In yesterday's post, I missed the most startling point in the ACA enrollment data I'd been staring at.

It's this: In 2019, virtually all of the enrollment decline in the ACA marketplace was concentrated in states on the HealthCare.gov platform that have expanded Medicaid. That's excluding Virginia and Maine, which are expanding Medicaid in 2019.*

Charles Gaba projects virtually flat enrollment in the states that run their own exchanges, in many of which enrollment for 2019 is still open. In the 16 remaining non-expansion states using HealthCare.gov, enrollment in 2019 is down less than 1% from enrollment in 2018 (excluding late adjustments, which should roughly cancel out similar adjustments made last year). Enrollment in the 21 HealthCare.gov states that have expanded Medicaid (excluding VA and ME) is down 7% in 2019. It was also down 7% in 2018, compared to 4% the in non-expansion states.

As I noted yesterday, outsized enrollment losses in 2018 were concentrated at lower income levels, where enrollment assistance is probably most vital, and where the value of Cost Sharing Reduction (CSR) mostly outstrips the value of bronze and gold discounts generated by silver loading** (an income breakout is not yet available for 2019). In HealthCare.gov expansion states, enrollment in the 100-150% FPL income band, where CSR is strongest, cratered in 2018, dropping 14%. At 150-200% FPL, enrollment in these states dropped 11%.

At higher income levels, as was the case generally in 2018, silver loading discounts in these states seem to have partially offset the forces driving enrollment down at lower income levels. At 300-400% FPL, enrollment in these states was up 8% in 2018 (it was up 12% in non-expansion states).

2018 enrollment by income: Expansion states on HealthCare.gov

Here's the enrollment change by income for the combined nonexpansion states {added 12/29]:

Ever since it struck me on Dec. 20 that the expansion states on HealthCare.gov were by and large the worst performers, my working hypothesis has been that enrollment in non-expansion states has been bolstered somewhat by those who would have qualified for Medicaid had their state accepted the expansion -- that is, those with incomes in the 100-138% FPL range. At that income level, CSR boosts the actuarial value of a silver plan to 94% and the benchmark silver plan costs just 2% of income. For many enrollees below 138% FPL, e.g. in regions where the cheapest silver plan is priced significantly below the benchmark, a silver plan is all but free. At 138-150% FPL, the cost of benchmark silver jumps to 3-4% of income.

I may have been onto something, in that enrollment drops at 138-150% FPL in expansion states were so much sharper than enrollment drops at 100-150% FPL in nonexpansion states. On the other hand, the contrast is almost as stark at 150-200% FPL -- a 6% drop in nonexpansion states vs 11% in expansion states (at 100-150% FPL, the contrast is -6% vs. -14%). [And really, throughout the income levels -- added 12/19.] I can't account for that.

What does seem likely is that enrollment in all HealthCare.gov states is hardest hit at the lowest income levels by Trump administration cuts to enrollment assistance, outreach and advertising. Most enrollees served by navigators are at lower income levels, and navigator funding has been cut by 90%. In California, which has maintained its outreach/advertising budget, enrollment at the lower income levels was basically flat in 2018.

But as to why enrollment was apparently stickier at 100-138% FPL (where subsidies are available only in nonexpansion states) than at 138-150% FPL, and stickier at 150-200% FPL in nonexpansion states than in expansion states on HealthCare.gov -- I don't know. Theories, anyone?

