Note: Free xpostfactoid subscription is available on Substack alone, though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up.

|

| Trumpcare 2.0 is also gold-laden |

Amidst the carnage wrought by the (still reversible) expiration of the enhanced subsidies in the ACA marketplace, one substantial mitigating factor has emerged: silver loading has reached a milestone. While net-of-subsidy premiums for benchmark silver plans will more than double for the average subsidized enrollee, the average lowest-cost gold plan will be priced below the benchmark (second-cheapest) silver plan for the first time.

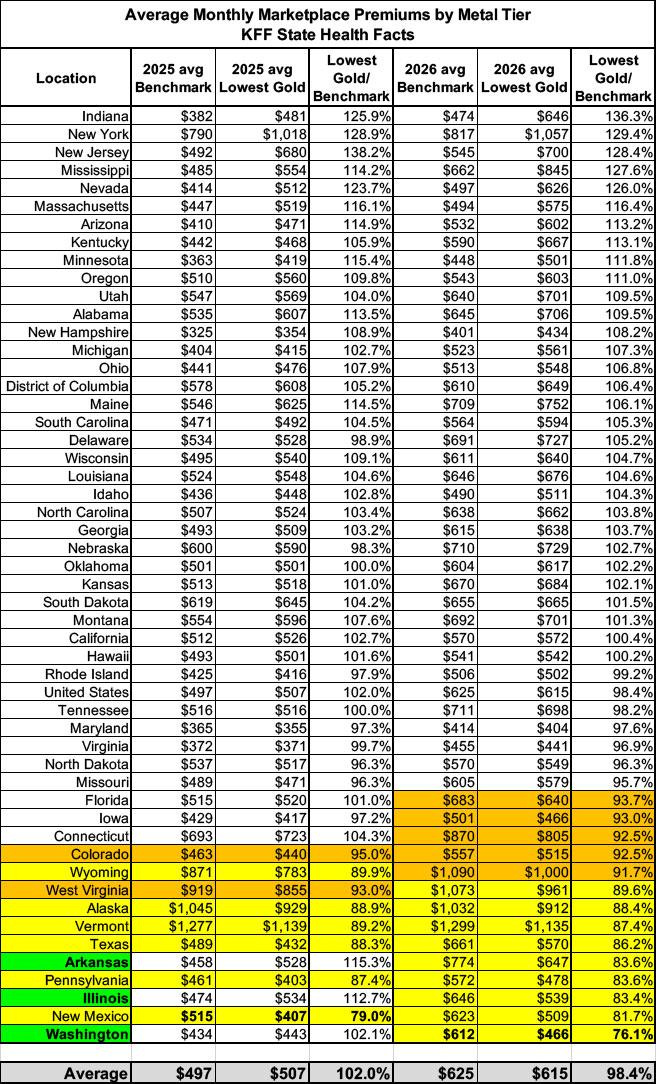

That average masks a ton of variation: the average lowest-cost gold plan is priced below benchmark in only 20 states. But those states include Texas and now Florida, which together accounted for more than a third of all enrollees nationally (8.7 million). In total, average lowest-cost gold plans have premiums below benchmark in 20 states with 12.7 million enrollees, 52% of all enrollees nationwide. (In another 12 states, lowest-cost gold premiums average less than 105% of benchmark premiums.)

Charles Gaba has helpfully ranked states by the degree to which lowest-cost gold is priced above/below benchmark silver in 2026 (see image at bottom) and mapped out several comparisons of what enrollees will pay for bronze, silver or gold plans in various states and locales.

