What is wrong with this picture?

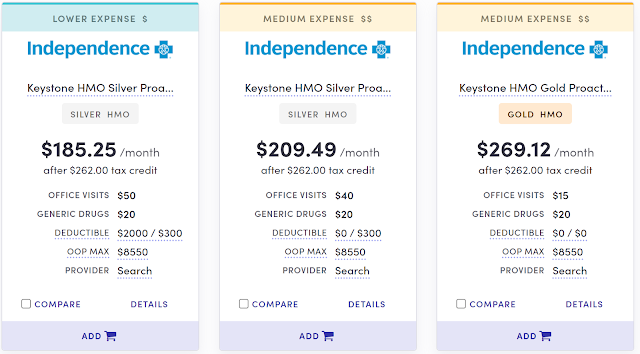

These health plan quotes, taken from the health plan comparison tool provided on Pennie, Pennsylvania's online ACA marketplace, show the lowest-cost silver and gold plans offered in Philadelphia by southeastern Pennsylvania's dominant insurer to a 40 year-old with an income of $38,000. (Premiums are net of a federal subsidy of $262 per month.)

In the pricing of its lowest-cost gold plan, Independence Blue Cross, issuer of the Keystone health plans listed above, is an outlier, in that its lowest cost gold plan is priced well above its lowest cost silver plans. That's not how it's supposed to work in Pennsylvania.

Since 2018, the Pennsylvania Department of Insurance has implemented a regulation for health insurers selling plans in the ACA marketplace -- that is, health plans sold to individuals -- that may seem odd on its face. The regulation requires insurers to price gold-level plans nearly on a par with (in fact, slightly below) comparable silver-level plans. Since ACA premium subsidies are set to a silver benchmark -- enrollees pay a fixed percentage of income (on a sliding scale ranging from 0 to 8.5%) for the benchmark silver plan -- the regulation places premiums for some gold plans at or below the benchmark (second cheapest silver) plan. Throughout the state, gold plans are on sale that are affordable by ACA standards.

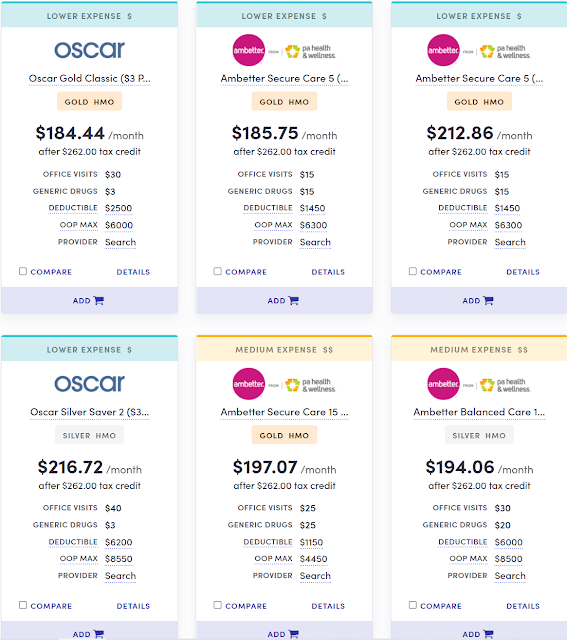

That's true in Rating Area 8, the 5-county pricing area that includes Philadelphia County -- but thanks only to Independence Blue Cross's competitors. Here are the lowest-cost silver and gold plans offered in Philadelphia to the same 40 year-old with an income of $38,000 by Oscar and Ambetter (Centene):

Independence Blue Cross dominates the market in RA-8, selling about 94% of the 124,000 health plans selected in 2021 on Pennie in Pennsylvania's Region 8, which encompasses Philadelphia, Montgomery, Bucks, Delaware and Chester counties. While low-cost gold plans are available in RA-8 people aren't buying them. RA-8 is Pennsylvania's largest rating area, accounting for more than a third of the state's total enrollment.

In RA-8, only 9% of enrollees selected gold plans in 2021 (figures supplied by PA Dept. of Insurance). In all rating areas excluding RA-8, 37% of enrollees selected gold plans. In the state as a whole, 26% of enrollees chose gold. As most gold plan enrollees have income over 200% FPL, the percentage of enrollees above that income threshold who select gold plans is much higher.

Gold or Silver? Depends on your Income

For people with low incomes, silver plans are usually worth more than gold plans, because a secondary subsidy, Cost Sharing Reduction (CSR), attaches to silver plans only. At incomes up to 200% of the Federal Poverty Level (this year, $25,520 for an individual, $52,400 for a family of four), silver plans with CSR are the rough equivalent of platinum plans. Gold plan discounts are in most cases irrelevant to people below this income threshold, who accounted for 44% of marketplace enrollees in Pennsylvania this year and 49% of enrollees in Region 8.

