Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up!

Selecting a health plan in the ACA marketplace is often a ridiculously complex task. Many markets now offer dozens of plans at each metal level, widely varying in deductible and out-of-pocket maximums. In those markets a single insurer may offer six or eight or twelve plans in a given metal level, salami-slicing not only deductibles and OOP maxes, but co-pays and coinsurance for each service, and with a wide variety of services not subject to the deductible (mostly in silver and gold plans, though bronze plans often exempt some or even all doctor visits and generic drugs from the deductible). Cross-cutting these varieties in payment design are wide differences in network adequacy

CMS and various state exchanges (e.g., Washington’s) are moving to rein in this metastasizing of “choice,” introducing standardized plans, and limiting the number of nonstandard plans insurers can offer. In the meantime, decision-support tools and messaging on the online exchanges can help, or fail to help, optimize choice.

That’s especially true for the single most consequential choice for more than half of enrollees: whether to select a silver plan and so avail themselves of the Cost Sharing Reduction (CSR) benefit that attaches to silver plans, and only silver plans, for low-income enrollees — those with income up to 250% of the Federal Poverty Level.

At incomes up to 200% FPL, CSR raises the actuarial value of a silver plan to a roughly platinum level (94% AV at incomes up to 150% FPL, and 87% AV at incomes up 200% FPL). At 200-250% FPL, the benefit is much weaker, raising AV to 73%.

Steering toward silver

As CSR is available only with silver plans, and bronze plans leave coverage largely unaffordable for low income enrollees, takeup of CSR among those eligible was the first question about the functioning of the ACA marketplace that I delved into when the first marketplace enrollment data came out in 2014. (At first, variation in silver selection rates among states was something of a mystery, as HHS did not break out metal level selection by income until 2016). I was an early fan the Connecticut and New York exchanges’ practice of “defaulting to silver” — that is, showing silver plans before all others to applicants or plan shoppers whose income qualified them for CSR. I noted with approval that in 2015, 89% of Connecticut enrollees with income up to 200% FPL chose silver plans and so availed themselves of CSR.

Outdated signposts

Since 2018, however, indiscriminately steering all CSR eligibles to silver plans has resulting in some misdirection — or, frankly, misinformation, in some cases at least. Through 2017, the federal government reimbursed insurers directly for the value of CSR, and insurers accordingly priced silver plans as if their actuarial value was always 70%, the silver AV with no CSR added. In October 2017, Trump cut off direct reimbursement of insurers for the value of CSR, and regulators in most states allowed insurers to price CSR directly into silver plan premiums, a practice that became known as silver loading. Since ACA premium subsidies are keyed to a silver benchmark — enrollees pay a fixed percentage of income for the benchmark (second cheapest) silver, inflated silver premiums created relative discounts in bronze and gold plans.

Though insurers tend to underprice silver plans, rendering these discounts less consistent and usually smaller than they’d be if CSR were fully priced in (except in states that directly or indirectly mandate strict silver loading), the value of the discount usually outstrips the value of the weak CSR offered at 200-250% FPL (which raises AV just three percentage points, for 70% to 73%). (At incomes below 200% FPL, the value of CSR usually exceeds the value of bronze and gold discounts created by silver loading.) More than half of enrollees in the 200-250% FPL can get a free bronze plan. In some states, gold plans are available below the cost of the benchmark silver plan, sometimes far below it (this should be the case in all states, but requires regulatory action).

