Back in mid-October, I devoted a handful of posts (1, 2, 3) to New Mexico's great ACA marketplace experiment: instructing insurers to price silver plans as platinum-value in 2022 -- that is, as if no one with an income over 200% FPL would buy a silver plan. Below that income threshold, silver plans, enhanced by strong Cost Sharing Reduction (CSR), actually are platinum-equivalent, having an actuarial value of 94% (at incomes up to 150% FPL) or 87% at 150-200% FPL). The instructions were adhered to: throughout the state gold plans offered for 2022 were priced well below the benchmark silver plan.

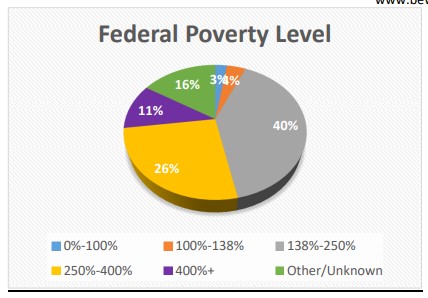

The results were largely as planned, and can fairly be deemed a success. At incomes over 200% FPL, two thirds of enrollees chose gold plans, compared to 35% last year. At incomes in the 138-200% FPL range, comprising most enrollees eligible for strong CSR, 65% of enrollees chose silver plans -- and just 4% chose bronze, generally a bad choice for low income people, with single-person deductibles averaging about $7,000. Among all enrollees, 57% chose gold plans.

Enrollment was up modestly, from 42,984 in Open Enrollment 2021 to 45,973 this year, a 7% increase. That's below the 11.5% average increase this year for states that have expanded Medicaid, as New Mexico has. But New Mexico launched a new state-based exchange, bewellnm, in the Open Enrollment Period for 2022, and that transition has often triggered enrollment losses for other states.

Here are the metal level choices broken out by income (courtesy of bewellnm, at the first link above):

There is a danger of unintended consequences among enrollees with incomes in the 150-200% FPL range, where the second-strongest level of CSR is available. At an income of $24,000 (a bit below 200% FPL), in [Albuquerque], a 40 year-old will pay $16/month for lowest-cost silver plan (deductible $1200), $33/month for the benchmark silver plan (deductible $500), and $0 for the four cheapest gold plans available -- one of which has a deductible of $750. Some will go for gold.That may look sensible to many, but it obscures a major advantage of high-CSR silver: a much lower annual out-of-pocket (OOP) maximum. For the two cheapest silver plans, the OOP maxes are $2200 and $2500, respectively. In the four zero-premium gold plans, the OOP max ranges from $4500 (unusually low for gold plans nationally) to $8700 (the highest allowable).

Many New Mexicans eligible for high-CSR silver (and the low OOP max) did in fact go for gold: 65% silver selection at incomes below 200% FPL is actually well below par. As the post quoted above notes, the new New Mexico exchange, Bewellnm, could do a better job highlighting the OOP max contrast.

4. Conversely, while a silver plan with the weak CSR attaching at 200-250% FPL has a lower AV than a gold plan (73% vs. 80%), it also has a statutory OOP max that's a couple of thousand dollars below the highest allowable OOP max for non-CSR plans -- and in fact lower than most gold plans. That could make a silver plan a better bet for some in this income range. As marketplace insurers are generally incentivized to sell silver plans, since a) a majority or strong plurality of enrollees in each state are eligible for strong CSR, and the cheapest silver plans capture many of them, and b) the risk adjustment formula used by CMS advantages silver plans, some insurers may have worked to entice higher-enrollee buyers into silver, with some effect.

For example, when I used the commercial broker HealthSherpa, which deploys an all-cost-estimator to make plan recommendations, searching as a 40 year-old in Albuquerque with an income of $27,000 (about 210% FPL), I was presented with this recommendation:

While free gold plans are available at this zip code with this income level, this is not an unreasonable recommendation, considering the deductible and the OOP max. Compare the two cheapest gold plans, left and center below (also courtesy of HealthSherpa):

Not an easy choice: the marketplace, and American health insurance programs generally, don't make for easy choices. But note that 27% of enrollees in the 200-250% FPL range still selected silver plans.

Update, 2/5/22: On a reread the morning after, I'm moved to step back and marvel at the bottom line results here: 4% gold selection at incomes up to 200% FPL, and more than two-thirds gold selection at incomes above 200% FPL. Enrollees obtained an average weighted AV of about 85% at incomes below 200% FPL, and of 75% at incomes above that threshold. In 2021, average AV was about 81% at incomes below 200% FPL, and 69% at incomes in the 200-400% FPL range. The comparison is not exact, because the income brackets differ somewhat, but the extra value added is clear.

-----

* In Wyoming, one of the smallest ACA market in the country, and the market with the highest base (unsubsidized) benchmark silver premiums, 58% of enrollees in 2020 and 62% in 2021 selected gold plans, which in 2022 are available free at incomes up to $34,000 for a single 40 year-old. The state BCBS was a monopoly insurer through 2020. In 2021, Mountain Health Co-op, which previously offered coverage in Montana and Idaho only, entered the Wyoming market, and did not shake up the gold-below-silver pricing structure (which is not mandated by regulation in Wyoming, which does not have an effective rate review process, according to the federal government (as noted, along with everything else you could possibly want to know about this or any other state exchange, by Louise Norris). No other state has come close to New Mexico's 57% gold selection this year. Maryland, which mandated somewhat less strict silver loading, had 40% gold enrollment in 2021, and Iowa was 40% gold in 2020. No other state has exceeded 40% gold selection in any year that I can see.

The availability of free gold plans in the 150-200% FPL income range in New Mexico is something of a mixed blessing, as gold enrollees in that income bracket take on a higher OOP gap with gold, as noted above.

Subscribe (free) to xpostfactoid

No comments:

Post a Comment