With a 50-50 Senate under Democratic control, how far will the Democrats go in rendering health insurance more affordable for those who currently find it unaffordable?

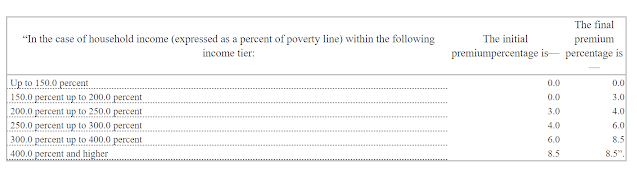

The Affordable Care Enhancement Act passed by the Democratic House last June would reduce the percentage of income paid for a benchmark silver plan in the ACA marketplace at every income level -- and remove the income cap on subsidy eligibility, currently 400% of the Federal Poverty Level ($51,040 for an individual, $104,800 for a family of four). Premiums for a benchmark silver plan would range from $0 (at incomes up to 150% FPL) to 8.5% of income. Here's the scale established by the bill:

- Among the subsidy-eligible, takeup of marketplace coverage is below 50%, according to the Kaiser Family Foundation ( or maybe a few points higher than Kaiser calculates).

- Enrollment among the unsubsidized in ACA-compliant plans dropped by 2.8 million, or 45%, from 2016 to 2019, according to CMS. That was in the wake of premium increases exceeding 20% in 2017 (a market correction after initial underpricing) and 2018 (driven by the failed Republican repeal drive and regulatory assault).

On one side of this question was Stan Dorn of Families USA, who has been pushing states to improve affordability at lower incomes (up to 300% FPL) for years. The main arguments: uninsured rates are much higher at lower incomes than over 400% FPL; takeup at incomes below 300% FPL in Massachusetts, where coverage is way more affordable than in other states thanks to a Medicaid-like marketplace available up to that threshold, is the best in the nation; and high takeup among the healthy young at lower incomes will drive down unsubsidized premiums (see again Massachusetts, which has the lowest or second lowest premiums in the nation). I would add that according to Kaiser's numbers, about 9-10 million uninsured are eligible for ACA subsidies.

On the other side of the question, tentatively and equivocally, is me. Point one is political: the Affordable Care Act has failed to make coverage affordable for millions of unsubsidized prospective enrollees, and Democrats have been flayed for that since the law's passage -- with some justification. The one subset of Americans that the ACA materially harmed were healthy pre-ACA individual market enrollees who paid less for coverage they found adequately comprehensive -- often far less -- than they had to pay once the ACA marketplace launched (along with their unsubsidized successors). Unquestionably, unsubsidized ACA-compliant coverage is a heavy financial lift, and quite literally unaffordable in some markets. As mentioned above, about 3 million enrollees have been priced out since 2016, and perhaps as many between the ACA marketplace's launch in 2014 and 2016.

In 2015 -- before the premium surges of 2017-2018 -- Urban Institute scholars Linda Blumberg and John Holahan calculated that individual market enrollees in the 400-500% FPL income bracket paid a higher percentage of income for coverage than any other income group (this in a study that proposed the premium subsidy boosts similar to those incorporated in the ACEA):

Of course, the regulatory measures aren't free: they would raise the cost of federal subsidies substantially. But aggressive regulatory action would take some of the heavy financial lift off the shoulders of a barely-Democratic Congress.

---

* Silver loading is a practice first implemented in the ACA marketplace for plans effective in 2018, after Trump cut off direct reimbursement of insurers for Cost Sharing Reduction (CSR) subsidies in October 2017. Since CSR is available only with silver plans, after the cutoff insurers were allowed to price the benefit into silver plan premiums only, which created steep discounts in bronze and gold plans in many states and regions. Silver loading has boosted enrollment, but its implementation has been haphazard and incomplete, as silver plans remain underpriced on average. Regulators can mandate that insurers price silver plans in accordance with their real actuarial value, as the ACA statute in fact requires.

** Actuarial value denotes the percentage of medical costs the average enrollee must pay out pocket, as calculated by a formula provided by CMS. At present, enrollees who exceed the annual out-of-pocket cost limit (about $8,500 this year) skew the average, as Bill Gates walking into a bar would skew the average income of customers present. A bronze plan with an AV of 60% might have a $7,000 deductible and cover just 50% of the cost of most services after the deductible is reached.

Update, 1/19/21: See Charles Gaba's deep dive into various Democratic plans to enhance the ACA on both federal and state levels.

Subscribe to xpostfactoid

Thank you so much for much good information, at this critical time when the slim Democratic Senate majority has opened up to possibly allow some badly needed ACA fixes to the extent permissible by "reconciliation".

