Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up!

It has been gratifying if frustrating to watch the number of states that have refused to enact the ACA Medicaid expansion (after the Supreme Court rendered the expansion optional to states in 2012) dwindle from 26 in 2014 (when the ACA’s core coverage programs launched) to 10 today.*

Those ten remaining nonexpansion states include Texas and Florida — two population behemoths that between them account for more than 60% of the 1.9 million uninsured people estimated by the Kaiser Family Foundation (KFF) to be in the “coverage gap” — eligible neither for Medicaid (available in expansion states to adults with income up to 138% of the Federal Poverty Level) nor for subsidized marketplace coverage (for which eligibility begins at a minimum income of 100% FPL in nonexpansion states). The arc of Medicaid expansion history may be bending toward justice, but for the poor uninsured it’s far too long.

The American Rescue Plan Act (ARPA) included an enticement to nonexpansion states to enact the expansion — a temporary but lucrative increase in the federal share of Medicaid costs for nonexpansion enrollees in any state that enacts the expansion. So far, only North Carolina has (provisionally) taken advantage of that incentive.

The lingering coverage gap, in which nearly two million uninsured adults with income below the poverty line remain mired with no federal help toward health coverage, has led some advocates to resurface an old proposal: Allow states to expand Medicaid eligibility only to incomes up to 100% FPL, rather than the statutory 138% FPL threshold now in effect in 38 states (with two more states, South Dakota and North Carolina, slated to join within the year). Such an expansion would be cheaper for states, since the federal government funds 100% of marketplace premium subsidies, versus a mere 90% of costs for Medicaid expansion enrollees.

Expansion to 100% FPL would eliminate the coverage gap, as eligibility for marketplace subsidies begins at 100% FPL in states that have not expanded Medicaid to 138% FPL. At present, Wisconsin alone has this eligibility structure, enacted without the enhanced federal financing that the ACA provides to states that enact the expansion. Three states — Idaho, Utah, and Georgia — have at different times filed waiver requests to expand Medicaid to 100% FPL, and two states that had expanded at the outset to 138% FPL — Arkansas and Massachusetts — asked to scale back to 100% FPL. CMS turned them all down.

The downsides of expanding Medicaid eligibility to 100% FPL as opposed to 138% FPL are manifest. They include higher cost to the federal government (though not to states); higher out-of-pocket costs for enrollees, which deters high-value as well as low-value treatment; higher enrollee satisfaction with Medicaid than with marketplace coverage reported in focus groups and surveys; much lower participation rates, reported in various surveys and studies, among people in the 100-138% FPL income bracket who were eligible for marketplace coverage than among those eligible for Medicaid; and shorter-term retention of coverage for marketplace enrollees.

In the pre-ARPA era, according to KFF estimates, enrollment in marketplace coverage by those who were subsidy-eligible (and therefore lacked access to other coverage) were consistently low — just 43% as of 2020. Finally, as I noted in my last post, in 2023 20% of enrollees with income up to 150% FPL in nonexpansion states enrolled in metal levels other than silver — mostly bronze — and so incur far higher out-of-pocket costs.

The “takeup gap” between Medicaid and Marketplace coverage may have shrunk

I think it’s unquestionable that Medicaid is better suited to most enrollees with income near the poverty line than is marketplace coverage. But one of the disadvantages of marketplace vs. Medicaid eligibility in the 100-138% FPL bracket — lower takeup of the available insurance — appears to have changed significantly in the era of ARPA-enhanced subsidies. ARPA rendered benchmark silver coverage, enhanced by Cost Sharing Reduction to an actuarial value of 94%, free to enrollees with income up to 150% FPL. As I have noted repeatedly on this blog, enrollment in nonexpansion states has surged during the pandemic era, particularly after ARPA was enacted in March 2021, and, in 2023 at least, particularly at low incomes.

In the twelve states that had not expanded Medicaid as of the Open Enrollment Period for 2023, enrollment in the 100-138% FPL income bracket increased by 72% from OEP 2021 to OEP 2023. KFF estimates of the uninsured population specifically in the 100-138% FPL bracket as of 2021, provided in the data brief on the coverage gap noted above, indicate low marketplace participation to that point. But participation is much higher now.

The KFF estimates of the uninsured are based on survey data (the American Community Survey), which is a very different measure from hard enrollment data, and the two should be laid side-by-side with caution — especially given that KFF analysis of ACS data runs only through 2021. That said, to the extent the KFF estimates of the uninsured at 100-138% FPL in nonexpansion states 2021 can be taken as a baseline, they point toward current takeup much higher than is generally assumed for the marketplace at any income level.

