Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up!

|

| Bronze sometimes works |

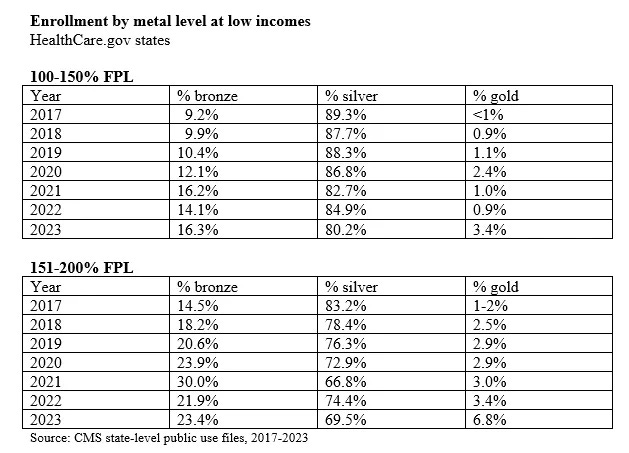

In a prior post, I raised concern that the percentage of ACA marketplace enrollees eligible for strong Cost Sharing Reduction (CSR) subsidies who access that valuable benefit by selecting silver plans has not increased significantly since the American Rescue Plan Act of March 2021 made benchmark silver plans much more affordable. (CSR is available only with silver plans.)

This despite the fact that ARPA rendered the benchmark (second cheapest) silver plan free for enrollees with income up to 150% of the Federal Poverty Level and costing no more than about $45/month for a single enrollee with income up to 200% FPL. While CSR takeup did improve modestly in 2022, it slipped in 2023 — to its lowest level ever for enrollees with income up to 150% FPL (80.2%) and to its second-lowest for enrollees in the 150-200% FPL range.

Compared to the bronze plans that most enrollees who forego CSR obtain, and to a lesser extent to gold plans, CSR massively reduces exposure to out-of-pocket costs for enrollees with income up to 200% FPL, raising the actuarial value of a silver plan from its baseline of 70% to 94% at incomes up to 150% FPL and to 87% (higher than most employer-sponsored plans) at incomes in the 150-200% FPL range. Bronze plan AV is 60%; gold, 80%*. At incomes up to 150% FPL, CSR reduces the median silver plan deductible to $0 and the mean deductible to $49 (see CMS’s Public Use File for plan design, 2014-2023). In the 150-200% FPL range, median silver deductibles are $450. Bronze plans have median deductibles of $7,200 — a figure reduced by a sizable percentage of bronze plans sporting $0 medical deductibles, albeit with drug deductibles average $3,800 and inpatient hospital copays of $3,000. The median deductible for gold plans in 2023 is $1,450.

The CSR advantage in plans’ annual out-of-pocket maximums is if anything even more pronounce. OOP maxes average $1,321 for silver plans at incomes up to 150% FPL and $2,741 at incomes in the 150-200% FPL range, according to KFF. For bronze and gold plans, OOP maxes are rarely below $7,000 and often approach or reach the maximum allowable, $9,100 in 2023.

From 2018 through 2021, the decline in silver plan selection was probably driven in large part by silver loading — the pricing of the value of CSR directly into silver plan premiums, creating discounts in bronze and gold plans, instituted after Trump cut off direct reimbursement to insurers for the value of CSR in October 2017. Silver loading made zero-premium bronze plans widely available at incomes up to (and beyond) 200% FPL — whereas, before ARPA, the cheapest available silver plan premiums could reach about $140 per month for a single enrollee with an income at 200% FPL.

ARPA has rendered high-CSR silver far more affordable than it ever was. So why the weak recovery of silver selection at 150-200% FPL and continued slide at 100-150% FPL? The sheer proliferation of available plans may be one factor: the average number of plans available to marketplace applicants rose from 26 in 2019 to 114 in 2023. Some applicants, clicking to view their choices (and perhaps blowing by text explaining the value of CSR), may see nothing at first view but a long parade of barely differentiable bronze plans, many of them free. An influx of low-income, often low-information new enrollees may play a role: almost all of the strong enrollment growth in the past two years in concentrated in states that have not expanded Medicaid, and 70% of enrollees in those states have income below 200% FPL.

I suspect, though, that a major factor in declining CSR takeup is related to, but different from, the sheer proliferation of plans: The entry in many markets of new insurers (new to that market — the new entries are often national brands) offering narrow-network plan at the lowest price points. When a new entrant undersells existing participants and gains the benchmark (second cheapest) silver plan position, premium subsidies go down, and plans that were affordable in the prior year become more expensive, sometimes much more. The trend toward narrow networks in the ACA marketplace has been operative since early years, and the effect is cumulative. In the last 2-3 years, Aetna, Cigna and UnitedHealthcare have re- entered the marketplace in force, often with narrow network plans

While declining CSR takeup at incomes up to 200% FPL entails exposure of a lot of low-income people to very high out-of-pocket costs, the decision to forgo CSR may less often be a simple mistake than I have been given to assume. A significant and perhaps growing number of low-income enrollees in bronze and gold plans (gold plans have a lower actuarial value than silver plans at incomes below 200% FPL) may be consciously sacrificing actuarial value to get the provider network they need or want.

