Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up.

The draft legislation released by the House Energy and Commerce Committee on Sunday night (May 11) gnaws at Medicaid and marketplace spending from so many angles and inhibits enrollment in so many ways, it’s hard to know where the bulk of the enrollment reductions and benefit degradation will come from. By CBO’s preliminary estimate, the Medicaid and marketplace provisions will cut federal spending by $715 billion over ten years and increase the ranks of the uninsured by 13.7 million (if you include failure to extend funding for the enhanced marketplace subsidies provided by the American Rescue Plan Act, which are funded only through this year; expiration of those subsidies accounts for 4.2 million of the coverage losses).

On the Medicaid side, work requirements (a.k.a. red tape requirements) have been clearly shown to drive eligible people off the rolls without boosting employment. Work requirements may account for more than half of the 7.7 million reduction in Medicaid enrollment that CBO forecasts, based on prior Urban Institute estimates (CBO has not yet itemized its Medicaid enrollment loss estimate by provision). Increasing the frequency of redeterminations and suspension of Biden administration rules designed to streamline enrollment would also take a significant toll on enrollment.

Here I want to focus on a double-barreled assault imposing a different form of harm: increased out-of-pocket costs for those who do enroll in coverage, in particular those with income a step above poverty, i.e. 100-138% of the Federal Poverty Level (FPL). In the 2025 ACA marketplace, which uses prior-year FPL, that’s income up to $20,783 for an individual, $43,056 for a family of four. For Medicaid, which uses current-year FPL, the thresholds are 3.9% higher. In the marketplace, we’ll also look at the broader 100-150% FPL bracket, since benchmark silver plans are available at zero premium up to 150% FPL under the enhanced subsides.

On the Medicaid side, in the 40 states plus D.C. that have enacted the Medicaid expansion, Section 44142 would impose new out-of-pocket costs on enrollees with income over 100% FPL. The cost-sharing may not exceed $35 per service or more than 5% of income — i.e., a bit less than $1100 for an individual and a bit more than $2200 for a family of four. Those limits are low for an employer-sponsored plans — but a very significant exposure at incomes near the poverty level.

On the marketplace side, the enhanced premium subsidies established by ARPA rendered benchmark silver coverage free at incomes up to 150% FPL. Up to that threshold, a silver plan comes with Cost Sharing Reduction (CSR) that raises the actuarial value to 94%. In 2024, the average single person out-of-pocket limit for silver plans at that income level was $1388. Assuming the enhanced subsidies expire, enrollees with income up to 138% FPL will pay 2% of income for benchmark silver (about $400/year for an individual), and enrollees with income in the 138-150% FPL band will pay 3-4% of income (up to $800/year for an individual, and about double that for a family of four).

Bronze plans will still be available at zero premium for virtually all enrollees in the 100-150% FPL income bracket (and most of those with income up to 200% FPL). But bronze plan out-of-pocket limits generally exceed $8000 and often reach the maximum allowed $9200, whereas the OOP max for silver plans at this income level can be no higher than $3050 and averages less than half that, as noted above.

The much higher out-of-pocket costs at low incomes will fall primarily on enrollees in the ten states that have refused to enact the ACA Medicaid expansion, where more than 60% of enrollment is in the 100-150% FPL range. In those states, the marketplace has evolved in recent years as a partial patch on the coverage gap — that is, for people who would qualify for Medicaid in expansion states but who get no government help if they estimate an income below 100% FPL. Enrollment in the 100-150% FPL bracket in nonexpansion states has roughly tripled since 2021, from 2.7 million in 2021 (exclude North Carolina here) to 7.9 million in 2025, per below (and 5.5 million in Florida and Texas alone).

That’s a lot of low-income red-state residents who are going to suffer under the new regime — while several million people in the 100-138% FPL income bracket enrolled in Medicaid in expansion states will be subject to increased out-of-pocket costs, if they run the gauntlet of work reporting requirements and more frequent income checks and stay enrolled.

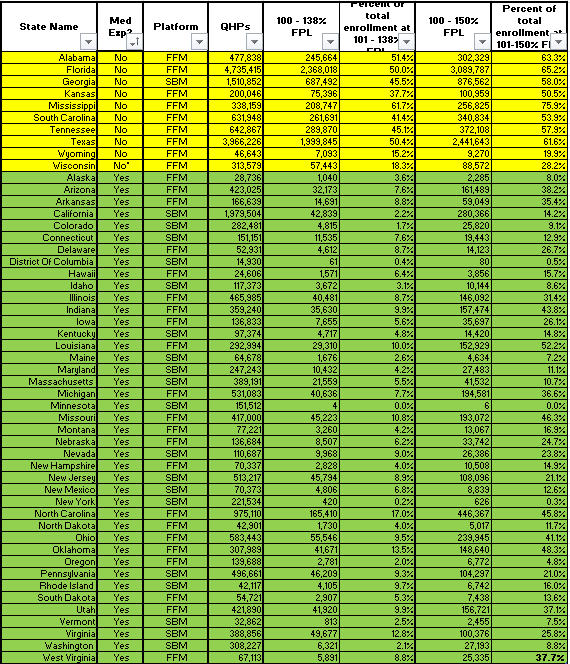

Courtesy of Charles Gaba, who has broken out 2025 marketplace enrollment by income bracket and kindly shared his Excel carve-out with me (derived from CMS’s Public Use Files) here are the enrollment totals for 2025 at incomes in the 100-138% FPL and 100-150% FPL brackets in nonexpansion vs. expansion states. First, the top line:

Enrollment at low incomes, ACA Marketplace, 2025: Expansion vs. Nonexpansion States

And state-by-state:

If the ARPA subsidy boosts expire, premiums will go up at all income levels. The average enrollee will pay 75% more than under the current subsidy schedule, according to a KFF brief. The pre-ARPA income cap on subsidies (400% FPL) will snap back in place, and the plight of those who earn too much to qualify for subsidies will be truly dire, especially for older enrollees, as unsubsidized premiums are three times higher for a 64 year-old than for a 21 year-old. But whereas 1.6 million enrollees who reported their income (i.e., perceived themselves subsidy-eligible) had incomes above 400% FPL in 2025, 10.9 million had incomes in the 100-150% FPL range. As is generally the case when Republicans write legislation, low-income people will suffer most.

No comments:

Post a Comment