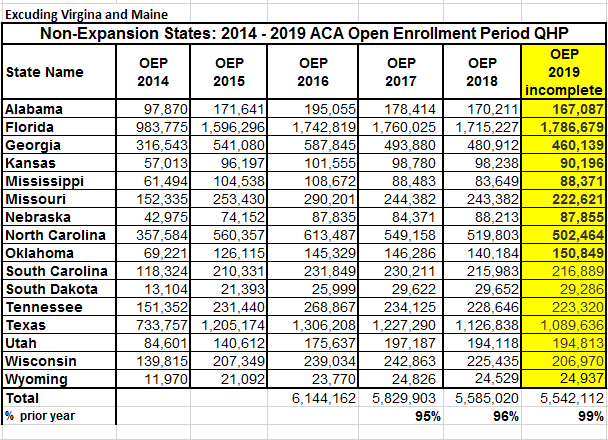

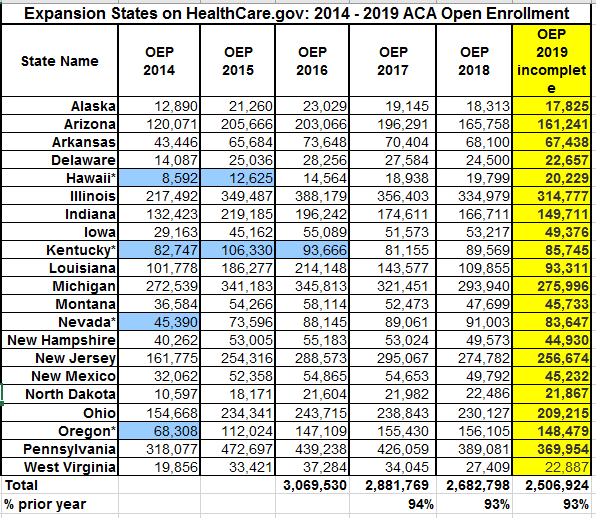

Here's the enrollment contrast between expansion and non-expansion states on HealthCare.gov. Thanks to Charles Gaba for providing his charts in Excel, which I've adapted here, splitting expansion and non-expansion states. Again, I've removed Maine and Virginia.

Update: I'm mulling the possibility that the performance difference between expansion and nonexpansion states is basically random. The expansion state enrollment population is much smaller, and Florida, which has a robust market and accounts for almost a third of the nonexpansion state enrollment total, provides a good deal of ballast there.

Update 2, 12/29: From 2016 to 2019, per the charts above, enrollment in nonexpansion states is down 10% -- and in expansion states, 18% (once again excluding Virginia and Maine). Really, though, Louisiana and Montana should also be taken out of that equation, as both expanded Medicaid in 2016, pulling people out of the marketplace in 2017. That reduces the expansion state drop to 17%. And Louisiana has had large enrollment losses in 2018 and 2019 as well.

Update 3, 1/2/19: Another factor that could account for some enrollment losses in expansion: in states that expand Medicaid belatedly (e.g., PA, IN, LA) there may be a multi-year transition among some low income people from the marketplace to Medicaid. First-year losses among enrollees in the 100-138% FPL income range are to be expected, but that transition may take years to shake out fully. Or so I've speculated in the next post.

* Virginia began Medicaid expansion enrollment for 2019 at the beginning of Open Enrollment this fall, and enrollment has accordingly dropped from 400,000 in 2018 to 334,000 this year, since those previous eligible for the marketplace at 100-138% FPL are now eligible for Medicaid only. While Maine enrollment under the Medicaid expansion that the incoming governor will implement has not yet begun, it was widely anticipated and so may have affected enrollment this fall. Maine enrollment dropped a relatively modest 6.4% for 2019.

** A note on silver loading

Silver loading refers to concentrating the cost of CSR subsidies (directly reimbursed to insurers by the federal government as stipulated by the ACA until Trump stopped payment in October 2017) in the premiums of silver plans, since CSR is available only with silver plans. Since premium subsidies, designed so that the enrollee pays a fixed percentage of income, are set to a silver plan benchmark (the second cheapest silver plan), inflated silver premiums create discounts for subsidized buyers in bronze and gold plans. And in states that allowed insurers to offer silver plans off-exchange with no CSR load, unsubsidized enrollees were protected from CSR costs, theoretically at least.

Related: Silver loading vs. sabotage in non-expansion states

When states expand Medicaid, is there a multi-year marketplace drain?

It's this: In 2019, virtually all of the enrollment decline in the ACA marketplace was concentrated in states on the HealthCare.gov platform that have expanded Medicaid. That's excluding Virginia and Maine, which are expanding Medicaid in 2019.*

Charles Gaba projects virtually flat enrollment in the states that run their own exchanges, in many of which enrollment for 2019 is still open. In the 16 remaining non-expansion states using HealthCare.gov, enrollment in 2019 is down less than 1% from enrollment in 2018 (excluding late adjustments, which should roughly cancel out similar adjustments made last year). Enrollment in the 21 HealthCare.gov states that have expanded Medicaid (excluding VA and ME) is down 7% in 2019. It was also down 7% in 2018, compared to 4% the in non-expansion states.

As I noted yesterday, outsized enrollment losses in 2018 were concentrated at lower income levels, where enrollment assistance is probably most vital, and where the value of Cost Sharing Reduction (CSR) mostly outstrips the value of bronze and gold discounts generated by silver loading** (an income breakout is not yet available for 2019). In HealthCare.gov expansion states, enrollment in the 100-150% FPL income band, where CSR is strongest, cratered in 2018, dropping 14%. At 150-200% FPL, enrollment in these states dropped 11%.