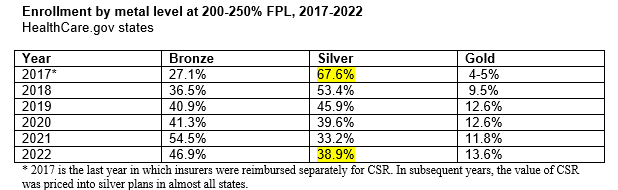

In response to the low-cost bronze and gold plan options that have opened up since 2018, enrollees in the 200-250% FPL income bracket have voted with their feet against silver plans:

Source: CMS state-level public use files

In Connecticut in 2023, the lowest-cost gold plans have premiums below those of lowest-cost silver plans (sometimes far below: in Litchfield County, at an income of $32,000 for a 43 year-old, the cheapest gold plan costs $28/month, versus $85/month for the cheapest silver plan; in Tolland, lowest-cost gold is $12/month and lowest-cost silver is $75). The plan comparison tool at Access Health Connecticut, however, still defaults to silver for all enrollees with income up to 250% FPL. The tool prompts a user to estimate her likely level of use of key medical services, but regardless of whether the enrollee anticipates minimal or heavy use, the plan menu shows silver plans first (and exclusively, until you change the filter).

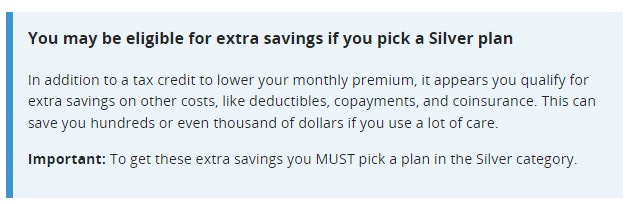

HealthCare.gov, the federal exchange now serving 33 states, does not default to silver for CSR eligibles, but since its launch in 2013 it has used text boxes to strongly emphasize the added value of CSR to applicants (or “plan preview” shoppers) whose income qualifies them for the benefit. For people who estimate an income up to 250% FPL, HealthCare.gov’s plan preview tool shows the following message before the user clicks through to view plans:

The default ranking in the listing of available plans is by premium, lowest first, which usually means a long line of bronze plans before any other metal level offerings appear. But on HealthCare.gov, the menu of available plans is topped by this messaging:

Here too, the messaging is the same for those in the 200-250% FPL bracket as for those eligible for the much stronger CSR at incomes up to 200% FPL. At present, that messaging is more appropriate and important than ever for enrollees with income up to 200% FPL in Texas, where a new state law and regulation rendered gold plans much cheaper than silver in 2023. Free gold plans may lure enrollees in the 150-200% FPL bracket in particular away from CSR-enhanced silver, as a benchmark silver plan costs 2% of income at 200% FPL (about $45/month for a single person). That’s a problem, as silver plans at this income level have a higher AV than gold plans (87% vs. 80%), and gold plans have far higher maximum out-of-pocket cost (MOOP) exposure. Statute limits CSR-silver MOOP at this income level to $3,000, and gold plan MOOP is generally — though not always — north of $8,000.

For prospective enrollees in the 200-250% FPL range, however, the CSR signposting is problematic. In Houston (zip code 77077), the lowest-cost silver plan for a 43 year-old with an income of $32,000 is $90/month with a deductible of $5,700, whereas the lowest-cost gold plan is $22/month with a deductible of $1,100. A total of 125 plans are available in this zip code. A HealthCare.gov user who does not respond to the prompt to see silver plans first will see plans ranked by premium (the default filter). Our 43 year-old Houstoner with an income of $32,00 will first see sixteen bronze plans, seven of them with a $0 premium, before encountering any gold plans.

HealthCare.gov does provide an option to see plans ranked by total estimated cost. For our Houston shopper, if she estimates average medical needs, that filter will elevate the cheapest gold plan to the top of the list. But given the prompt to view silver plans first, then the default ranking by premium if that option is rejected, I have to wonder how anyone finds their way to the cheap gold plans — until I remind myself that more than half of enrollees are broker-assisted, and many others are helped by nonprofit navigators.

It’s never simple

I should acknowledge that even where gold plans are priced below benchmark silver, the gold-vs.-silver choice in the 200-250% FPL bracket is not always a slam dunk, notwithstanding gold’s higher statutory actuarial value (80% vs 73% for silver in this income bracket). That’s due in large part to a lower allowed limit on MOOP in “CSR-73” plans: $7,200 for an individual, vs. $9,100 for any plan without CSR, including gold plans. In Connecticut, the lowest-cost gold plans uniformly have MOOPs in the $8,000-9,100 range.

