The final snapshot for the Open Enrollment Period on HealthCare.gov and ten state-based exchanges is in. We're almost done, though eight SBEs are still open. Already, enrollment in marketplace plans is up 21% over OEP 2021, to a record-breaking 14.5 million nationally, well above the previous high of 12.7 million in 2016.

Two caveats. First, when the Trump administration cut OEP in HealthCare.gov to six weeks (Nov. 1 - Dec. 15) and gutted advertising and enrollment assistance in HealthCare.gov states, while plan selection in OEP dropped, attrition also dropped -- that is, the percentage of people who never paid their first premium went way down. Early effectuated enrollment went from 85% of OEP plan selections in 2016 to 94% in 2021. A longer OEP and heavier outreach apparently attracts more marginal enrollees -- though with benchmark silver plans now free up at incomes up to 150% FPL and cheaper at all incomes, attrition may not drop to pre-2017 levels.

Second, the steep premium hikes of 2017 and 2018 decimated off-exchange enrollment in ACA-compliant plans, which dropped from 5.0 million in Q1 2016 to 2.1 million in Q1 2019, by KFF's estimate. All told, individual individual market enrollment may be about where it was at the 2016 peak.

Subscribe (free) to xpostfactoid

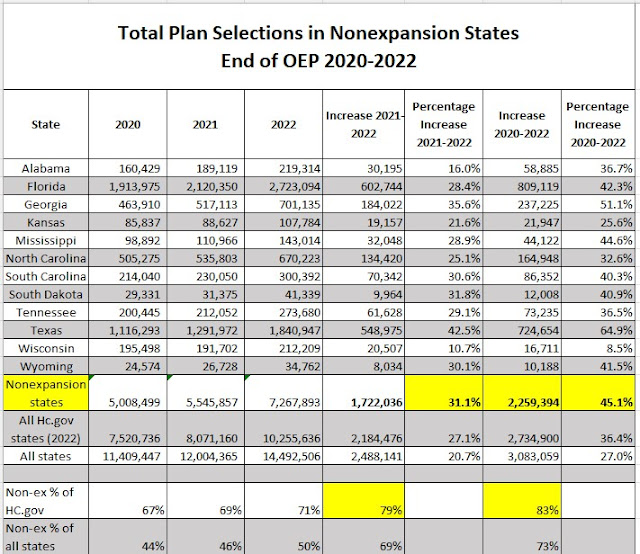

Another major difference: since the end of OEP for 2016, eight states have expanded Medicaid, decreasing their uninsured population but also their marketplace enrollment. As is dramatically illustrated below, marketplace enrollment is heavily concentrated in states that have not expanded Medicaid: the 12 remaining nonexpansion states account for 50% of current total enrollment, and about 40% of the enrollment in those states is by people who would qualify for Medicaid had their states expanded.

Leaving the complete lowdown on today's numbers to Charles Gaba, I will focus once more on the staggering enrollment growth in the twelve remaining nonexpansion states. In two years, enrollment in those states has increased by 45%, or 2.26 million. Have a look:

Totals for "all HealthCare.gov states" in each year are for the 33 states using the federal platform in OEP 2022.*

I suppose the 45% two-year increase in nonexpansion states should not surprise, as it roughly matches the 44% increase from August 2019 to August 2021, as of the end of this year's emergency SEP. These twelve states account for 73% of the two-year increase in all states -- and 79% of this year's increase so far, though those percentages will shrink a little by the time the eight still-open SBEs close their OEP books.

Enrollment in Florida and Texas alone is up by 1.5 million compared to OEP for 2020. That's a bit more than half the increase in all states (or maybe a shade less than half by the time OEP is finished in all states).

I suspect, as I have posited all year, that a significant number of the current low income enrollees in nonexpansion states may in past years have found themselves in the coverage gap -- ineligible for subsidized coverage because they estimated their income at below 100% FPL, and ineligible for Medicaid because nonexpansion states offer very limited (though varied) eligibility to single or non-pregnant adults. Here's my most recent iteration of the various factors that may have helped people -- spurred by the pandemic -- climb out of the gap:

Government actions that helped in this regard include the large supplemental unemployment insurance granted in 2020 by the CARES Act; the provision in the American Rescue Plan deeming anyone who received any unemployment insurance income in 2021 eligible for free benchmark silver coverage; a rule implemented in May 2021 that stopped the exchanges from requiring income verification from people who claimed an income over 100% FPL (the eligibility threshold) if "trusted sources" indicate that their income is lower; and a major surge in federally funded enrollment assistance (assistors can help applicants make sure they consider all income sources). The newly effective rule essentially granting year-round enrollment to anyone reporting an income below 150% FPL should help further, as any income boost may enable an applicant to estimate an annual income above the required threshold.

Also, the commercial broker HealthSherpa, which processes about a quarter [update: make that a third (!)] of HealthCare.gov enrollment, signposts the coverage gap by explaining to visitors who estimate an income below 100% FPL why they don't qualify -- and has done so since OEP for 2019. HealthCare.gov should do this too. I have been bugging the Sherpas to provide some data on very-low-income enrollees --say, up to 110% or 120% FPL, and whether their share of enrollment in nonexpansion states has grown over recent years. Maybe some day they'll help me out -- or HHS ASPE will look at enrollment at a very low threshold.

--

* New Jersey and Pennsylvania left HealthCare.gov to form state-based exchanges for OEP 2021, and Kentucky, Maine and New Mexico did so for OEP 2022.

No comments:

Post a Comment