In my last post, I noted that on May 5 CMS finalized a rule that patches a bit of the coverage gap afflicting low-income people in 13 remaining states that have refused to implement the ACA Medicaid expansion.

In those states, eligibility for ACA premium subsidies begins at incomes above 100% of the Federal Poverty Level (FPL). State residents with incomes below that threshold who do not qualify for Medicaid under the states' restrictive criteria get no government help to pay for coverage. Some 2 million adults are in this gap.

In its annual Notice of Benefit and Payment Parameters for the ACA marketplace (NBPP 2021), published May 5, CMS announced that if an applicant estimates an annual income above 100% FPL, but the "trusted data sources" tapped by HHS indicate an income below that threshold, the applicant will no longer be required to provide documentation of the projected income.* The rule change is in prompt compliance with a court decision delivered on March 4 in response to a suit filed by Columbus, Ohio and several other cities (and two individuals) seeking to overturn several Trump-era rules for the marketplace -- including a requirement that exchanges demand documentation in this situation.

In effect, anyone in a nonexpansion state otherwise eligible for marketplace coverage can now claim an income in excess of 100% FPL and become subsidy eligible. Thanks to the subsidy boosts implemented in the American Rescue Plan in March, generous coverage with low out-of-pocket costs is available to enrollees with income below 150% FPL. An emergency Special Enrollment Period running through August makes that coverage available now (on the first of the month following enrollment).

ACA marketplace applicants provide the required financial data under penalty of perjury. And the federal government is not in the business of encouraging people to defraud it. Indeed, the decision requiring this rule change (by Federal District Court Judge Deborah K. Chasanow in City of Columbus, et al. v. Cochran) is predicated on the lack of evidence that enrollees fraudulently inflated their income to qualify for subsidies before the Trump administration mandated documentation in this situation in advance of Open Enrollment for 2019.

Judge Casanow, however, also cites comments submitted in response to the Trump administration proposed rule in 2018 noting that "'low-income consumers are more likely to experience variance in their income levels'...many 'work in part-time or in hourly positions,' 'rely on multiple part-time or part-year jobs,' or 'work in cash industries, such as food service, where tip-income makes up the largest portion of their earnings'" (p. 22).

These conditions not only make it difficult to document income -- the Judge's chief concern -- they make it difficult to project annual income, as a marketplace applicant must do, either for the year following (during Open Enrolment in late fall/winter) or for the year in progress (when the applicant obtains a Special Enrollment Period).

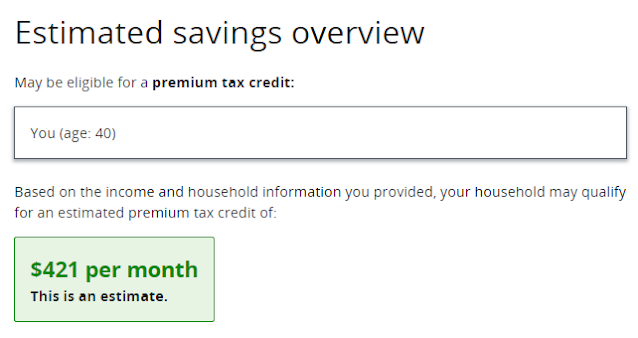

CMS could nudge people toward projections that will get them over the 100% FPL threshold -- simply by marking that threshold out, both in the application and in the "see plans and prices" preview tool on HealthCare.gov. In that tool, a user provides an estimate of income along with information about household members and their ages; subsidized plan prices are estimated on that basis.

At present, a user who enters an income below 100% FPL in a nonexpansion state will get results showing no eligibility for subsidy, with no explanation. Here are the results for a single adult in Texas entering an income of $12,000, or 94% FPL:

No soup for you. Why? Is my $1000/month income too high? No clue provided.Related: In May, CMS moved quietly to shrink the coverage gap

--

* To be exact, since it takes time to retool HealthCare.gov, an applicant in this situation will first receive a request for documentation, but subsequently be informed that the information is not required. See the previous post for the explanation in the NBPP.

** Another zero-premium silver plan in this rating area has a $750 deductible -- but also a $750 annual out-of-pocket maximum, in contrast to $2,850 in the plan above (the highest allowable). In between, HealthCare.gov shows two bronze plans -- very bad deals for someone eligible for zero-premium high-CSR silver. In the wake of the subsidy boosts in the ARP, HealthCare.gov needs a lot of work.

Thank you, Andrew, for going into important areas and details that the rest of the regular press, and health policy press, avoids.

ReplyDeleteI wonder about these:

a)If there are any states that have not expanded Medicaid but do have their own exchanges, I wonder if the "we won't check" rule applies.

b)If there is no trusted database source at all, I wonder if the Federal exchange will request documentation.

c)Is there any, or a considerable clawback, at tax-resolution time? Particularly if the IRS decides perjury in the initial reporting of estimated income that wasn't double checked?

