Once upon a midnight* dreary,

While I pondered weak and weary...

over one more quaint and curious wrinkle in ACA enrollment patterns (New Hampshire enrollment was down 6% in 2018, but subsidized enrollment was up 5%!--why?), I saw something that drew me up short.

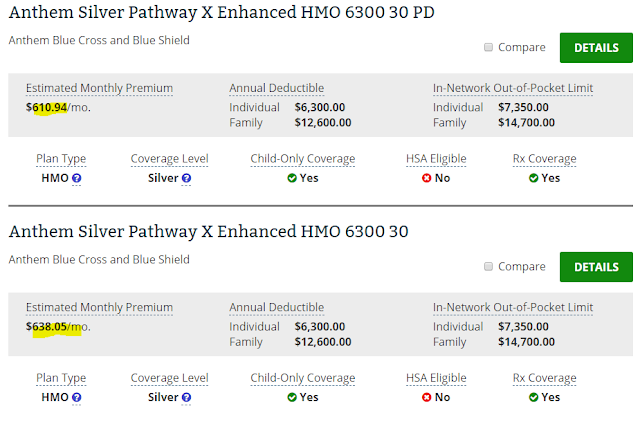

I was looking at whether silver loading had created off-exchange discounts in silver plans available in New Hampshire. It had, a little. The plans listed below are the two cheapest silver plans on offer in 2018 to an unsubsidized 50 year-old in Manchester. The top plan is available off-exchange only, the second one both off- and on-exchange. But that's by the way.

What arrested me was the deductible -- $6,300 for a silver plan, which is purportedly designed to cover 70% of the average user's medical costs**. Primary care visits ($40) are not subject to the deductible, nor are generic drugs ($15). There's free preventive care as well. But this essentially is catastrophic coverage, of value mainly if you are sick or injured enough to hit the $7,350 yearly out-of-pocket maximum -- and have that much to lose. For that you pay more than a tenth of median household income in the United States. And that's for usually narrow network coverage, which often involves a struggle to find in-network providers and snares people in out-of-network balance billing.

Deductibles at this level for silver plans are still more the exception than the rule for the ACA marketplace. But silver plan deductibles north of $5,000 or more are no longer rare (they averaged $3,600 last year). When the ACA marketplace launched, I was brought up short by bronze plan deductibles then averaging about $5,000. That sticker shock is what turned my attention to enrollee takeup (or failure thereof) of Cost Sharing Reduction (CSR) subsidies -- the ACA's uncertain shield against underinsurance -- which protects most enrollees with incomes below 200% of the Federal Poverty Level from prohibitive cost sharing of the kind illustrated above. About 45% of ACA marketplace enrollees obtain strong CSR, which gives them coverage with a higher actuarial value than that of most employer plans.

This year, the gold plan discounts ironically generated by Trump's spiteful cutoff of federal funding for CSR mitigated the relentless climb of out-of-pocket costs for some of the more affluent subsidy-eligible enrollees (in the 200-400% FPL range). Many plans, too, have Swiss-cheese deductibles, with numerous services not subject to the deductible. And catastrophic coverage (which is what most bronze plans and a growing number of silver plans effectively provide) is not without value.

Still, it should be acknowledged that the ACA marketplace has devolved into a travesty in many places and for many enrollees and prospective enrollees. That's particularly true those with incomes above 200% FPL, the threshold below which CSR has a strong impact, and all the more so for about 6 million enrollees in the ACA-compliant market who don't qualify for premium subsidies. Networks are narrow, doubtless snaring many in balance billing, and out-of-pocket costs rise relentlessly as the per-member cost of care rises -- as much because sabotage is degrading the marketplace risk pool as because of medical inflation. For a single 50 year-old with an income of $50,000 for whom all silver plans under $700 per month carry deductibles over $6,000, the term Affordable Care Act is a mockery.

