Update, 5/4/21: New data via the CMS state-level public use files for 2021 shows that enrollment at 100-138% FPL in nonexpansion states increased dramatically in 2021. See this post for an update.

In a brief estimating how many people remain in the "coverage gap" -- uninsured poor adults in states that have refused to enact the ACA Medicaid expansion -- the Kaiser Family Foundation also sheds a sidelight on a question I've been pondering.

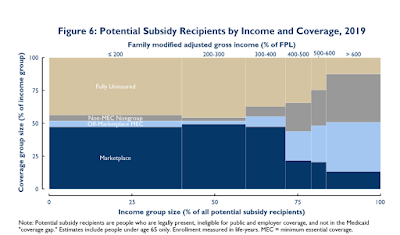

It's this: In nonexpansion states, what percentage of those in the 100-138% FPL income bracket, who would be eligible for Medicaid had their states enacted the expansion, enroll in the marketplace coverage that's available on relatively favorable terms?

In expansion states, eligibility for marketplace subsidies begins at 138% FPL; people below that income level are eligible for Medicaid. In nonexpansion states, marketplace subsidy eligibility begins at 100% FPL. People with incomes in the 100-138% FPL income range, who "should" be in Medicaid, can purchase a benchmark silver plan with strong Cost Sharing Reduction for 2% of income, or a maximum of $29 per month at the high end. The actuarial value of silver at that income level is 94%; the average deductible is around $200, and the average annual out-of-pocket maximum is about $1100.

In addition to estimating the number of people in the coverage gap, who are eligible for no aid at all under the ACA, KFF, parsing 2019 American Community Survey data, estimates the number of uninsured people at 100-138% FPL in each state that has refused to enact the expansion. That number can be set against the number of enrollees in the 100-138% FPL bracket in each state as of the end of Open Enrollment for 2020 (CMS has not yet broken out enrollment by income for 2021).

There's one catch: CMS breaks out income at 100-150% FPL, not 100-138% FPL. In 2016, however, in a one-time analysis, CMS did provide enrollment figures at 100-138% FPL, and Charles Gaba charted the percentage of enrollees in the larger bracket (100-150% FPL) who were also in the narrower should-have-been-in-Medicaid bracket (100-138% FPL). Those percentages are unlikely to have changed much. Putting it all together, then, here are the results

Takeup of ACA marketplace coverage at 100-138% FPL in nonexpansion states

Sources: CMS State-level Public Use Files, 2020 (enrollment); KFF (uninsured estimate); Charles Gaba (enrollment at 138% FPL).*

These estimates cut against an older perception that takeup is significantly higher at lower income levels, where CSR is strong and the percentage of income required for a benchmark silver plan is relatively low. In 2015, Avalere Health reported a conclusion along those lines:

as of the close of the 2015 open enrollment period, exchanges using HealthCare.gov had enrolled 76 percent of eligible individuals with incomes between 100 and 150 percent of the federal poverty level (FPL) or $11,770 to $17,655. However, participation rates declined dramatically as incomes increase and subsidies decrease. For instance, only 16 percent of those earning 301 to 400 percent FPL picked coverage through an exchange, even though they may be eligible for premium subsidies.

Changes since 2015 in total marketplace enrollment (basically null) and income distribution cannot explain such a stark difference in conclusions. Survey-based data reflecting insurance status and household composition and income is fraught with uncertainties, as both KFF's technical appendices and Fiedler's analysis make amply clear. By this point, though, it seems clear that takeup of marketplace coverage at low incomes is far below takeup of Medicaid, which exceeds 90% across all categories if KFF's estimate that 7.2 million of the Medicaid-eligible are uninsured is accurate. Medicaid enrollment has almost certainly topped 80 million in the pandemic. About 8 million Medicaid enrollees are dually eligible for Medicare, leaving a nonelderly enrollment population in excess of 70 million (half of all enrollees are children).

The American Rescue Plan Act, signed on March 11, has made benchmark silver marketplace coverage free at incomes up to 150% FPL*, while also ramping up spending on outreach and enrollment assistance. Whether marketplace takeup under these new conditions approaches Medicaid levels at low incomes remains to be seen.

--

A few notes on sources and estimates: Given the 5% marketplace enrollment increase in 2021, plus the extended emergency Special Enrollment Period launched on Feb. 15 this year and continuing through August, current effectuated enrollment is likely to be comparable to 2020 total plan selections as of the end of Open Enrollment. The 2021 increases probably roughly offset the yearly gap between plan selections recorded in the PUF as of the end of OE and enrollment actually effectuated as of February, a total not yet reported for 2021. As to the percentage of enrollees in the 100-150% FPL bracket who are also in the 100-138% FPL range, that is unlikely to have changed significantly since the one-time snapshot in 2016. Finally, KFF left Oklahoma and Missouri out of its analysis of the coverage gap, as both were presumed to be primed to enact the expansion in July 2021. The Missouri legislature recently balked at funding that referendum- and state constitution-mandated expansion, however.

* Corrected, 4/12, from 200% FPL. At 150-200% FPL, benchmark silver coverage now costs 0-2% of income.