Thanks, Norm. Answers:

Delete1. All remaining nonexpansion states use HealthCare.gov

2. Exchanges will not request documentation for income estimates that they might suspect are too *high.*

3. There is no claw-back of APTC provided if the enrollee's income comes out below 100% FPL at tax time.

On:

ReplyDelete"2. Exchanges will not request documentation for income estimates that they might suspect are too *high.*"

In a slightly different context, this brings up some of the problems with our byzantine system, which the ACA is kludged on to.

As I think I reported in a comment on your blog recently, some of what the too-complex system has yielded is that for me, in Massachusetts, our exchange has switched me down twice mid-year to expanded Medicaid from a subsidized on exchange plan on short notice of just a few days. (My modest income results from my early-retiree finances -- I'm not poor. )

One of the cases is explained by this: after doing my taxes for the prior year, and following the instructions on the exchange website to report any change in income to the exchange, I did such. I reported an income by linear extrapolation of the last two years into the year of insurance coverage, yielding a number above the 138% cutpoint, which would give me subsidized on-exchange, like I had before.

(I got no guidance from the exchange, when I asked for it, on what estimate of income the exchange would accept, and was only told send your forms to the Health Insurance Processing Center.)

Well, apparently they rejected my "linear extrapolation" that I explained in my note, and just took the value of the last tax return. This switched me to expanded Medicaid, on short notice, which, as I point out, could have bankrupted me had I had approved in-network procedures and providers voided by the coverage change.

This is one of the two cases where this sudden switch happened to me in Massachusetts. The other was the decision of the state Medicaid agency, mid-year, to use new Federal Poverty Level cutpoints.

Each state will have it's own problems in dividing between expanded Medicaid and subsidized on exchange.

It's just too complex. The people at the 50 state Medicaid agencies, and all of the exchanges do not have the considerable amount of logical skill needed to avoid coverage gaps and abrupt transitions and such.

Thus, as folks like you and I work to fill the gaps in the ACA, often by complex and roundabout methods, we can't fix them all. We have a fundamental system that is too complex.

Oh, the merits of the Canadian provincial systems or the UK system, where everyone is just covered by the one thing! (As I've said before.)

Yow. I am surprised that they would do this by fiat. I recally reading some Mass Connector doc about reducing "churn" --not losing you when your income changes (or their perception of your income changes, I guess) -- but this is not the way to do it.

DeleteI have been an "early retiree" with a nice nest egg in my Roth IRA, taking tax-free distributions - and doing some Roth conversions to take advantage of the 0% federal tax rate, resulting a "Roth ladder" of conversions & tax/penalty-free distributions 5 years thereafter), so my AGI - which is pretty much the official income to use for ACA subsidies (there are a few exceptions such as tax-free interest & income abroad that needed to be added to AGI) - is low. Because I had a jagga33 governor (his nickname is The Exorcist) when the ACA came about, my state didn't then do the Medicaid expansion, and so the only way I could partake of the ACA and get health care again (I had last had it in the form of COBRA, but I got diagnosed with CANCER, so I had been "uninsurable" since then) was if I got the Premium Tax Credit.

ReplyDeleteMy AGI for 2012 (which was the latest on file in December 2013, when I was signing up for coverage in 2014) was below 100% of poverty, and my income accrual situation was one of random Roth conversions, so I could not plausibly say that I had "regular income". I took the attitude that what I was doing by prognosticating that my income for 2014 would be 100% of poverty + $1 (I'll get to that later) was simply being "optimistic" that I would hit this number - and that any charges of fraud for doing so could not possibly test the "due process" requirement of the law. This is very similar to the way that a customer could answer that his income is pretty much anything that he would wish it to be for a credit application. (NOTE: The applicant cannot forge documentation; that would most definitely be fraud, but it has already been proven in Court that giving an "inaccurate" value on a credit application is not fraud.) And I gave this advice to anyone I would talk to in the same situation.

As for the $1 reference, I can personally attest that there was a big in the healthcare.gov web application in which were it to be entered the exact amount for 100% of poverty, the response would be NO PREMIUM TAX CREDIT FOR YOU. As a retired programmer, I could definitely see how the coder used the '>' operator instead of the proper '>=' operator, so I did another application with that extra buck, and got my cash prize.

As for my jerk Exorcist governor, my state got a Democrat governor in January 2016, and he signed (on Day 2 of his administration) the Medicaid expansion bill that he had shepherded through the legislature as a legislator, just waiting for a governor to sign it. So now, instead of the 100% of poverty income being the important number, the 138% of poverty is the important one, and I have arranged my affairs to not hit it.

The problem of Medicaid churn - i.e., someone having a temporary income of over 138% and thus being officially required to get onto an ACA plan - should be addressed by simply having it be replaced by the Public Option, and such that the subscriber doesn't actually pay anything until he gets his tax bill and then knows after-the-fact what his income was for that coverage year.