At higher income levels, as was the case generally in 2018, silver loading discounts in these states seem to have partially offset the forces driving enrollment down at lower income levels. At 300-400% FPL, enrollment in these states was up 8% in 2018 (it was up 12% in non-expansion states).

2018 enrollment by income: Expansion states on HealthCare.gov

Here's the enrollment change by income for the combined nonexpansion states {added 12/29]:

Year

|

Total enrollment

|

100-150% FPL

|

150%-200% FPL

|

>200% to ≤250% FPL

|

>250% to ≤300% FPL

|

>300%- ≤400% FPL

|

Other FPL*

|

2017

|

6,320,036

|

2,750,502

|

1,281,503

|

792,247

|

433,904

|

435,790

|

626,090

|

2018

|

6,060,844

|

2,587,081

|

1,202,256

|

786,543

|

438,500

|

489,249

|

557,215

|

% of 2017

|

96%

|

94%

|

94%

|

99%

|

101%

|

112%

|

89%

|

I may have been onto something, in that enrollment drops at 138-150% FPL in expansion states were so much sharper than enrollment drops at 100-150% FPL in nonexpansion states. On the other hand, the contrast is almost as stark at 150-200% FPL -- a 6% drop in nonexpansion states vs 11% in expansion states (at 100-150% FPL, the contrast is -6% vs. -14%). [And really, throughout the income levels -- added 12/19.] I can't account for that.

What does seem likely is that enrollment in all HealthCare.gov states is hardest hit at the lowest income levels by Trump administration cuts to enrollment assistance, outreach and advertising. Most enrollees served by navigators are at lower income levels, and navigator funding has been cut by 90%. In California, which has maintained its outreach/advertising budget, enrollment at the lower income levels was basically flat in 2018.

But as to why enrollment was apparently stickier at 100-138% FPL (where subsidies are available only in nonexpansion states) than at 138-150% FPL, and stickier at 150-200% FPL in nonexpansion states than in expansion states on HealthCare.gov -- I don't know. Theories, anyone?

Here's the enrollment contrast between expansion and non-expansion states on HealthCare.gov. Thanks to Charles Gaba for providing his charts in Excel, which I've adapted here, splitting expansion and non-expansion states. Again, I've removed Maine and Virginia.

Update: I'm mulling the possibility that the performance difference between expansion and nonexpansion states is basically random. The expansion state enrollment population is much smaller, and Florida, which has a robust market and accounts for almost a third of the nonexpansion state enrollment total, provides a good deal of ballast there.

Update 2, 12/29: From 2016 to 2019, per the charts above, enrollment in nonexpansion states is down 10% -- and in expansion states, 18% (once again excluding Virginia and Maine). Really, though, Louisiana and Montana should also be taken out of that equation, as both expanded Medicaid in 2016, pulling people out of the marketplace in 2017. That reduces the expansion state drop to 17%. And Louisiana has had large enrollment losses in 2018 and 2019 as well.

Update 3, 1/2/19: Another factor that could account for some enrollment losses in expansion: in states that expand Medicaid belatedly (e.g., PA, IN, LA) there may be a multi-year transition among some low income people from the marketplace to Medicaid. First-year losses among enrollees in the 100-138% FPL income range are to be expected, but that transition may take years to shake out fully. Or so I've speculated in the next post.

* Virginia began Medicaid expansion enrollment for 2019 at the beginning of Open Enrollment this fall, and enrollment has accordingly dropped from 400,000 in 2018 to 334,000 this year, since those previous eligible for the marketplace at 100-138% FPL are now eligible for Medicaid only. While Maine enrollment under the Medicaid expansion that the incoming governor will implement has not yet begun, it was widely anticipated and so may have affected enrollment this fall. Maine enrollment dropped a relatively modest 6.4% for 2019.

** A note on silver loading

Silver loading refers to concentrating the cost of CSR subsidies (directly reimbursed to insurers by the federal government as stipulated by the ACA until Trump stopped payment in October 2017) in the premiums of silver plans, since CSR is available only with silver plans. Since premium subsidies, designed so that the enrollee pays a fixed percentage of income, are set to a silver plan benchmark (the second cheapest silver plan), inflated silver premiums create discounts for subsidized buyers in bronze and gold plans. And in states that allowed insurers to offer silver plans off-exchange with no CSR load, unsubsidized enrollees were protected from CSR costs, theoretically at least.

Related: Silver loading vs. sabotage in non-expansion states

When states expand Medicaid, is there a multi-year marketplace drain?

No comments:

Post a Comment