Why and how are gold plans, which have an actuarial value of 80% (with small allowed variation), be priced below silver plans, which have a base AV of 70%? Well, if I may plagiarize myself, “silver loading” refers to

the practice of pricing the value of Cost Sharing Reduction (CSR), which attaches to silver plans for enrollees with income up to 250% FPL, directly into premiums for silver plans. Doing this was rendered possible/necessary when Trump cut off direct reimbursement to insurers for the value of CSR in October 2017*. Since CSR raises the actuarial value of a silver plan to a roughly platinum level at incomes up to 200% FPL, and most silver plan enrollees are below that income threshold, silver plans’ average actuarial value exceeds that of gold plans — so gold plans should be cheaper than silver. Since marketplace subsidies are structured so that enrollees pay a fixed percentage of income for a benchmark silver plan, pricing CSR into silver raises subsidies along with silver premiums, making plans that are cheaper than the benchmark more affordable.

In practice, silver loading is usually only partial, as insurers have several incentives to underprice silver plans. Several states, however, have mandated “strict” silver loading, directing insurers to price plans at each metal level in strict proportion to their average actuarial value (which for silver plans is higher than gold’s 80% AV in most states). A handful of states — most notably, Texas, which has 4 million enrollees — have gone further, directing insurers to assume that all silver plan enrollees have income below 200% FPL, i.e., that silver plans have an AV of about 90%. That’s meant to be a self-fulfilling prophecy: if gold plans are cheaper than silver plans, no one with an income over 200% FPL has any reason to select silver.

I’ll add here that in states that have not expanded Medicaid, where subsidy eligibility in the marketplace begins at an income of 100% FPL (rather than at 138% FPL, the Medicaid eligibility ceiling in expansion states), the average silver AV is generally near 90%, as the vast majority of enrollees in those states have incomes below 200% FPL. Strict silver loading reflects current reality in those states.

In advance of OEP 2026, three states — Illinois, Washington, and Arkansas - -have newly mandated strict silver loading, with lowest-cost gold plans ranging from 76% of benchmark silver on average in Washington to 83% in Illinois and 84% in Arkansas. Perhaps more consequentially (or perhaps not..), the insurer Oscar introduced into the Florida market gold plans priced well below benchmark, as well as offering the cheapest bronze plans. In Miami (zip code 33131), a 40 year-old with an income of $30,000, a bit below 200% FPL, will pay $168/month for the cheapest silver plan (deductible $650, OOP max $3,350)— or $110/month for Oscar’s lowest-cost gold (deductible $3,000, OOP max $9,950) or $0/month for Oscar’s lowest-cost bronze (deductible $9,000, OOP max $10,600).

There’s a catch, though. Florida Blue, the state’s dominant insurer, is not playing the cheap gold game — and it is offering the cheapest silver plan, at least in Miami. That recalls the situation I examined in the Philadelphia region and surrounding counties in 2021, when Oscar and Ambetter were offering cheap gold but Independence Blue Cross, the region’s dominant insurer, wasn’t. People stuck with IBC, which claimed 94% market share in the area in 2021. Will Florida follow that pattern in 2026?

Insurer brand equity aside (and it’s a big aside; provider network and formulary strength are hugely consequential to people who know they need healthcare), the metal level lineup in Miami illustrates stark tradeoffs between premium and out-of-pocket cost exposure. Silver loading not only brings gold plan premiums below silver premiums; it also increases by millions the number of prospective enrollees to whom zero-premium bronze plans are available (as KFF regularly highlighted in the early silver loading years, before the enhanced subsidies kicked in in March 2021). For enrollees with income below 200% FPL, silver plans, enhanced with CSR, provide better out-of-pocket protection than gold plans, let alone bronze.

This year, barring a late (and not unlikely) restoration of the enhanced subsidies, sticker shock for lower income enrollees will probably drive many of them into gold and bronze plans, increasing their financial risk while lowering their monthly costs if they stay healthy. In many states and regions, the Miami situation may be reversed: an insurer with broader provider networks or preferable formularies may offer a gold or bronze plan with an affordable premium, while its comparable silver plan may be out of reach (e.g., above benchmark). The calculus is further scrambled in some markets by bronze plans with $0 medical deductibles, albeit offset with features like $4,000 drug deductibles or $3,000 hospital inpatient copays.