ReplyDeleteParticularly, thanks for:

"The one subset of Americans that the ACA materially harmed were healthy pre-ACA individual market enrollees who paid less for coverage they found adequately comprehensive -- often far less -- than they had to pay once the ACA marketplace launched."

That's a fact that you don't see very much in the press. (My recollection is only, in fact, seeing it once -- in a recent Krugman column.)

I also love:

"Enrollment among the unsubsidized in ACA-compliant plans dropped by 2.8 million, or 45%, from 2016 to 2019, according to CMS."

as those numbers, which I was unaware of, show the enrollment affect of the problem around the "subsidy cliff".

(I have been aware of the "subsidy cliff" at 400% FPL as a potential problem since ACA passage.

And I even calculated, in 2019, the second lowest cost bronze plan for a Chicago couple, 63, at income levels of 399% of FPL and 401% of FPL, would be $5,559 a year and $18,513 a year, respectively. The jump in cost at the discontinuity point is $12,954, and the percent of MAGI that these represent are 6.6% and 21.9%, respectively. I used bronze rather than silver because of the possible silver loading making silver non-optimal for the two cases, which are non-cost-sharing cases.)

Note a third of the substantial problems with the current ACA is the "family glitch", which is that a family only becomes eligible for subsidized on-exchange coverage if any employer insurance that would cover the employee only (not the whole family!) is affordable (by whatever % of income that affordability cutpoint is.)

From https://www.healthaffairs.org/do/10.1377/hblog20210107.817888/full/ , I see the ACA Enhancement Act, which you mention, did eliminate that. So it's in the Democrat's sight, though it's unclear they will attempt it now.

Also, on Massachusetts, note one of reasons the rates are lower is that the state merges the individual and small group markets actuarially by law. Thus, to the extent that individuals are more expensive to insure because they are sicker than working people, or there is particular adverse selection in the individual market, the affect gets diluted by merging with the small business groups.

(That's here: https://www.healthinsurance.org/massachusetts-state-health-insurance-exchange/#regs

"Massachusetts and Vermont are the only two states where the individual and small group risk pools have been merged (DC also has a modified merged risk pool, but it operates more like the rest of the country, and less like Vermont and Massachusetts), which means that the individual market is less volatile than many other states."

and also here:

https://www.healthaffairs.org/do/10.1377/hblog20180903.191590/full/)

I had left out a MA detail that may be responsible somewhat for the lower on-exchange rates, besides the pooling of individuals with small businesses.

ReplyDeleteMA still has a mandate to carry coverage. It had that mandate with Romneycare, did not stop it with the ACA (so there was, at ACA outset, both a state and a federal penalty) and the state mandate continues.

Also note: In terms of maximum rates hitting older people, MA allows only 2:1 rate ratios old to young, rather than the ACA maximum permitted 3:1.

Also note: despite these good things, MA should not claim it is so perfect for healthcare. It is one of the about 12 states that estate recover ordinary health coverage (non-long-term-care) Medicaids and expanded Medicaid for people 55+--the problem highlighted in your last blog.

MA claims about 97% are health insured in the state, but if you count the roughly 4% of the people in the state with a Medicaid or expanded Medicaid who are 55+ correctly, as having no insurance at all, but rather a loan for medical expenses, then the insured rate is 93%. This miscounting by the state of MA follows a US Census practice with the same miscounting.)

The prior xpostfactoid blog mentions Massachusetts recently decided to exempt the first $25,000-$50,000 of paid out medical bills from estate recovery, but that's not much, and the fundamental problem remains: "OK, we'll force you low income people into intergenerational poverty, but you can keep $25,000 - $50,000. But, if your income is a little higher at 138% FPL+-- subsidized on exchange--then you're the real people that count, and you get real insurance with heavy subsidies--you can keep any wealth to pass on inter-generationally."

As I see it, despite however well the actuaries have managed to control maximum on-exchange premiums (note: partly with a pooling mandate that taxes small businesses with higher premiums rather than a more honest revenue-through-visible-taxation source), on the expanded Medicaid and Medicaid part, they're failing by not giving people insurance--just a loan.

(It's especially goofy in MA, since MA still has has a mandate to carry coverage with a penalty. The mandate is justified as needed to make sound insurance available -- prevent adverse selection and death spirals, but the Medicaid and expanded Medicaid people, who are subject to the penalty, have no insurance at all -- just a volatile loan until death for whatever medical happen to occur!)

Thank you for the clear explanations. One small dictation software fail "paid a hire percentage"

ReplyDeleteHa, thanks. That "dictation software" is in my desktop computer..

DeleteThe state of California rather quietly extended ACA subsidies so that persons with over 400% of poverty would start getting help with premiums

ReplyDeleteBased on what I remember from the California cost projections, extending this increase to the whole nation should cost $4-%6 billion a year. Why not do this right away?