Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up.

A press release from New Jersey’s Department of Banking and Insurance (DOBI) urging Congress to extend the enhanced ACA marketplace subsidies created by the American Rescue Plan Act (ARPA) in 2021, which are funded only through this year, led me to discover that DOBI has resumed quarterly tracking of off-exchange as well as on-exchange enrollment, after a long hiatus (1-2 years?). Reports are now available through Q2 2024.

In general, nationally, off-exchange enrollment data is spotty, and the off-exchange enrollment numbers in NJ open a window into how expiration of the ARPA-enhanced subsidies, which Republicans are unlikely to extend, may affect those with income above 400% FPL, the once and likely future cap on subsidy eligibility. In the Open Enrollment Period (OEP) for 2021, the last year with the 400% FPL cap on income eligibility, 43% of state enrollees in ACA-compliant plans were unsubsidized. In 2024, just 25% were unsubsidized. We will probably soon be back to 40%-plus.

The prospect of a large increase in a subsidy-ineligible population seeking coverage also raises the salience of New Jersey’s reinsurance program, implemented in advance of OEP 2019 after two years of steep premium increases. Reinsurance reduces premiums for unsubsidized enrollees but tends to raise them for the subsidized, since subsidies shrink with the benchmark (second cheapest) silver plan premium, which reduces spreads between the benchmark and cheaper plans. That reinsurance program is still in place, poised to make coverage less expensive for a rising population of unsubsidized enrollees while perhaps raising premiums for some subsidized enrollees.

Let’s have a look at how enrollment patterns in New Jersey have evolved since 2016. A note on sources and methods is at bottom.

Observations:

Subsidized enrollment rose 72.4% from Q1 2021 to Q1 2024. While we don’t have first quarter numbers yet for 2025, we can make the same comparison for end-of-OEP, and subsidized enrollment in OEP 2025 (462,408) was 117% higher than in OEP 2021 (212,952).

That’s mainly because of the ARPA subsidy boosts — along with a longer OEP, increased investment in marketing and enrollment assistance, year-round enrollment at incomes under 200% FPL, and various measures to smooth the enrollment process — all of which are on the brink of disappearing under pending Republican legislation (and a set of new rules proposed for the marketplace that the legislation would codify). The DOBI press release portends dire enrollment decreases among the subsidized:

Currently, with this enhanced federal support [the ARPA subsidy increases], nearly half of all enrollees (48 percent) receiving financial help pay $10 a month or less for coverage, compared to just 13 percent before the expansion of the tax credits. Of this population, 201,289 (or 43 percent of those receiving financial help) pay $1 or less a month — free or nearly free premiums — as compared to just 7 percent before the expansion of tax credits.

The loss of enhanced federal tax credits would have a devastating impact on individuals and families. New Jersey would lose more than half a billion dollars in enhanced premium tax credits, and 454,016 New Jerseyans — 88 percent of Get Covered New Jersey consumers — would see their premiums increase if the tax credits were allowed to lapse.

The average person receiving tax credits would see their costs go up by 110 percent, more than doubling their current premium, with costs increasing by $1,260 per person, per year on average, or $4,168 per year for a family of four.Unsubsidized enrollment dropped 31% from its peak of 161,822 in Q1 2017 to 111,323 in Q1 2024. That’s mostly due to a drop in off-exchange enrollment in the post-ARPA era, during which a larger percentage of enrollees have been able to get subsidies online. Unsubsidized enrollment on-exchange has been relatively stable.

Beginning with in OEP 2023, the second post-ARPA OEP, CMS started tracking enrollment at incomes of 400-500% FPL and greater than 500% FPL, as some enrollees in those categories became subsidy-eligible thanks to ARPA (under which no one who lacks access to other affordable insurance pays more than 8.5% of income for the benchmark silver plan). In OEP 2025, enrollment in those two income categories, 52,796, is roughly equal to the drop in unsubsidized enrollment in the ARPA era.

New Jersey’s 513,000 enrollees is 2025 is pretty close to 1/50 of the 24.3 million enrollees nationally. If 50,000 in New Jersey lose subsidy eligibility next year, perhaps that suggests about 2.5 million nationally. Many more who remain subsidy-eligible will find the available coverage unaffordable.