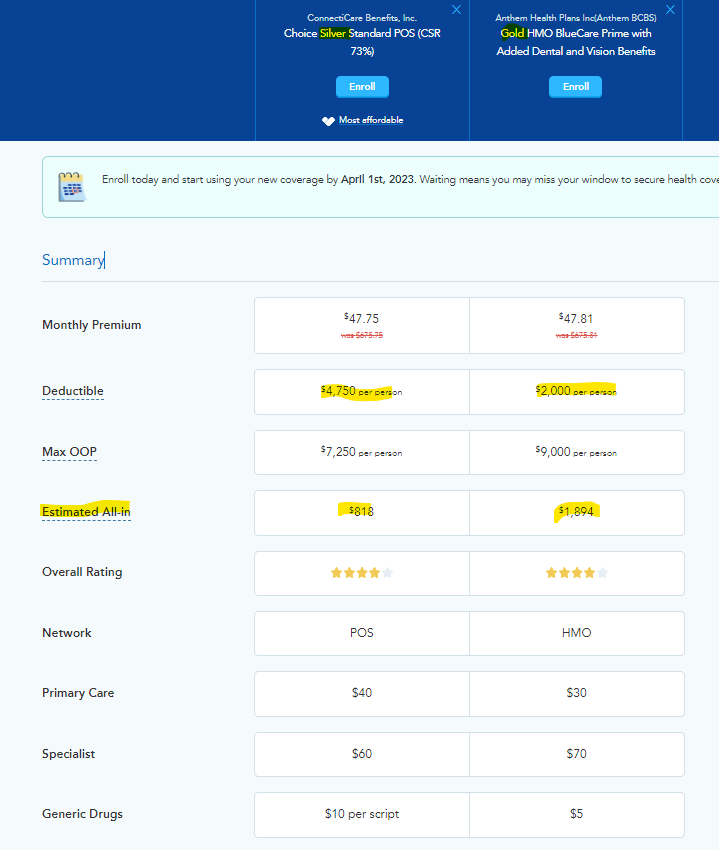

In fact, in Fairfield County in Connecticut, the commercial e-broker HealthSherpa, which deploys an “all-in” cost estimator, recommends a silver plan priced almost identically to a gold plan to a person in the 200-250% FPL income bracket who estimates his likely medical care usage as average. That’s notwithstanding a much lower deductible for the gold plan. The results for someone not expecting to hit the MOOP (e.g., estimating average medical usage) seem counterintuitive:

This recommendation hinges on imaging and lab work costs, which are subject to the deductible in the gold plan but not in the silver plan. Which is to say, every plan design effectively constitutes a complex actuarial bet, and an obsessive shopper would have to go down the full list of covered services to begin to calculate which plan is likely to be optimal. Of course, very few of us can fully anticipate our likely needs for medical care.

The exception is those who know they will reach their MOOP because of ongoing treatment for a chronic or life-threatening condition. In that situation, the MOOP, balanced against the premium, is the only benefit design feature that matters.

Finally, none of these calculations include overall network adequacy — though the exchanges’ decision support tools will filter for inclusion of particular providers or facilities specified by the shopper.

I am currently about halfway through the great healthcare economist Uwe Reinhardt’s last and posthumously published book: Priced Out: The Economic and Ethical Costs of American Health Care. Throughout, Reinhardt emphasizes that the insanely byzantine convolutions of U.S. healthcare payment systems stem from our unwillingness, unique among wealthy nations, to explicitly commit to a goal of making healthcare equally affordable to all. An implicit premise of the ACA marketplace is that individual financial acumen, euphemized as the freedom to select a plan ideally tailored to our individual healthcare needs and budget, will determine how affordable our coverage proves to be.

No one — okay, almost no one — relishes the opportunity to exercise their analytical faculties in this high-stakes game. But that’s the opportunity our fetishization of markets has created.

No comments:

Post a Comment