I don’t have statistical evidence that the entry of new low-cost narrow network plans into numerous markets is driving down CSR uptake, or at least inhibiting its post-ARPA rise. I do think the question of whether this dynamic is at work would be a good one for academics analyzing the marketplace.

To rely for the moment on anecdote: below are examples of four markets where some low-income enrollees might feel tempted if not compelled to forgo high-CSR silver in 2023. Three of these examples are distilled or updated from prior posts, as indicated.

Priced out of BCBS silver outside of Dallas

As I noted in a post this past February, Dallas-area health insurance broker Jenny Hogue, president and CEO of KG Health Insurance, drew my attention to Cigna’s entry in 2023 into many Texas counties with low-cost, narrow network plans, rendering plans with more robust networks less affordable. For example, in Kaufman County outside Dallas, Cigna offers plans priced far below those of the only other two insurers in the county, BCBS and Aetna (also a new entrant, and also narrow-network, with just two in-network hospitals listed for plan holders under zip code 75142). BCBS’s For a 40 year-old with an income of $19,000 per year in Kaufman in 2023, Cigna offers two zero-premium high-CSR silver plans, one with a $0 deductible and $1,250 out-of-pocket maximum. In the Cigna Connect network, there are no in-network emergency rooms within 30 miles, according to Hogue’s analysis, and no in-network hospitals nearer than 35 miles away, according to my check on the Cigna site.

The cheapest non-Cigna silver plan, from Aetna (also narrow-network), costs this enrollee $62 per month — and the cheapest BCBS silver plan, which was free at this income in 2022, and which offers a far more robust provider network than its competitors, costs $152 per month. BCBS does offer this enrollee a bronze plan at zero premium, albeit with a $6,000 deductible and $9,000 OOP max. Since primary care visits and generic drugs are not subject to the deductible in this plan, some enrollees who need facilities or doctors in the robust BCBS network maybe forgo CSR and buy bronze.

Metal level choice in Texas was further scrambled in 2023 by enactment of a 2022 law requiring that gold plans be priced below silver plans (since most Texas silver plan enrollees obtain CSR that raises the actuarial value of a silver plan to a roughly platinum level, 94% or 87%). While cheap gold plans are a boon to enrollees with income above 200% FPL, who are not eligible for strong CSR, their availability confuses the calculus for enrollees with income below 200% FPL. While annual out-of-pocket maximums are generally in the $1,200 range for silver plans at incomes up to 150% FPL, and in the $2,000-2,900 range at incomes in the 150-200% FPL bracket, gold plan OOP maximums range from $6,500 to $9,100. That said, gold plans can be a viable option in Texas for those priced out of silver plans with robust networks. In Texas in 2023, 14% of enrollees with income in the 100-200% FPL range selected gold plans, and silver selection was just 64%. Nationally, 78% of enrollees in the 100-200% FPL range selected silver plans.

Going bronze for Blue in Charleston, SC

As I noted recently, the plan choices facing a single 40 year-old with an income of $19,000 in Charleston County, South Carolina, zip code 29485, may push some enrollees toward bronze. At that income, the benchmark (second cheapest) silver plan is free and has a $100 deductible and $900 out-of-pocket maximum. But the insurer is Ambetter (Centene), a narrow-network HMO with (I’m told) difficult customer service in that market. In fact, Ambetter offers an enrollee at this age/income level three zero-premium bronze plans in the region, and three more for under $6/month. Competitor BCBS South Carolina offers BlueExclusive plans, with a relatively robust regional network, and BlueEssentials plans, which cover every hospital in the state. For our 40 year-old with an income of $19,000, the cheapest silver BlueExclusive plan will cost $45/month, and the cheapest silver BlueEssentials plan, $95/month. But several BlueEssentials bronze plans are available for free — including one with a $0 medical deductible (albeit with a $3,000 drug deductible and a $1900/day facility fee for the first two days for in-hospital care). The bronze BlueEssentials plans have out-of-pocket maximums ranging from $8,550 to $9,100, however, while the Blue silver plans cited above have OOP maxes below $1000.

