Dear xpostfactoid readers: All subscriptions are now through Substack alone (still free). I will continue to cross-post on this site, but I've cancelled the follow.it feed (it is an excellent free service, but Substack pulls in new subscribers). If you're not subscribed, please visit xpostfactoid on Substack and sign up!

Over the years, I have devoted many posts to tracking the percentage of low-income ACA marketplace enrollees who avail themselves of the strong Cost Sharing Reduction (CSR) available with silver plans at incomes up to 200% FPL by choosing silver plans. TLDR: the percentage is high, but not high enough.

Since October 2017, I have also devoted many posts to tracking the effects of silver loading. In that month, recall, Trump cut off direct reimbursement of insurers for the value of CSR and thus ushered in silver loading era — that is, pricing the value of CSR directly into silver plans alone (since CSR is available only with silver plans), creating discounts in bronze and gold plans (see note at bottom*). Trends to watch have included

Silver plan selection at incomes above 200% FPL, where CSR is weak-to-nonexistent. TLDR: it fell off a cliff in 2018 and years following.

Gold plan selection at incomes above 200% FPL. TLDR: it’s far higher than pre-2018, but not high enough.

The relentless math that pushes most enrollees (including me) with income above 200% FPL into bronze plans (notwithstanding deductibles averaging more than $7,000), except in states where gold plans are priced below benchmark silver.

Gold plan selection at incomes over 200% FPL in states where gold plans are consistently available at premiums below that of the benchmark silver plan, either by state government design or through insurers’ pricing decisions. TLDR: Gold selection in those states very high, and roughly proportional to the degree of gold discount.

The broad parameters of rational choice in metal levels have been clear since 2018, and a majority of enrollees, albeit too small a majority, have hewn to them. Usually, the optimal choices are silver at incomes up to 200% FPL, bronze at incomes above 200% FPL, and gold where silver loading or insurer choice (often monopoly or dominant-insurer choice) make gold affordable. Two recent factors that have had an impact: 1) the American Rescue Plan Act’s subsidy boosts, which made silver an easier reach for some enrollees at all income levels, modestly boosting silver selection in 2022; and 2) a growing trickle of states requiring insurers to price gold plans below benchmark.

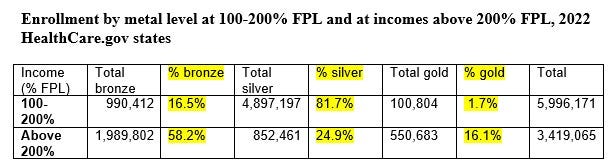

Here is how metal level choice shook out in the 33 states using HealthCare.gov** (the federal exchange, as opposed to a state-based exchange) in 2022. For the first time, CMS in 2022 included income categories above 400% FPL, reflecting ARPA’s removal of the former 400% FPL income cap on subsidies. I have excluded enrollees with income below 100% FPL, where a relatively high percentage of unsubsidized enrollees somewhat scrambles choices. Those enrollees who did not report income are also excluded.

The great divide at 200% FPL is attributable to CSR, which raises the actuarial value of a silver plan from a baseline of 70% to 94% at incomes up to 150% FPL and to 87% at incomes in the 150-200% FPL. That extra value-add (at no cost to the enrollee) mostly trumps the discounts in bronze plans created by silver loading. In the 200-250% FPL income bracket, the value of CSR drops sharply, raising AV just 3 percentage points to 73%, but it’s still not negligible. Most notably, “CSR73” plans have a lower allowable annual out-of-pocket maximum, $7,250, as opposed to $9,100 to plans at other metal levels*** or silver with no CSR (that is, silver at incomes above 250% FPL). The average deductible for CSR73 ($3,215) is also 32% lower than the average for no-CSR silver ($4,753). That difference has widened considerably in recent years; it was 21% in 2020. In 2022,, enrollees in 200-250% FPL bracket choose silver plans at more than twice the rate of enrollees at higher incomes.

While silver selection is much higher at 200-250% FPL than at higher incomes, in 2017, the last year in which CSR was not priced directly into silver premiums, silver selection in this income bracket was 67.6% in HealthCare.gov states.

Note too that silver selection drops steadily with income. In the silver loading era, enrollees in silver plans without CSR are essentially paying for less AV than they’re getting (unless they avail themselves of CSR-free silver plans off-exchange, which are still available in some states).

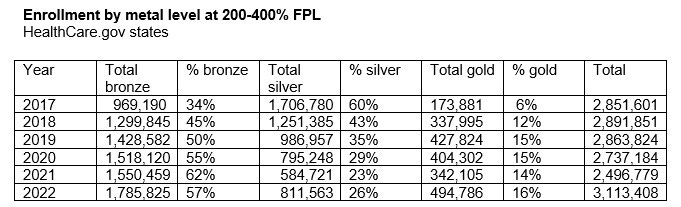

Lastly, let’s have a look at how metal level selection (and overall enrollment) at incomes above 200% FPL has changed since 2017 — jolted first by silver loading in 2018 and then by the ARPA subsidy boosts in 2021. Because CMS did not break out income categories above 400% FPL (the former cap on subsidy eligibility) prior to 2022, this table shows selections at incomes in the 200-400% FPL range only.

Three things to note:

Total enrollment is up more than indicated in the far right column, as 39 states were using HealthCare.gov in 2017 and just 33 did so in 2022.

Gold enrollment doubled in the first year of silver loading and has crept up in subsequent years. While most of the states that mandate strict silver loading run their own exchanges, Texas is joining the club in 2023, and heavily discounted gold plans offered throughout the state this year will probably add a couple of percentage points to gold selection nationally.

Bronze selection downticked in 2022 (at incomes below 200% FPL as well as above that threshold). That’s probably due mainly to the ARPA subsidy boosts enacted in March 2021, which reduced premiums for benchmark silver plans at every income level.

I could accuse myself of twiddling my thumbs here while waiting for more information about enrollment in 2023 - -first, an updated enrollment snapshot coming on Wednesday (Jan. 11), and later, in the springtime, public use files for this year. Oh well. I hope the close look at this year’s trends and market forces at work since 2017 has been useful to someone.

- - - -

* Silver loading, the pricing of the value of CSR directly into silver plans only (since CSR is available only with silver plans), began in 2018, after Trump in October 2017 cut off the direct reimbursement of insurers for CSR, which was required by the ACA statute but never funded by a Republican Congress (or by a Democratic Congress, after the benefits of silver loading became apparent). By inflating silver premiums, silver loading also inflates subsidies and creates discounts in bronze and sometimes in gold plans.

** CMS did not break out metal level selection by income in states that run their own exchanges, or in all states, because two such states, New York and Idaho, did not provide the necessary information. Below, I’ve run a breakout for all states except New York and Idaho. I didn’t include this in the text body because the totals don’t quite sum: If I add in enrollees with income below 100% FPL, enrollees with income unknown, and enrollees in platinum and catastrophic plans, and then subtract New York and Idaho enrollees in those categories, the total comes out about 200,000 (1.4%) above total enrollment. That said, the breakout is not dramatically different than for HealthCare.gov states. FWIW, here it is. Source is again the public use files.

*** An exception is HSA-linked plans (almost all of which are bronze), for which the out-of-pocket max cannot exceed $7,500 in 20223. HSA-linked plans cannot exempt any services from the deductible except mandatory free preventive care.

No comments:

Post a Comment