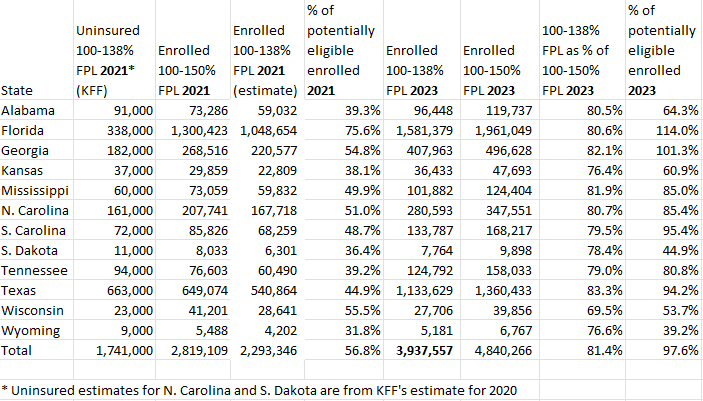

Below, I’ve set KFF’s estimates of the uninsured at 100-138% FPL as of 2021 in each current nonexpansion state against marketplace enrollment in 2021 and 2023 in that income bracket in those states. The estimated takeup rates in the table below should not be taken literally, but maybe, um, seriously. That is, if takeup at 100-138% FPL was somewhere over 50% in 2021, and enrollment has risen 72% in that bracket since then, the inference of much higher takeup is unavoidable. (For 2023, the “% of potentially eligible enrolled” column below is the total enrolled in 2023 divided by the sum of the 2021 uninsured and enrolled. Differences in the size of the potential pool from 2021 to 2023 are not accounted for.)

Marketplace Enrollment and Uninsurance at 100-138% FPL in Nonexpansion States, 2021-2023

Sources: CMS marketplace public use files, 2021 and 2023; KFF analysis of coverage gap

While the 2021 ACS data that KFF analyzed showed only a modest decrease in the uninsured population at this income level compared to 2019, Jennifer Tolbert, a coauthor of the KFF brief, tells me, “We expect to see a continued drop in both the coverage gap and subsidy-eligible 100%-138% uninsured estimates in the 2022 data.” Enrollment at 100-150% FPL in nonexpansion states increased by 27% in 2022, and doubtless by a similar percentage in the narrower 100-138% FPL bracket.

The Wisconsin anomaly

Note that in the one nonexpansion state without a coverage gap, Wisconsin, enrollment at 100-138% FPL (and, more certainly, at 100-150% FPL, shown below) has anomalously decreased slightly since 2021. That may be a data point in support of the hypothesis that in other nonexpansion states, more enrollees with income below or hovering near the 100% FPL eligibility threshold are jumping that threshold, as the income estimate that determines eligibility is just that — an estimate. In Wisconsin, the inherent flexibility in estimates of future income may push people the other way, to retain Medicaid coverage. And during the pandemic-era moratorium on Medicaid disenrollments (ending May 11 in most states), some Wisconsin Medicaid enrollees who may have otherwise “earned out” of Medicaid eligibility and sought coverage in the ARPA-enhanced marketplace may have remained in Medicaid.

Other possible (related) factors driving low-income enrollment in nonexpansion states during the pandemic era: 1) rising incomes; 1) fewer people in households below the poverty line (though inflation adjustments to FPL brackets work against that factor); 2) a pandemic jolt to the motive to get insured; 3) the large supplemental unemployment insurance implemented by the CARES Act in 2020, which may have pushed a number of prospective enrollees over 100% FPL for the first time; 4) the ARPA subsidy boosts, which made high-AV coverage free at incomes up to 150% FPL; 5) a tenfold increase in federal funding for enrollment assistance, after the Trump administration had cut that funding by 84%; and 6) year-round enrollment for enrollees with income up to 150% FPL, implemented by CMS in early 2022.

Again, none of this is to suggest that the marketplace is a desirable replacement for Medicaid coverage at 100-138% FPL. But the assumption that marketplace takeup at low incomes will be a fraction of Medicaid takeup should be reexamined in the ARPA subsidy era. And the improvement in takeup at low incomes may suggest that marketplace enrollment by people who lose Medicaid coverage in the unwinding of the pandemic moratorium on disenrollments may be more robust than is generally anticipated.

——-

Data note: The enrollment reported at 100-138% FPL in 2021 in the table above is an estimate because CMS only began breaking out that income bracket in 2022. In years prior, the nearest bracket reported was 100-150% FPL. For the estimate above, I divided 2023 enrollment at 100-138% by enrollment at 100-150% FPL for each state and applied the percentages to the 2021 totals for 100-150% FPL. The table below shows the columns on which those calculations are based. Also, KFF omitted North Carolina and South Dakota from its recent update of the analysis of the coverage gap, because those states are slated to expand Medicaid within a year. Because my concern is enrollment patterns through 2023, and Medicaid is still unavailable in those states, I substituted estimates for those states from a prior iteration of the KFF analysis that estimated the uninsured as of 2019, with similar results (the earlier KFF estimates are preserved in this post of mine).

Marketplace enrollment and Uninsurance at 100-138% FPL in Nonexpansion States, 2021-2023

One more note on data: before 2022, CMS broke out enrollment at 100-138% FPL only once, in 2016. At that point, as a chart here shows, the percentage of enrollees in the wider 100-150% FPL bracket with income below 138% FPL was considerably higher — 85.5% vs. 81.4%. Perhaps that’s because high-CSR silver coverage is now available free at incomes up to 150% FPL, whereas in the pre-ARPA era, the premium for benchmark silver jumped from 2% of income at 100-138% FPL to 3-4% of income at 138-150% FPL.

—-

* Most recently, South Dakota voted by referendum to enact the expansion in 2022 and will open the gates on July 1. North Carolina passed a law enacting the expansion late last month (March 27), contingent upon a funding agreement for the 2023-2024 budget. Coverage is expected to begin in January 2024.

No comments:

Post a Comment