For the same 40 year-old with an income $27,000 per year, the cheapest silver plan, from Ambetter, costs $38 per month, compared to $90/month for the cheapest BlueExclusive plan and $138 for the cheapest BlueEssentials plan. Bronze plans are still available for zero premium, including from BCBS, but the $0 deductible Blue at this income level costs $40/month. The most premium-conscious enrollees seeking the Blue provider networks will therefore be looking at deductibles in the $6,300 - $9,100 range, while those willing to pay $40-odd per month may choose between an Ambetter silver plan with a deductible of $500 and an out-of-pocket maximum of $2,800 and the BlueEssentials bronze with a $0 deductible and an $8,700 OOP max. Again, those who value provider network above all and don’t want to pay $90 or $139/month for the BCBS silver options may opt out of high-CSR silver.

In South Carolina, as in Texas, just 64% of enrollees with income in the 100-200% FPL range selected silver plans. As gold plans in South Carolina are not priced below silver as in Texas, 34% of enrollees in the strong-CSR-eligible income range enrolled in bronze plans.

The pull of a blue-chip brand in California

As KFF’s Cynthia Cox pointed out to me last year, silver plans from Kaiser Permanente, probably the nation's foremost provider-run HMO and the state's dominant insurer, with 35% market share in 2023, are priced well above those of the lowest-cost insurers in much of the state. In zip code 90007 in LA County in 2023, at an income of $20,200** (slightly under 150% FPL), silver plans from L.A. Care and Anthem are available for free, while the Kaiser silver plan costs $41 per month for a single 40 year-old. At an income of $27,000, age 40, the Kaiser Permanente silver plan costs $85 per month, compared to $34 for the lowest-cost silver plan from LA Care. Bronze options include a zero-premium bronze HSA plan from KP, with all services except free preventive care subject to a $7,000 deductible, or a $13/month standard bronze KP plan, with three primary care visits (at $65 each) not subject to the deductible.

While 19.4% of Anthem's enrollees obtained the highest level of CSR and so had incomes below 150% FPL, just 8.6% of Kaiser enrollees did. Some low-income enrollees may choose bronze plans to get free or lower-cost access to Kaiser or more expensive plans (e.g., broader-network PPOs) offered by other insurers. That said, CSR takeup in California (where plan designs are standardized at each metal level) exceeds national averages, with 87% of subsidized enrollees in the 138-150% FPL income range and 78% in the 150-200% FPL range selecting silver plans (1.6% of enrollees in these income brackets are unsubsidized, most of them in the 150-200% FPL range).

Narrow networks in Denver, CO

Louise Norris, main author of a living ACA marketplace encyclopedia at healthinsurance.org (where I also sometimes publish) and co-owner with her husband Jay Norris of a health insurance brokerage in Wellington, Colorado, points me to Denver, where the Denver Health Medical Plan and its second brand, Elevate, offer narrow network plans priced well below those of competitors with much larger networks. At an income of $20,200 for a 40 year-old, Elevate and Denver Health silver plans cost less than $1.00 per month, whereas Kaiser Permanente silver plans, the next cheapest option, begin at $30/month. Anthem Blue Cross, Kaiser, and UnitedHealthcare, under the Rocky Mountain brand, all offer bronze plans at zero premium at this income level. At an income of $27,000, the lowest-cost silver from Denver Health is $43/month, vs. $73 for Kaiser. Two Kaiser bronze plans are available for less than $10/month. It should be noted, too, that Denver Health also prices its gold plans below its silver plans, making gold available at $15/month for the 40 year-old with a $27,000 income. Kaiser’s lowest cost gold plan is priced slightly above its lowest-cost silver.

* * *

It seems to me that only in the context of the dysfunctional U.S. healthcare system could the narrow-network plans prevalent in many ACA marketplace rating areas be deemed even marginally acceptable healthcare coverage. When Congress set out in 2009 to create a new coverage program for the not-poor uninsured, common sense in a political environment less constrained by free market fundamentalism would have dictated a program that offered, like traditional Medicare, affordable access to nearly all licensed medical facilities and providers. If the notion that managed care organizations exercise any meaningful quality control in limiting networks were given credence, those managed care alternatives would have been subject to rigorous network adequacy standards. (CMS did modestly boost network adequacy requirements in its Notice of Benefit and Payment Parameters for the marketplace in 2024.) Making such a program affordable, however, would entail uniform rate-setting for participating public and private payers — a sine qua non of affordable access that was and still is a political impossibility in the United States.

—-

Enrollment statistics cited in this post are derived from CMS’s Public Use Files for the ACA marketplace and from Covered California’s Gross Active Member Profile as of Feb. 2023, available here.

* Some variation in AV is allowed. Bronze plan AV can range from 58-65%; other metal levels are allowed +/- two percentage points; and CSR silver plans, +/- one point.

** While ACA marketplace subsidies are set to the Federal Poverty Level for 2022, Medicaid eligibility is now based on the FPL for 2023, which enacted a large inflation adjustment. In states that have expanded Medicaid, e.g., California, $20,200 is close to the lowest single-person income that will render an applicant eligible for marketplace rather than Medicaid coverage.

Photo by Robert Fisk

No comments:

Post a Comment