Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up.

KFF data and analysis is essential to anyone seeking to understand the U.S. healthcare system. It’s copious, reliable, and clearly presented. But inevitably, it’s not always up to date.

In late 2024, KFF posted a calculator estimating how much more ACA marketplace enrollees at any income, income and family size would pay for coverage in 2026 if the subsidy enhancements created by the American Rescue Plan Act (ARPA) are allowed to expire (they are funded only through 2025). If the ARPA subsidy schedule expires, which appears near-certain at this point, the subsidy schedule will revert to the pre-ARPA formula used through OEP 2021, adjusted by an annual inflation factor.

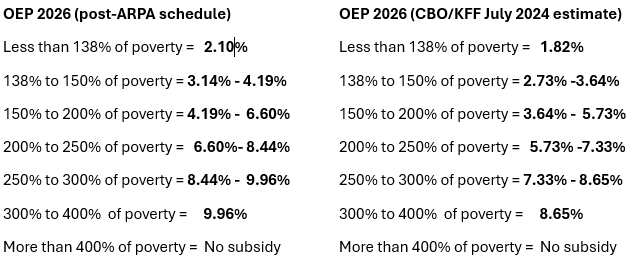

When the calculator was created, the subsidy schedule for 2026 was unpublished, and KFF used estimates created by CBO and the JCT in June 2024 (see p. 9 here). Last month, the IRS published the subsidy schedule for 2026, and the CBO estimates turn out to have been quite low. At higher incomes, the actual percentage of income required to buy the benchmark (second cheapest silver) plan is more than a full percentage point higher than CBO estimated (e.g., 9.96% of income at an income of 300% of the Federal Poverty Level (FPL) vs. the CBO estimate of 8.65%).

Percentage of income required to purchase a benchmark silver plan at different income levels in Plan Year 2026: Actual vs. KFF/CBO 2024 estimate

Sources: IRS, KFF, CBO. See note at bottom for the ARPA enhanced subsidy schedule.

The large difference in the applicable percentages as estimated by CBO and as actually implemented must be due in part to a change in the calculation method mandated by Trump’s CMS in its marketplace “integrity” rule, finalized in June. Reversing a Biden-era adjustment, the new rule mandates including individual market premium increases along with employer-sponsored premium increases in the calculation. That rule change resulted in the highest allowable annual out-of-pocket maximum jumping from $10,150 to $10,600, and I would assume that it also increased the applicable percentages for premium payment. When CMS implemented a similar rule change in the first Trump administration, it made the applicable percentages 2.7% higher in 2020 than they would have been without the change, according to CBPP (thanks, Louise Norris).

The application of individual market premiums to the inflation calculation includes all years that the ACA marketplace was in operation, and so is still inflated by the large premium hikes of 2017-2018 (each north of 20%), notwithstanding years of premium stability after 2018. This year, premium increases once again are likely to come in at or near 20% on average* — due in part, as in 2018, to Trump- and Republican-induced market turmoil — ensuring a further large increase in the applicable percentages next year.

CMS estimates that reversion to the Trump 1.0 era method of calculating the applicable percentage will reduce enrollment by 80,000 in 2026 and reduce the Treasury’s payments to insurers by between $1.27 billion and $1.55 billion. In response to commenters’ concerns that the increased costs will disproportionately harm lower-income enrollees and worsen the risk pool, CMS acknowledges those points but effectively responds, “too bad.” All that matters is that the calculation accurately reflect the entire commercial insurance market for the nonelderly and fulfill Congress’s intent —as defined by the current CMS. [Update added, 8/15/25]

Given the jump in applicable percentages, KFF’s estimate that the average marketplace enrollee’s premiums will increase by 75% understates the premium increases that subsidized ACA enrollees will experience if the ARPA subsidy schedule expires (the carnage at incomes above the pre-ARPA income cap on subsidy eligibility, 400% FPL, is unaffected by these estimates). In the comparisons below, net-of-subsidy premiums for a benchmark silver plan range from 8% to 15% higher than KFF estimates.

The KFF/CBO underestimate of the applicable percentage table is partly offset by a corresponding underestimate of the annual inflation adjustment for the Federal Poverty Level. That is, the calculator slightly overestimates FPL for Plan Year 2026 at any given income, raising the percentage of income required for the benchmark plan (in the marketplace, the applicable FPL is for the year prior to the Plan Year). For example, the actual single-person income at 200% FPL for PY 2026, $31,300, is deemed 208% FPL in the KFF calculator.

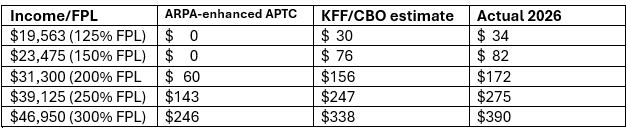

Below, I’ve set the actual cost of benchmark silver for an individual at various incomes against the KFF estimates and the costs under the ARPA subsidy schedule (which does not adjust for inflation).

Monthly net-of-subsidy premium for benchmark silver plan in 2026 if ARPA subsidy enhancements expire: KFF/CBO estimate vs. actual applicable percentage

Single adult, any age. FPL for 2025 (applies to PY 2026)

The full name of the rule for the marketplace finalized in June by Trump-appointed CMS director Peter Nelson is the “Marketplace Integrity and Affordability Rule.” To the extent that the stated aim of “affordability” is not Orwellian, it must refer to “affordability” for taxpayers, since just about every provision affecting costs makes coverage more expensive for enrollees, while numerous new barriers to eligibility and enrollment (e.g., verifying income and immigration status before subsidies can be credited) will degrade the risk pool, as healthier enrollees are less likely to jump through the hoops.

At the same time, CMS just announced (with DOL and the Treasury) that it will pause enforcement of the Biden administration’s imposition of a four-month time limit on lightly regulated, medically underwritten so-called Short-term, Limited Duration (STLD) plans, setting the stage for re-establishing that market as a rival to the ACA-compliant marketplace, as the first Trump administration did. With premium and out-of-pocket costs primed to soar, this administration seems on course to convert the ACA marketplace into a high-risk pool, with unsubsidized and inadequately-subsidized enrollees driven into the STLD market or other alternatives yet to be introduced.

Many insurance brokers are chomping at the bit to sell STLD plans — partly because many have many clients who will lose subsidy eligibility, and partly because commissions are much higher for the lightly-regulated STLD plans, which can have medical loss ratios as low as 45% (vs. a mandatory minimum 80% for ACA-compliant plans). It’s reasonable to infer that Trump 2.0 will be more successful establishing ACA-noncompliant markets than Trump 1.0. While much ink is spilled about the political risks for Republicans generated by jacking up premiums and out-of-pocket costs for 20 million subsidized marketplace enrollees, degrading the ACA marketplace — and then lying about the fallout — seems more in keeping with MAGA priorities and practice than trying to mollify constituents by shoring it up.

- - -

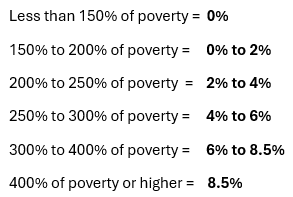

Applicable Percentages under ARPA (funded through 2025)

* Pending Charles Gaba estimate to be posted later today.

No comments:

Post a Comment