But for people with higher incomes (as in the sample above, which shows premiums for a single 40 year-old with an income of 38,000, slightly below 300% FPL), the opportunity to buy a gold plan for less than the benchmark silver premium (that is, at a premium deemed "affordable" by ACA standards) is a major boost to affordability. At higher incomes, silver plan deductibles average about $4,800. Gold deductibles are in the neighborhood of $1600 (in both gold and silver plans, many services are not subject to the deductible).

The rationale for Pennsylvania's requirement to price gold and silver plans with the same provider network all but equally is that thanks to the CSR subsidy, silver plans, on average, are as at least as generous as gold plans -- more generous for low income people, less generous for those with higher incomes. (This pricing practice is often dubbed "silver loading," since it depends on adding the estimated value of CSR to silver plans only. See the note at bottom for a fuller explanation.)

The regulation works, to the extent that most insurers in Pennsylvania have complied. Throughout the state, the lowest-cost gold plans are priced below the benchmark silver plan in each area.

A gold hole in Philadelphia and surrounding counties

While that's true in every region, it's not true for every insurer. The outsized exception is Independence Blue Cross's Keystone East plan menu offered in Rating Area 8.

In Philadelphia, for a 40 year-old, Independence's lowest-cost silver plan, Keystone HMO Silver Proactive Lite, costs $84 per month less than the insurer's lowest-cost gold plan. That gold plan, Keystone HMO Gold Proactive, is $60 per month more expensive than the more directly comparable Silver Proactive (not "Lite"). For a 60 year-old, those price spreads double (as the unsubsidized premium for a 60 year-old is twice as high as for a 40 year-old).

Throughout RA-8, there are similar gaps between Independence's low-cost silver and gold plan offerings. Enrollees in these five counties can find low-cost gold plans, but they have to look to the two other insurers, Oscar and discount insurer Ambetter, to find them. And very few do.

The value of Independence gold

Why is Independence's Keystone HMO Gold Proactive plan priced well above its HMO Silver Proactive Plan? Independence's explanation in its rate filing focuses on the plans' 3-tiered network. Plan members pay more for services from providers (hospitals, doctors, etc.) in the higher tiers. While Keystone's gold and silver "Proactive" plans offer the same provider network, and the same tiers, the cost penalty for using higher-tiered providers in silver plan is much steeper than in the gold plan.

When enrollees use "Tier 1" providers, both plans have a $0 deductible. (That means the silver plan nominally has a deductible well below that of the cheap gold plans on sale from competitors Oscar and Ambetter in Philadelphia.) But the silver plan has a $6,000 individual deductible in Tiers 2 and 3 ($12,000 for a family) -- and the gold plan has no deductible in those tiers. The plans have the same annual out-of-pocket maximum: $8550 for an individual, the highest allowable.

The difference between the two plans is particularly stark in enrollee costs for inpatient hospital services. In the gold plan, those services are $350/day in Tier 1, $700/day in Tier 2, and $1100/day in Tier 3 (up to the out-of-pocket max). In the silver plan, hospital inpatient care is $600/day in Tier 1. In Tiers 2 and 3, hospital service is subject to the deductible ($6,000) and runs to $900/day (Tier 2) or $1,300/day (Tier 3).

As I noted back in 2018, moreover, when Independence was playing a different game with metal level pricing, "In Philadelphia, Montgomery and Bucks counties...desired facilities are in the higher tiers: University of Pennsylvania and Mainline Health, the latter key to the suburbs, are both in Tier 3. Doctors are generally affiliated with one health system or another." That insight was courtesy of Antoinette Kraus of the Pennsylvania Health Access Network. In 2021, Penn and Mainline remain in Tier 3 [paragraph added 9/22/21].

In its rate request filed with the Dept. of Insurance, Independence claimed that its gold plans were in fact more generous than platinum plans. ACA-compliant plans at the different metal levels are supposed to cover fixed percentages of the average enrollee's costs, according to a formula provided by the Center for Medicare and Medicaid Services (CMS). That percentage is known as the plan's "actuarial value" (AV). Within a few points of leeway, bronze plans are required to provide 60% AV, silver plans (without CSR) 70%, gold plans 80%, and platinum plans 90%.

