the Open Enrollment Period, or OEP) increased by 13.4% — more than the 12.7% year-over-year increase in plan selections during OEP, as the percentage of OEP plan selectors who effectuated enrollment reached an all-time high. That increase in retention of OEP signups continues a long-term trend.

The table below shows the ratios of early effectuated enrollment and average monthly enrollment to OEP signups since 2016.

ACA Marketplace Retention, 2016-2023