Relentless Republican sabotage of the marketplace triggers a lot of if onlys. If only officials in every state had actively overseen their insurance markets, done their utmost to educate and encourage the uninsured to enroll, and presented the individual mandate as a moral imperative to get covered, as Mitt Romney did in Massachusetts in 2006. If only every state had embraced the Medicaid expansion, which improves the marketplace risk pool as well as providing affordable coverage to the poor and near poor (the expansion is the truly successful lung of the ACA).

If only Republicans at all levels of government hadn't disparaged marketplace offerings and taken measures in many states to hamstring enrollment assistance. If only the U.S. government hadn't been forced by the Republican Congress to stiff and so really defraud insurers of their risk corridor payments, triggering the collapse of most co-ops. For that matter, if only co-op funding itself hadn't been serially sabotaged. If only Congress might have found the wherewithal to fix the family glitch and renew the reinsurance program after its three-year phaseout. If only insurers hadn't been shaken by wave after wave of court challenges, and as a result of one of those been stiffed a second time on their Cost Sharing Reduction responsibilities. If only Republicans, exulting in the dysfunction they've largely triggered, weren't working to further undercut the market with an alternative market in medically underwritten and lightly regulated plans. --saltwater peddled to the thirsty. If only if only.

But it has to be admitted too that the ACA marketplace was obviously under-subsidized and riddled with design flaws, as detailed by Jon Walker here. Why, in a country that pays more per procedure and per capita for healthcare than any country in the world, with that pay scale topped by commercial insurers, would you undertake to cover the uninsured by deploying commercial insurers in a marketplace where they negotiate their own provider payment rates? Why leave them free to slice and dice actuarial value in hundreds of dizzying variations? Why not establish a dominant public option, as in Medicare, against which private insurers are privileged to compete, as in Medicare Advantage?

The best you can say for the ACA marketplace is that a functional Congress would have found it fairly simple to improve it as experience dictated, as Congress has with every other public insurance program. That may yet happen, if Republicans fail to defund and dismantle it entirely.

------

* It was closer to noon, TBH, but who's counting?

** A silver plan unenhanced by CSR has an actuarial value of 70% -- that is, it's allegedly designed to cover 70% of the average enrollee's annual costs. But that's a Bill-Gates-walks-into-a-bar kind of average, skewed by the small number of enrollees who incur costs in the tens or hundreds of thousands of dollars and so hit their yearly out-of-pocket maximum, which can be as high as $7,350, as in the plans above. Moreover, the Trump administration has widened the range by which insurers can miss the AV target: a silver plan can have an actual AV as low as 66%.

While I pondered weak and weary...

over one more quaint and curious wrinkle in ACA enrollment patterns (New Hampshire enrollment was down 6% in 2018, but subsidized enrollment was up 5%!--why?), I saw something that drew me up short.

I was looking at whether silver loading had created off-exchange discounts in silver plans available in New Hampshire. It had, a little. The plans listed below are the two cheapest silver plans on offer in 2018 to an unsubsidized 50 year-old in Manchester. The top plan is available off-exchange only, the second one both off- and on-exchange. But that's by the way.

What arrested me was the deductible -- $6,300 for a silver plan, which is purportedly designed to cover 70% of the average user's medical costs**. Primary care visits ($40) are not subject to the deductible, nor are generic drugs ($15). There's free preventive care as well. But this essentially is catastrophic coverage, of value mainly if you are sick or injured enough to hit the $7,350 yearly out-of-pocket maximum -- and have that much to lose. For that you pay more than a tenth of median household income in the United States. And that's for usually narrow network coverage, which often involves a struggle to find in-network providers and snares people in out-of-network balance billing.

Deductibles at this level for silver plans are still more the exception than the rule for the ACA marketplace. But silver plan deductibles north of $5,000 or more are no longer rare (they averaged $3,600 last year). When the ACA marketplace launched, I was brought up short by bronze plan deductibles then averaging about $5,000. That sticker shock is what turned my attention to enrollee takeup (or failure thereof) of Cost Sharing Reduction (CSR) subsidies -- the ACA's uncertain shield against underinsurance -- which protects most enrollees with incomes below 200% of the Federal Poverty Level from prohibitive cost sharing of the kind illustrated above. About 45% of ACA marketplace enrollees obtain strong CSR, which gives them coverage with a higher actuarial value than that of most employer plans.