In their rate filings, however, insurers report and justify a "pricing AV" that may be somewhat at variance with the official AV. In 2021, Independence accorded a pricing AV of 95% s to its gold plans (including the lowest cost gold plan, HMO Gold Proactive) and 70-73% for its silver plans (73% for HMO Silver Proactive). In other words, AV as calculated by the company was in line with the CMS formula for silver plans, but way above the norm for gold plans (and exceeding the norm for platinum plans). Ambetter and Oscar calculate "pricing AVs" much closer to those of the CMS formula, pegging gold plans in the 80-87% AV range and silver plans in the low-to-mid 70s.

Close observers of the plan menu above may note that the $0 deductible attached to Independence's silver plans appears to trump the deductibles for Oscar and Ambetter's low-cost gold plans, for which deductibles range from $1150 to $2500. But in Pennsylvania's RA-8 as in many ACA markets, plans offer a bewildering maze of services subject and not subject to the deductible, with wildly varying copays and coinsurance percentages for various services. The $6,000 deductible for Tiers 2 and 3 in the Independence silver plans applies mainly to hospital inpatient care, and that's consequential. By the insurers' own calculations underpinning their pricing AVs, the Oscar and Ambetter gold plans provide more generous coverage than the Independence silver plans, despite their higher headline deductibles. Besides brand recognition, the Independence plans may have other advantages, such as the breadth of the provider network.

The wide spread between pricing AVs for Independence's gold and silver plans far exceeds the spread for other insurers in the state. UPMC's "pricing AVs" for gold plans hew close to 80%. Geisinger's are in the high 80s for gold, but in the high 70s for silver -- a proportionate spread, compared to the statutory formula. Highmark, a Blue Cross insurer that sells in 7 of Pennsylvania's 9 rating areas (but not in Region 8), likewise posts pricing AVs in the high 80s for its gold plans and in the high 70s for its silver plans.

The state insurance department asked Independence to explain the high pricing AVs for gold Keystone plans. In response (see p. 75 in Independence's final rate filing for 2021), Independence asserts that claims in the Philadelphia market are particularly expensive:

Q: Please explain why the pricing AVs are significantly higher than the metal AVs [AVs calculated according to the CMS formula] for Gold plans, as shown in Table 10 of the rate filing exhibits. In addition, please compare the average 2021 pricing AV’s by metal level to the actual observed 2019 paid-to-allowed ratios by metal level. To the extent the pricing AV’s are significantly different than the actual observed experience for a particular metal level, please explain and justify why the pricing AV’s are appropriate.

A: Please note that the metal AV is to determine compliance with Actuarial Value and is not a Pricing AV. The metal AV is based on the AV calculator which is calibrated to national average costs. The Philadelphia market is significantly more expensive than the national average from a cost of services standpoint. This means that the same deductible or copay is worth significantly less as a percentage of total allowed cost in the Philadelphia market compared to the national average. This leads to different Pricing AVs for the same metal level.

Philadelphia is indeed an expensive market, but the response does not address why the pricing AV for silver plans is not proportionately high. "If you are trying to make the case that Philly is unique in being a high cost area and therefore a higher AV is expected then that should be a consistent assumption across all metal levels," says Daniel Cruz, an actuary at Axene Partners who has consulted with state insurance departments about ways to ensure that plans at each metal level are priced in proportion to their generosity.

In response to my query as to whether IBX's high gold pricing in Region 8 is appropriate, the Department of Insurance emailed the following:

IBX appropriately applied the non-funding of CSR adjustment in its approved plans. The difference between the AVs of a gold and silver plan can be greater than the non-funding factor, meaning the insurers (in general) may decide to file gold plans that are more expensive than the insurer’s on-exchange, loaded silver plans. That decision represents a company business practice...the Department does not set price relativities across metallic levels.

We have required insurers to “silver load” since the Trump Administration cut of reimbursement to insurers for cost-share reductions. The practice, consistent across insurers, has enabled insurers to increase premiums on silver-level plans to compensate for the increased actuarial value that the plans provide to enrollees. We believe that silver loading helped stabilize our markets and continues to ensure the available of affordable coverage for Pennsylvanians.

The latter claim is true: the Department's requirement that insurers price the value of CSR into silver plans according to a specific formula (that is, price each silver plan at 1.2 times what they would charge for the same plan with no CSR enrollees) has generated substantial gold and bronze plan discounts statewide. Independence, however, is evading the spirit of the law in a region in which it is dominant, -- depriving residents of the most populous part of the state of access to affordable gold plans from the insurer preferred by 94% of enrollees.

Regulatory fixes: state or federal?

