Subscribe to (free) xpostfactoid

Let's take one more look at enrollment results in New Mexico's ACA marketplace, where extreme silver loading rendered average lowest-cost gold plan premiums 14% lower than those of lowest-cost silver plans, and gold plans were available well below the cost of a benchmark silver plan statewide (excepting those for whom silver plans also were free, or had single-digit premiums).

The unadulterated good news was for enrollees with incomes above 200% of the Federal Poverty Level, more than two thirds of whom chose gold plans, while only about 13% choose bronze. That's a real advance.

The good news at incomes below 200% FPL was that just 4% chose bronze plans, which carry deductibles usually in the $7,000 range for an individual. Most of those who selected bronze at low income levels may have been subsidy-ineligible, usually because of an employer's offer of insurance. That's generally the case for a small percentage of enrollees with incomes in subsidy range.

The not-so-good news is that 31% of enrollees with incomes in the 138-200% FPL range chose gold plans, although silver plans have a higher actuarial value than gold plans at incomes below 200% FPL, reflected most dramatically in annual maximum out-of-pocket cost (MOOP) caps that can't go higher than $2,900, vs. a maximum allowable MOOP of $8,700 for gold plans.

As I noted back in October, some enrollees with incomes in the 150-200% FPL range might rationally choose gold over silver, as they generally had several free gold plans to choose from, whereas the cheapest silver plan might cost $16-30 month for a single 40 year-old with an income just below 200% FPL.

At incomes up to 150% FPL, however, the benchmark (second cheapest) silver plan is free. And as the New Mexico insurance dept. has kindly broken out plan selection at lower income levels for me, I can report that at incomes in the 138-150% FPL range, 25% of enrollees selected gold plans. That's also the case at incomes in the 100-150% FPL range. (Enrollees with incomes below 138% FPL are either legally present noncitizens time-barred from Medicaid eligibility, who are eligible for marketplace subsidies, or enrollees who are ineligible for subsidies, usually because of an "affordable" offer of insurance from an employer.)

In Albuquerque, the cheapest silver plan (i.e., a free plan*) for a single enrollee with an income of $19,000 -- just under 150% FPL -- has a MOOP of just $775 (deductible $400). Four gold plans are either free or cost $1/month, and their MOOPs range from $6,300-8,700.

Indeed, in Albuquerque and much of the state, at least one silver plan is available free at incomes up to $22,000 for a 40 year-old individual -- about 170% FPL.

The heavy gold selection in New Mexico at incomes below 200% FPL, and particularly below 150% FPL, is problematic -- though again, some enrollees at incomes near 200% FPL may have rational cause to select gold.

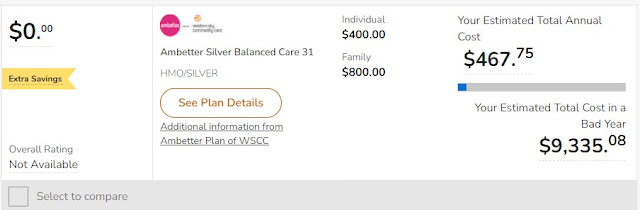

Design changes -- and a technical fix -- to the state's new ACA exchange, bewellnm, could help. bewellnm is the only exchange I know of that does not include the MOOP in the basic summary of each plan that appears in the menu of available plans. Instead, it provides an estimate of total costs -- and an erroneous estimate (as far as I can tell) of costs "in a bad year." It takes two more clicks to get to the MOOP, and you have to look for it.

Again, the MOOP at the income for which this estimate was generated is $775, so where does the $9K-plus potential total cost come from? Not even the highest allowable MOOP without CSR -- $8,700 -- would get you there.

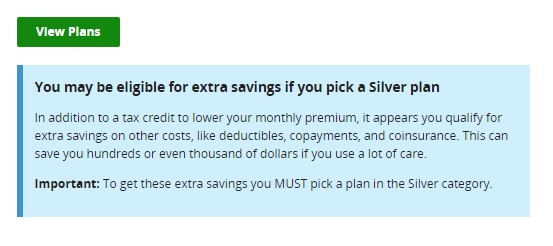

bewellnm also does not signpost the specific benefits of CSR. If you choose to get help selecting a plan, the program does ask, "If you needed costly medical care, what is the largest bill you could afford to pay in a year?" If you choose a low amount, CSR-enhanced silver plans will be foregrounded (if your income is below 200% FPL). But that's a bit subtle compared to, say, HealthCare.gov's CSR notices:

That signpost on HealthCare.gov is followed by this one at the top of the menu of available plans:Subscribe to (free) xpostfactoid

No comments:

Post a Comment