Yesterday, the Pennsylvania Insurance Department proudly announced that insurers in the state's ACA-compliant individual market requested premium increases averaging 4.9% -- compared to 30.6% last year.

Insurance Commissioner Jessica Altman took a victory lap:

Altman attributes the minimal increases to Pennsylvania’s competitive market and the department’s efforts to maintain enrollment in the individual market despite the federal government’s efforts to shorten the ACA’s open enrollment period and curtail enrollment outreach, while working to achieve affordability for consumers. The Insurance Department launched an outreach campaign to make up for a lack of marketing from the federal government during the 2018 open enrollment season.

The department also worked to make coverage more affordable for more consumers by mitigating the number of individuals subject to premium increases when the federal government eliminated cost-sharing reduction reimbursements. As a result, 396,725 Pennsylvanians selected health plans on the exchange in 2018, only a small decline from the previous year.

It may well be true that state action helped minimize enrollment losses and so stabilize the market to a degree. But on the top line at least, that "small decline" was not so small. CMS enrollment figures show a 9% drop in marketplace enrollment in Pennsylvania in 2018 -- compared to 4% nationwide and 5% in the 39 states (including PA) that use the federal exchange, HealthCare.gov.

At the same time, Pennsylvania's strenuous efforts to offset the disruption caused by Trump's cutoff of CSR funding likely did pay off. The state not only encouraged insurers to concentrate the cost of CSR in on-exchange silver plans only -- creating discounts in bronze and gold plans for the subsidized, and protecting unsubsidized buyers from paying for CSR. The Insurance Dept. also created a website enabling comparison shopping of off-exchange and on-exchange plans.

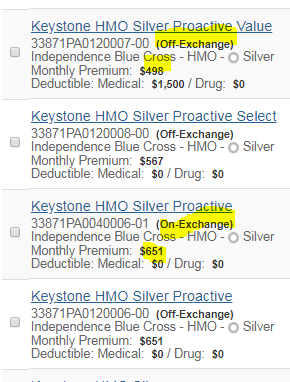

Throughout the state, silver plans were available off-exchange at much lower premiums than the cheapest silver offered on-exchange. In Pittsburgh, an unsubsidized 50 year-old would pay $373 for the cheapest off-exchange silver plan and $500 for the cheapest on-exchange silver (both UPMC). A silver UPMC PPO plan offered off-exchange only was cheaper than the cheapest on-exchange silver. In Philadelphia, where Independence Blue Cross was the only insurer, the cheapest silver off-exchange silver plan for a 50 year-old was $490 per month; the cheapest on-exchange silver (albeit with a $0 deductible, vs. $1500 for cheapest off-ex) was $651. See the silver plan menus (cheaper end only) for both cities at bottom.

Perhaps as a result, a disproportionate chunk of the total enrollment loss was concentrated in unsubsidized enrollees. Subsidized enrollment was down just 5%. In 2018, 90% of enrollees were subsidized, vs. 87% in 2017.

Unfortunately, we don't have off-exchange enrollment figures. If we did, they might still show a drop. But much of that drop may have been mitigated by formerly on-exchange subsidized enrollees moving off-exchange.

A comparison of enrollment in 2018 and 2017 in each income category shows the effects of on-exchange silver loading. Total enrollment, according to CMS public use files, was 426,059 in 2017 and 389,081* in 2018, a 9% drop.

Pennsylvania On-exchange Enrollment by Income, 2017 - 2018

Year

|

0-100% FPL*

|

100-150% FPL

|

150-200% FPL

|

200-250% FPL

|

250-300% FPL

|

300-400% FPL

|

Unsubsidized*

|

2017

|

8095

|

73,028

|

116,702

|

72,349

|

44,572

|

54,148

|

57,165

|

2018

|

7393

|

65,079

|

105,274

|

69,990

|

44,105

|

58,907

|

38,333

|

Change

|

-9%

|

-11%

|

-10%

|

-6%

|

-1%

|

+9%

|

-33%

|

* The 0-100% FPL totals are estimated on the basis of enrollment in that bracket in 2016, the last year for which CMS provided a breakout (2% of those who provided income data, or 1.9% overall). That estimate is subtracted from the total for "unsubsidized," comprised of those who did not report income or who reported income over 400% FPL. A small percentage of those in the 300-400% bracket are also unsubsidized, but not tallied as such here.

The steep drop in enrollment in the 100-150% and 150-200% FPL brackets is strange, as not only free bronze but free silver and in some cases gold plans were widely available in those brackets. The boost in the 300-400% FPL bracket makes sense, as steep gold plan discounts for the subsdized were widely available -- statewide, 43% of enrollees in this bracket selected gold. The huge drop in unsubsidized on-exchange enrollment may reflect either large-scale migration off-exchange, or an overall drop in unsubsidized enrollment, or both.

------

Here is the lineup of silver plans on offer (with more expensive plans excluded) to an unsubsidized 50 year-old in Pittsburgh:

In the two most nearly comparable plans, the off-exchange premium is just 74% of the on-exchange counterpart. An off-exchange plan with a premium network (PPO) costs less than the on-exchange partner network (EPO) plans.

Here's the choice among the cheapest silver options for an unsubsidized 50 year-old in Philadelphia:

---

* The PA Insurance Dept. claims total enrollment of 396,725, as compared to 389,081 reported by CMS. The higher total would reduce the enrollment drop to 7%. But the state may well have had a higher tally than CMS for the end of OE 2017 as well. Effectuated enrollment typically drops in each quarter. CMS has not yet reported totals as of 3/31.

Pittsburgh must be an oasis of reasonably priced plans. I tried the plans for Lancaster PA (zip code 17106). Most were in the range of $750 a month for a high deductible plan, and $1,000 a month for a zero deductible plan for a 50 year old male without subsidies.

ReplyDeleteThe death spiral is in full force in many rural states and rural areas.