Attention xpostfactoid readers: All subscriptions are now through Substack alone (still free). I will continue to cross-post on this site, but I've cancelled the follow.it feed (it is an excellent free service, but Substack pulls in new subscribers). If you're not subscribed, please visit xpostfactoid on Substack and sign up!

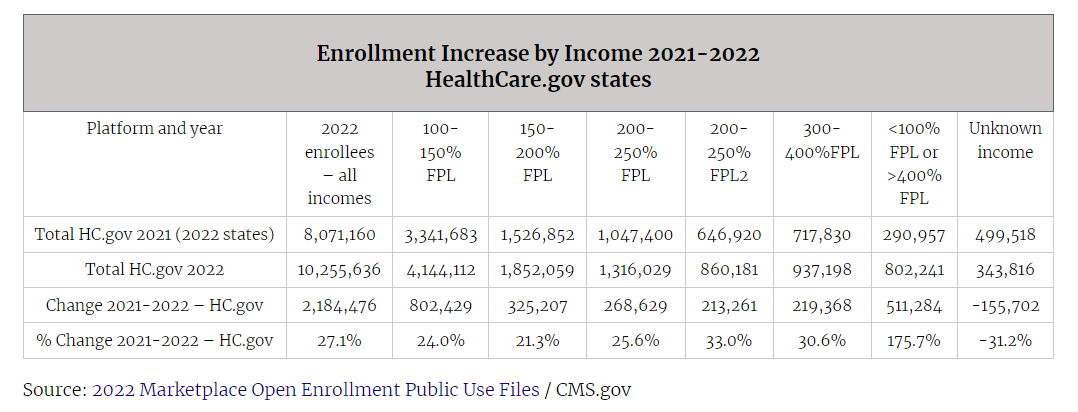

In 2022, the first plan year in which the enhanced ACA marketplace subsidies created by the American Rescue Plan Act (ARPA) were available in the Open Enrollment Period, enrollment at incomes above 400% of the Federal Poverty Level more than doubled in the 33 states using HealthCare.gov. Pre-ARPA, enrollees with income above 400% FPL were ineligible for premium subsidies; ARPA removed that eligibility cap.

I have a post up at Healthinsurance.org that charts the enrollment increase at high incomes in HealthCare.gov states in 2022 and the ARPA impact on premiums at high incomes in Houston in 2023. Just to tease here, a couple of charts:

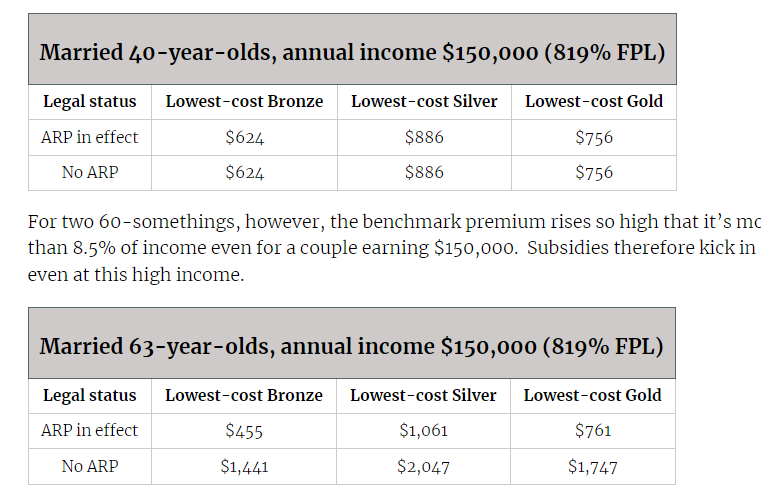

Here is how premiums shape up in 2023 for couples with $150,000 income in Houston at different ages. For two 40 year-olds, the benchmark costs less than 8.5% of income, so (as you might expect)no subsidy…

These premium snapshots also show the effects of the strict silver loading requirement implemented in Texas in time for plan year 2023, rendering gold plans cheaper than silver plans this year.

For more about how these configurations came about, have a look at the full post.

—-

P.S. A couple of notes about the enrollment stats: In the state-based marketplaces, enrollment at high incomes also likely surged, but an oddity in the income breakouts reported to CMS makes that hard to determine exactly. I delved into that in this post last spring. Second: in the first chart above, enrollment at reported incomes above 400% FPL is mingled with enrollment at incomes below 100% FPL because that’s how CMS reported those categories from 2017 through 2021. In 2022, when CMS broke out enrollment at incomes below 100% FPL separately, enrollment below 100% FPL was 146,297 — so it’s certain that enrollment more than doubled at reported incomes above 400% FPL. In fact, in 2016, the last time CMS reported enrollment below 100% FPL, it was about 267,000 in HealthCare.gov states (it was reported as a percentage of total enrollment among enrollees who provided income information). As total enrollment in Healthcare.gov states was higher in 2022 than in 2016, it looks unlikely that enrollment below 100% FPL grew at all from 2021 to 2022.

Most Americans with income below 100% FPL are ineligible for ACA premium subsidies. The exception is legally present noncitizens who are subject to a federal 5-year bar on Medicaid eligibility, or an even longer bar in some states. They are eligible for premium subsidies — and, after ARPA, eligible for free silver plans with the highest level of Cost Sharing Reduction. Enrollment statistics published by Covered California, the CA state marketplace, show 97% of enrollees with income below 138% FPL (the Medicaid eligibility threshold) as subsidized, suggesting that almost all are legally present noncitizens time-barred from Medicaid. In previous years the unsubsidized percentage was in the one third to one quarter range.

No comments:

Post a Comment