As I never tire of noting, CSR takeup has been eroding steadily since 2017, as cut-rate insurers enter more markets with low-priced, narrow network plans. Increased silver loading this year may reduce the number of people who drop coverage entirely while increasing the number of enrollees with income below 200% FPL (65% of all enrollees in 2025) who forgo CSR-enhanced silver coverage.

At incomes over 200% FPL, silver loading provides a less ambiguous benefit. In Texas in 2025, 819,000 enrollees reported income over 200% FPL(a mere 43,000 reported no income at all). Of those, 56% chose gold plans and 42% chose bronze.

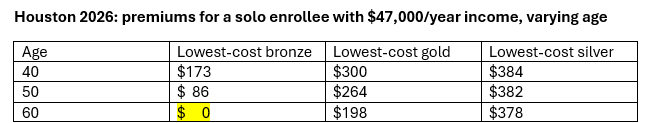

In a year when benchmark premiums are going up an average of 30%, it should be noted that higher benchmark premiums increase the effects of silver loading, as higher benchmark premiums mean higher subsidies and increased spreads between the benchmark and cheaper plans (e.g., gold plans in 20 states). Those spreads increase with age, as the base premium for a 64 year-old is three times the premium for a 21 year-old. Watch what happens to premiums below benchmark for a single person with an annual income of $47,000 as ages rises in Houston (zip code 77001) in 2026:

A lot of people with income under 400% FPL will have access to zero-premium bronze plans — especially in strict silver loading states, and especially at older ages.

- - -

* For enrollees with income up to 250% of the Federal Poverty Level (75% of all enrollees in 2025), secondary Cost Sharing Reduction (CSR) subsidies raise silver AV to 94%, 87%, or 73%, descending with income. The average silver plan enrollee has a plan with an AV well above 80%. In states that have not expanded Medicaid, where subsidy eligibility in the marketplace begins at an income of 100% FPL, the average silver AV is generally near 90%.

The ACA stipulated that insurers be reimbursed separately for the value of CSR, and set silver plan premiums as if the AV were 70%. But in one of several consequential drafting errors, the law declined to make spending on CSR mandatory, and the Republican Congress refused to appropriate funds for it. Under Obama, CMS found the money to reimburse insurers for CSR in couch cushions; Republicans sued to stop it; a court agreed that the payments were illegal, but stayed its ruling pending appeal. When Trump was elected, it was widely anticipated that he would cut off CSR reimbursement. Insurers were leaving the ACA marketplace in large numbers in 2016 and 2017, and as the ACA repeal effort geared up in 2017, it was thought that cutting off CSR payments might spook insurers into a mass exodus. That was apparently Trump’s intent; when he cut off the payments, he boasted that Obamacare was “virtually dead.” But he waited too long: by the time he cut off CSR payments in October 2017 — just two weeks before Open Enrollment — states had made contingency plans, allowing or encouraging insurers to price CSR directly into silver plans.

The probable effects of silver loading were first scoped out in an HHS ASPE brief in December 2015, followed by an Urban Institute analysis in January 2016. In August 2017, the Congressional Budget Office forecast that cutting off direct CSR reimbursement would increase federal spending on premiums by $194 billion over ten years. All of these analyses anticipated that gold plan premiums would swiftly drop below those of silver plans. But that is happening slowly, state by state. Thanks to CSR, silver remains the most-purchased metal level, and insurers compete to offer the lowest-cost and benchmark silver plans. In addition, the risk adjustment program for the marketplace, according to some analyses, unduly favors silver plans, overestimating the degree to which CSR (which reduces out-of-pocket costs) stimulates usage (I hate the word “utilization”) of medical services by low-income enrollees. That can arguably distort markets that mandate strict silver loading.

Here is Charles Gaba’s remix of KFF premium data showing lowest-cost gold premiums vs. benchmark by state:

No comments:

Post a Comment