The Department of Insurance might consider whether further regulation is required to ensure that benefits and prices proportionate to metal level are offered by all insurers -- including the dominant one in the state's most populous region. The Department could, for example, standardize plan designs at each metal level, as California does. Or it could require insurers to offer plans at each metal level that differ in actuarial value, with proportionately different out-of-pocket costs, but are otherwise alike.

To a degree, however, state regulators are constrained by a national feature of the individual market.

That factor is the risk adjustment program that CMS administers to deter insurers from trying to attract the healthiest enrollees. The current formula, created prior to the ACA marketplace's launch and based on usage of medical services by enrollees in employer-sponsored insurance, favors silver plans, at the expense of gold and bronze plans, by assuming that CSR will stimulate more usage of medical services than has proved to be the case. That's probably because CSR enrollees have lower incomes than those in employer plans, and even the relatively low out-of-pocket costs in high-CSR plans inhibit care more than anticipated. Insurers that attract too much enrollment at other metal levels may suffer in the zero-sum risk adjustment game.

Insurers have other incentives to underprice silver plans compared to bronze and gold. Silver remains the most popular metal level, mainly because CSR makes it an all-but-inevitable choice for lower income enrollees (who are also favored by the risk adjustment formula). That's all the more true since the American Rescue Plan, enacted in March 2021, increased subsidies. Benchmark silver plans with low cost-sharing are now free for enrollees with incomes up to 150% FPL ($19,140 for an individual) and cost no more than 2% of income for people earning up to 200% FPL (topping out at $43/month for an individual earning 200% FPL, or $25,520).

Cruz of Axene Partners argues that the ACA statute requires insurers to price otherwise comparable plans at different metal levels in strict proportion to their actuarial value, and that state regulators should hold them to this requirement. A level playing field means that all health plans compete on quality, efficiency and cost of care as opposed to price-based risk selection. If they attempt the latter, regulators should stop them. Some industry analysts counter that forcing insurers to design and sell products disadvantaged by the risk adjustment imbalance will create market distortions: some insurers will find ways to avoid selling proportionately more bronze and gold plans than their competitors.

Independence's offerings in Philadelphia and surrounding counties appear to be a case in point. On the other hand, Pennsylvania's regulations mandating strict silver loading are, broadly speaking, working:, at least in the short term: steep gold and bronze discounts are available throughout the state. Pennsylvania is one of three states, with Maryland and Virginia, that have already implemented regulatory measures to maximize those discounts; three more -- New Mexico, Colorado and Texas -- will do so in 2022 or 2023.

In the absence of a federal fix to risk management, should regulators implement "CSR funding adjustments" more or less like Pennsylvania's; refrain from mandating strict AV-proportionate pricing; or tighten regulations further* to maximize discounts in gold and bronze plans? In different states, we will probably see all of the above.

--

Note: Why should gold plans be cheaper than silver plans?

In the ACA marketplace's first years of operation from 2014 through 2017, silver plans were consistently priced well below gold plans because the federal government directly reimbursed insurers for the cost of providing CSR, the cost-sharing subsidy that makes silver plans much more generous for low income enrollees. Silver plans were priced as if they only provided the level of cost-sharing obtained by higher income enrollees.

In October 2017, however, the Trump administration cut off direct payments to insurers for providing CSR. This move had been anticipated by state regulators, who in most states then allowed or instructed insurers to price the value of CSR directly into silver plans only, since CSR is available only with silver plans. Since premium subsidies, designed so that the enrollee pays a fixed percentage of income, are set to a silver plan benchmark (the second cheapest silver plan), inflated silver premiums create discounts for subsidized buyers in bronze and gold plans.

The Pennsylvania Department of Insurance standardized the discounts by instructing insurers to price silver at approximately 1.2 times its base value to account for the CSR provided to low income enrollees. That ratio places silver plan premiums slightly above gold plan premiums, all other factors being equal. In effect, the Department calculated that when you factor in the value of CSR obtained by most silver plan enrollees, silver plans are slightly more generous on average than gold plans - that is, they leave enrollees with slightly lower out-of-pocket costs on average.

* In New Mexico in 2022, insurers will be required to assume that all silver plan enrollment will be at incomes below 200% FPL, which means that all silver plan enrollees obtain a CSR-enhanced plan with an actuarial value of 94% or 87% (compared to 80% for gold). That entails pricing silver at 1.44 times the value of a silver plan with no CSR (70% AV), compared to the 1.2 multiplier used in Pennsylvania (with slight annual variations). The high multiplier is meant to be a self-fulfilling prophecy: it will place gold premiums so far below silver that no one with an income above 200% FPL will be tempted to buy silver plans.

No comments:

Post a Comment