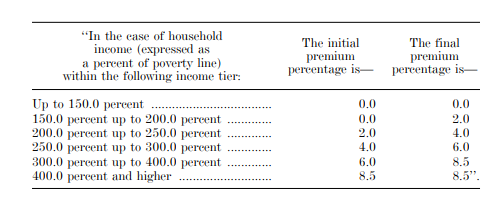

It's here! After five years in which progressives have dreamed of boosting the generosity of subsidies in the ACA marketplace, the framework for half the Covid relief bill released by the House Ways and Means yesterday would do so temporarily, for 2021 and 2022. The subsidy schedule is even more generous than that of the Affordable Care Enhancement Act passed by the House last June (and left to die in the Senate, natch). Here are the percentages of income required to purchase a benchmark (second cheapest) silver plan (Part 7, beginning on p. 83):

3. As I've noted elsewhere (see the latter part of this post), CMS has the power to mandate full silver loading* -- that is, that insurers price comparable plans at different metal levels in precise proportion to their actuarial value. Since most silver plan enrollees have plans enhanced by CSR, silver plans on average have a higher actuarial value than gold plans. Hence gold plans should be priced below the silver benchmark, as they currently are in a minority of markets (silver loading exists, but it's haphazard and incomplete). CMS can change that so that a gold plan is always available at a premium below the benchmark. If that's done, then every enrollee in the ACA marketplace will have access to a plan with an actuarial value of at least 80% (the gold standard) at a cost below that of benchmark silver. Given the proposed legislation's cap on benchmark premiums at 8.5% of income no matter how high the income, everyone who lacks access to employer-sponsored insurance or other insurance (Medicaid or disability Medicare) would have access to gold coverage or better for no more than 8.5% of income, and usually far less.

4. These enhancements would be temporary, which causes heartburn. It would be incumbent on Democrats to make them (or something close) permanent.

Update, 2:30 p.m.: GetCoveredNJ, New Jersey's new state-based marketplace, which has extended its open enrollment period through May 15, also allows current enrollees to switch plans in the SEP, as stated rather off-handedly at end of this q-and-a item, and require a phone call:

I already have health insurance through Get Covered New Jersey. Can I switch plans through the COVID-19 Special Enrollment Period?

A: Yes. Special Enrollment Periods are available throughout the year for residents who have a major life change, called a qualifying life event (QLE), which allow for enrollment outside of the open enrollment period. Certain QLEs also allow for enrollees to change their existing plan. They include: birth, adoption, marriage, death, dependent aging off coverage, moving, income loss that changes eligibility for Marketplace coverage (for example, newly qualifies you for financial help). Remember to update your application with any income or household changes as it may impact your financial help. Changes to current coverage unrelated to a specific life event can be made through the COVID-19 Special Enrollment Period by calling the Customer Assistance Center at 1-833-677-1010 (my emphasis).

----

* Silver loading refers to concentrating the cost of CSR subsidies (directly reimbursed to insurers by the federal government as stipulated by the ACA until Trump stopped payment in October 2017) in the premiums of silver plans, since CSR is available only with silver plans. Since premium subsidies, designed so that the enrollee pays a fixed percentage of income, are set to a silver plan benchmark (the second cheapest silver plan), inflated silver premiums create discounts for subsidized buyers in bronze and gold plans.

Thanks for the quick-to-press reporting on what made it into the current draft COVID legislation.

ReplyDeleteI share your disappointment that the removal of the "subsidy cliff" (and reduction of maximum post-subsidy premiums for silver to 8.5% of income) is only temporary. For two years, I think. (The earlier Biden outline of the COVID relief bill did not specify that temporary aspect.)

As I see it, the ACA has five essential fixes needed to make it an affordable insurance system. The fixes of course need to be permanent: subsidy cliff, family glitch, excessive out-of-pocket maxes, non-expansion of Medicaid, estate Recovery of ordinary medical Medicaids including expanded Medicaid.

Further, before Congress changes, there are 3 spending-reconciliation bills allowed only, one of which is used up here. (It's generally one a year affecting spending, but for some reason there is an extra one allowed this time, from what I read somewhere.)

I doubt the fixes will all get done anytime soon. So, 11 years after the ACA was passed, the country has failed at its goal of universal affordable health insurance available to all that we thought the ACA might take us to.

Thanks for the article. By my calculation, a person making 400% of poverty will pay a maximum of $366 a month of their own money for a silver plan. For anyone over about age 45, that is a real bargain compared to today.

ReplyDeleteI note that no one seems to be asking how much this will cost the general taxpayer. You know, kind of for old times' sake.

Quick note to Norman Speier - it is true that the ACA has not gotten us much closer to universal coverage. However, I think that it took about 15 extra years for Social Security to cover farm workers and domestic servants, so this slow pace is not unprecedented.