This year, the gold plan discounts ironically generated by Trump's spiteful cutoff of federal funding for CSR mitigated the relentless climb of out-of-pocket costs for some of the more affluent subsidy-eligible enrollees (in the 200-400% FPL range). Many plans, too, have Swiss-cheese deductibles, with numerous services not subject to the deductible. And catastrophic coverage (which is what most bronze plans and a growing number of silver plans effectively provide) is not without value.

Still, it should be acknowledged that the ACA marketplace has devolved into a travesty in many places and for many enrollees and prospective enrollees. That's particularly true those with incomes above 200% FPL, the threshold below which CSR has a strong impact, and all the more so for about 6 million enrollees in the ACA-compliant market who don't qualify for premium subsidies. Networks are narrow, doubtless snaring many in balance billing, and out-of-pocket costs rise relentlessly as the per-member cost of care rises -- as much because sabotage is degrading the marketplace risk pool as because of medical inflation. For a single 50 year-old with an income of $50,000 for whom all silver plans under $700 per month carry deductibles over $6,000, the term Affordable Care Act is a mockery.

Relentless Republican sabotage of the marketplace triggers a lot of if onlys. If only officials in every state had actively overseen their insurance markets, done their utmost to educate and encourage the uninsured to enroll, and presented the individual mandate as a moral imperative to get covered, as Mitt Romney did in Massachusetts in 2006. If only every state had embraced the Medicaid expansion, which improves the marketplace risk pool as well as providing affordable coverage to the poor and near poor (the expansion is the truly successful lung of the ACA).

If only Republicans at all levels of government hadn't disparaged marketplace offerings and taken measures in many states to hamstring enrollment assistance. If only the U.S. government hadn't been forced by the Republican Congress to stiff and so really defraud insurers of their risk corridor payments, triggering the collapse of most co-ops. For that matter, if only co-op funding itself hadn't been serially sabotaged. If only Congress might have found the wherewithal to fix the family glitch and renew the reinsurance program after its three-year phaseout. If only insurers hadn't been shaken by wave after wave of court challenges, and as a result of one of those been stiffed a second time on their Cost Sharing Reduction responsibilities. If only Republicans, exulting in the dysfunction they've largely triggered, weren't working to further undercut the market with an alternative market in medically underwritten and lightly regulated plans. --saltwater peddled to the thirsty. If only if only.

But it has to be admitted too that the ACA marketplace was obviously under-subsidized and riddled with design flaws, as detailed by Jon Walker here. Why, in a country that pays more per procedure and per capita for healthcare than any country in the world, with that pay scale topped by commercial insurers, would you undertake to cover the uninsured by deploying commercial insurers in a marketplace where they negotiate their own provider payment rates? Why leave them free to slice and dice actuarial value in hundreds of dizzying variations? Why not establish a dominant public option, as in Medicare, against which private insurers are privileged to compete, as in Medicare Advantage?

The best you can say for the ACA marketplace is that a functional Congress would have found it fairly simple to improve it as experience dictated, as Congress has with every other public insurance program. That may yet happen, if Republicans fail to defund and dismantle it entirely.

------

* It was closer to noon, TBH, but who's counting?

** A silver plan unenhanced by CSR has an actuarial value of 70% -- that is, it's allegedly designed to cover 70% of the average enrollee's annual costs. But that's a Bill-Gates-walks-into-a-bar kind of average, skewed by the small number of enrollees who incur costs in the tens or hundreds of thousands of dollars and so hit their yearly out-of-pocket maximum, which can be as high as $7,350, as in the plans above. Moreover, the Trump administration has widened the range by which insurers can miss the AV target: a silver plan can have an actual AV as low as 66%.

Great article. thanks for explaining the devious definition of Average Actuarial Value.

ReplyDeleteThe entire market for ACA insurance in New Hampshire is probably well under 100,000 persons, and the unsubsidized market might be under 20,000. This is not large enough to get carriers to compete in any way.