Pt 1:

ReplyDeleteExcellent work in the details, going in at the numbers in a way that not all people with a Ph.D. in Literature would be able to do. You have more than one talent. (My Ph.D. is in mathematical statistics, and I worked for a long while as a statistician in the pharmaceutical industry, so you would expect quantitative fluency with my background but not necessarily yours!)

As you know, I am a bit of a "half-empty" person on the current ACA (including the prior-existing Medicaid systems that are part of post-ACA coverage), so let me make two remarks indicating the defects in the system that are brought to mind by this 100-138% FPL category that you focus on.

1)Around my concern expressed in comments frequently: the estate recovery on expanded Medicaid and other non-long-term-care Medicaids for people 55-64 in at least 12 expansion states, including blue MA, MD, and NJ. (Which estate recovery can be either all medical bills paid out, or a capitation. In the former case, its a terrible thing for people with assets to lose to have to deal with in this goofy not-yet-fixed ACA--they have no insurance at all.)

Regarding your "should be in Medicaid" population, people with income 100-138% FPL, for people with any assets to lose 55-64, it actually is WORSE for them if the state expands Medicaid (if it has the Federally-permitted policy of estate recovery non-long-term Medicaids for people 55-64).

Because, without the expansion, they get real insurance, and don't have the risk of losing their entire ability to pass on assets. But, if Medicaid is expanded, the possibly catastrophic estate-loss risk exists then exists for these people.

(I often need to point out that expanded Medicaid eligibility, which blocks subsidized on-exchange enrollment by ACA rules, is income to 138% FPL with NO ASSET CAP. It is a mistake to believe all expanded-Medicaid eligible are poor with few assets. Indeed, expanded Medicaid eligibility is common for people with lots of assets: people early-retired, people taking a few months off from work, self-employed people without contracts for a few months, people unemployed. (Note in most states, expanded Medicaid eligibility is monthly, and a month with it in many states causes the exchange to switch a person automatically to expanded Medicaid and cancel the on-exchange. This monthly aspect makes it apply to even more people who have substantial assets to lose, though even where Medicaid eligiblity is annual, it still applies to large numbers of people with assets to lose.)

Pt 2:

ReplyDelete2)Otherwise, the issue of the way ACA subsidy eligibility is structured, and particular, a tight logical analysis of your roughly but not exactly correct in the very-fine detail of individual months:

"In expansion states, eligibility for marketplace subsidies begins at 138% FPL; people below that income level are eligible for Medicaid. In nonexpansion states, marketplace subsidy eligibility begins at 100% FPL." is actually an oversimplification, because of monthly on the one hand, and annual on the other hand.

And it brings up another problem with this goofy cobbled-together system.

To be eligible for subsidized on exchange for a given month, you have to:

a)Have income 100% FPL or above for the whole year

and

b)be ineligible for expanded Medicaid for the month. (Expanded Medicaid eligibility, where states do it monthly, which I think is most common, is income for the month to 138% FPL with no asset test.)

A little math problem:

There are arrangements of monthly income for a person in an expansion state where a person whose annual income is below 100% FPL is eligible for neither expanded Medicaid or subsidized on-exchange coverage for certain months.

I won't fill in the arrangements of monthly income that cause this, but they exist, and the interested readers may enjoy coming up with some examples.

(Being very mathematical, I saw this possibility immediately on ACA passage if states did Medicaid eligibility monthly, and I caught on the web at least two "experts" warning states to make expanded Medicaid eligibility annual, like the income for subsidized on exchange that determine amount of subsidy.

But, apparently, most states missed it.)

What a crazy system!

Good of you, Andrew, to plow through details of this crazy, byzantine system and try to make it as good as possible by recommending little tweaks to make it just a bit better.

Pt 3:

ReplyDeleteFor those going through the comments who are unaware of the issue in (1), here are some references on this criminally under-reported issue:

From Andrew:

https://xpostfactoid.blogspot.com/2019/06/aca-medicaid-expansion-lien-on-me.html

https://xpostfactoid.blogspot.com/2021/01/the-117th-congress-should-end-medicaid.html

And from me, adding info to Wikipedia in 2019, when I first found out about the issue:

https://en.wikipedia.org/wiki/Medicaid_Estate_Recovery_Program

(assertions can be verified from the references, which are all online)

Backed up, in case someone pulls content from the article:

https://web.archive.org/web/20200701011813/https://en.wikipedia.org/wiki/Medicaid_Estate_Recovery_Program

Thanks for staying on this issue, Norm.

ReplyDeleteI am curious about how this can impact a person aged 55-64 with low taxable income but high assets. (I worked up to age 65, so I never went through this myself.)

Let's say that a person is at that age and living off savings, so they have no taxable income.

My first response is that this is a very fortunate person in many respects. they have a lot of free time when they are normally healthy enough to enjoy it. They have a lot more money (I assume) than the average American.

Now I despise the penny-pinching anti-social insurance philosophy of the Medicaid asset recovery laws.

But that being said, should I feel sorry for a person that otherwise I might be jealous of?

I may be quite wrong on this, feel free to correct me.