The reinsurance program launched before OEP 2019 appears to have stopped a decline in off-exchange enrollment, all of which is unsubsidized, from 107,000 in Q1 2016 to 89,000 in 2018. Premiums had spiked more than 20% in 2017, when there was a market correction following the expiration of the 3-year national reinsurance program provided by the ACA to smooth the marketplace’s launch, and again in 2018, when the market withstood the threat of ACA repeal and a regulatory assault by the Trump administration. Reinsurance at that point addressed a political imperative to provide relief to the unsubsidized. In 2019, unsubsidized premiums were 9% lower on average than in 2018. At the same time, subsidized enrollment dropped, though the gap had mostly disappeared by Q2 2019 as retention improved (see this post for more on the apparent tradeoffs).

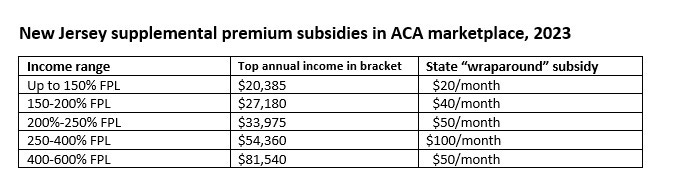

New Jersey’s supplemental “wraparound” subsidies will somewhat mitigate the loss of the ARPA enhancements — if the state can afford to maintain them under Republican cuts to Medicaid reimbursement, which the state estimates at $3.6 billion annually if the E&C legislation is enacted as is. The state subsidy can be as high as $200/month for families at the upper end of (pre- and post-ARPA) subsidy eligibility. At the lower end of the income scale, up to 138% FPL, the state subsidy more or less wipes out the premium for benchmark silver. Here are the subsidy levels as of Plan Year 2023 — and my spot check on GetCoveredNJ indicates they’re the same now:

Also somewhat mitigating the loss of ARPA subsidies in NJ is the availability of bronze plans with $3,000 deductibles — at present there are at least three at relatively low premiums. All have out-of-pocket maximums over $9,000, however.

Another possible mitigating measure, proposed in a bill that’s passed out of at least one committee this year, is to mandate “strict silver loading” — that is, require the gold plans be priced roughly at par with silver in year 1 and well below silver (as in Texas) in year 2. (The basis for such mandates is that silver plans at low incomes include Cost Sharing Reduction (CSR) subsidies that raise actuarial value to a roughly platinum level, and since 2018, CSR has been priced into premiums — so on average, silver plans have higher AV than gold plans.) Gold plans priced below benchmark would be a boon for enrollees with income over 200% FPL (as CSR is negligible to 250% FPL and not available at incomes over 250% FPL) — especially in Jersey, where gold plan premiums are the highest in the nation. In 2025, just 1.2% of New Jersey enrollees selected gold plans — gold coverage is essentially unavailable. This post describes the New Jersey bill, which has been reintroduced in the current legislative session. My testimony in support of the current bill is here.

Of course, all of these potential mitigations will only marginally reduce the harm of ARPA subsidy expiration for those who rely on the ACA marketplace for coverage.

See this post for a discussion of mitigating factors nationally if the ARPA subsidies expire.

- - -

Note on sources and methods: GetCoveredNJ provides annual final enrollment reports for on-exchange enrollment alone. Those numbers are as of the end of OEP, as are CMS’s Public Use Files for ACA marketplace enrollment. End-of-OEP “plan selections” (counted before the first premium is paid) are generally higher than quarterly totals such as NJ DOBI’s, though the gap between OEP and Q1 has narrowed in the post-ARPA era, as a) plans are generally much more affordable and b) about 40% of enrollees pay no premium at all.

The figures in the table above are Q1 totals from NJ DOBI. To get on-exchange subsidized/unsubsidized breakouts, however, I had to make one extrapolation to get these numbers. From CMS’s PUFs, which show enrollment as of the end of OEP, I took the percentage of enrollees who received/didn’t receive federal premium subsidies (APTC, advanced premium tax credits) and applied it to the Q1 on-exchange numbers in the DOBI reports, as GetCoveredNJ does not tally off-exchange enrollment. Those percentages could be slightly off if subsidized and unsubsidized enrollees who enroll or disenroll between the end of OEP and the Q1 tally do so at different rate.

Finally, the numbers for 2025 are from the CMS PUF. DOBI’s figures go only through Q2 2024 at present.

No comments:

Post a Comment