In the ACA marketplace, insurers whose core business has been Medicaid managed care, most notably Centene and Molina, have increasingly underpriced the competition in markets where they compete. These insurers field narrow networks and probably pay little more than Medicaid rates to providers.

United Healthcare, the nation's largest health insurer, has made waves by reporting large losses in the ACA marketplace and threatening to withdraw from it. Yesterday Richard Mayhew posited that UHC's complaints mainly reflect the extent to which the giant has gotten its clock cleaned in the marketplace -- offering more extensive networks than competitors, charging much higher rates in many key markets, and thereby likely attracting sicker enrollees who place a premium on provider choices.

Mayhew's main source is an Urban Institute analysis of 2016 rates, mainly focused on 81 ACA rating regions that account for 47% of the country's population. Urban's John Holahan and Linda Blumberg found that in 2015, UHC sold plans in 36 of those 81 regions, but offered the cheapest or second-cheapest silver plan in only eight of them. In 2016, UHC is in 48 regions, and offers cheapest or second-cheapest (benchmark) silver in just 15 of them.

In marked contrast, Medicaid managed care providers, led by Centene (fielding the Ambetter brand) and Molina, are playing in 48 of the 81 regions this year and offering cheapest or second-cheapest silver in 44 of them. That up up from 36 out of 44 in 2015.

Offering cheap plans and gaining huge market share can be a recipe for disaster as well well as success, as the demise of more than half the ACA coops has made all too clear. But the Medicaid insurers are putting up narrow networks and apparently paying very low rates to providers. UHC doesn't seem to be following suit in most of the large ACA markets in which it's active.

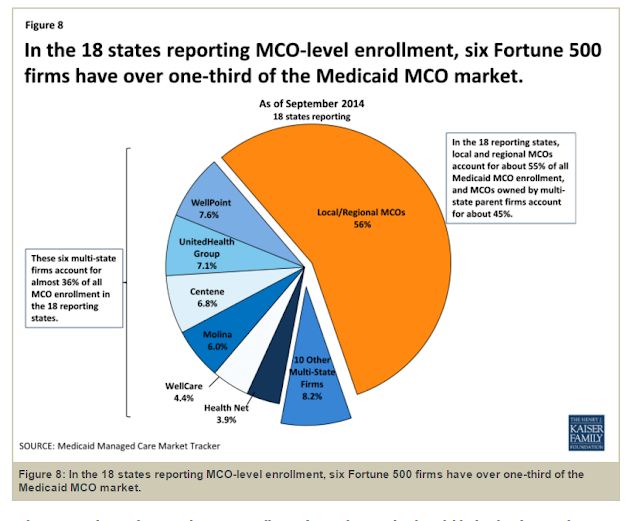

Since UHC is a giant in the employer-sponsored market, it might not seem so surprising that it's offering more ESI-like networks and paying more ESI-like rates. But UHC is also a major Medicaid managed care provider -- larger, in fact, than Centene or Molina. Here is a Kaiser graphic of the MCO market from December 2014:

In 2015, United Healthcare sold QHPs in 24 states* and was a Medicaid managed care provider in 15 of them. Presumably the company could offer Medicaid-like networks in the marketplace if it so chose.

In fact it may do so in some markets. Urban's analysis included a secondary study of 346 less populous regions in the 38 states using HealthCare.gov plus California, covering 37.3% of the U.S. population. In these regions, UHC is the cheapest or second-cheapest insurer in almost exactly half of the 182 regions in which it's participating in 2016. In 2015, UHC was cheapest or second-cheapest insurer in fully 56% of the markets in this less populous subset in which it participated. As Holahan and Blumberg conclude, "United seems to be more aggressively participating in less-populous and less-competitive markets."

That's not the case in markets where UHC goes head-to-head with Ambetter. Below is a rate comparison of the cheapest silver plan offered by each in major cities of the seven states in which both participate in the marketplace. The markets marked in red are in states in which UHC is not a Medicaid managed care provider.

United Healthcare, the nation's largest health insurer, has made waves by reporting large losses in the ACA marketplace and threatening to withdraw from it. Yesterday Richard Mayhew posited that UHC's complaints mainly reflect the extent to which the giant has gotten its clock cleaned in the marketplace -- offering more extensive networks than competitors, charging much higher rates in many key markets, and thereby likely attracting sicker enrollees who place a premium on provider choices.

Mayhew's main source is an Urban Institute analysis of 2016 rates, mainly focused on 81 ACA rating regions that account for 47% of the country's population. Urban's John Holahan and Linda Blumberg found that in 2015, UHC sold plans in 36 of those 81 regions, but offered the cheapest or second-cheapest silver plan in only eight of them. In 2016, UHC is in 48 regions, and offers cheapest or second-cheapest (benchmark) silver in just 15 of them.

In marked contrast, Medicaid managed care providers, led by Centene (fielding the Ambetter brand) and Molina, are playing in 48 of the 81 regions this year and offering cheapest or second-cheapest silver in 44 of them. That up up from 36 out of 44 in 2015.

Offering cheap plans and gaining huge market share can be a recipe for disaster as well well as success, as the demise of more than half the ACA coops has made all too clear. But the Medicaid insurers are putting up narrow networks and apparently paying very low rates to providers. UHC doesn't seem to be following suit in most of the large ACA markets in which it's active.

Since UHC is a giant in the employer-sponsored market, it might not seem so surprising that it's offering more ESI-like networks and paying more ESI-like rates. But UHC is also a major Medicaid managed care provider -- larger, in fact, than Centene or Molina. Here is a Kaiser graphic of the MCO market from December 2014:

In 2015, United Healthcare sold QHPs in 24 states* and was a Medicaid managed care provider in 15 of them. Presumably the company could offer Medicaid-like networks in the marketplace if it so chose.

In fact it may do so in some markets. Urban's analysis included a secondary study of 346 less populous regions in the 38 states using HealthCare.gov plus California, covering 37.3% of the U.S. population. In these regions, UHC is the cheapest or second-cheapest insurer in almost exactly half of the 182 regions in which it's participating in 2016. In 2015, UHC was cheapest or second-cheapest insurer in fully 56% of the markets in this less populous subset in which it participated. As Holahan and Blumberg conclude, "United seems to be more aggressively participating in less-populous and less-competitive markets."

That's not the case in markets where UHC goes head-to-head with Ambetter. Below is a rate comparison of the cheapest silver plan offered by each in major cities of the seven states in which both participate in the marketplace. The markets marked in red are in states in which UHC is not a Medicaid managed care provider.

Seven Cities Where Ambetter and UnitedHealthcare Compete

in 2016

Cheapest available silver plan for each insurer

Unsubsidized premiums for a 40-year old

|

City

|

Ambetter 2016

|

UnitedHealth

2016

|

Spread

|

|

|

$195

|

$292

|

$97

|

|

|

$254

|

$350

|

$96

|

|

|

$298

|

$390

|

$92

|

|

|

$224

|

$302

|

$78

|

|

|

$258

|

$302

|

$44

|

|

|

$278

|

$315

|

$37

|

|

|

$264

|

$291

|

$27

|

The price spreads are wider in states where UHC is not an MCO -- though admittedly the sample is small enough that that could be coincidental. In all of these markets, though, according to a measure of network strength provided by HealthSherpa.com, the UHC networks are far more robust. The measure purports to show for each plan a percentage more or less than the average plan in the region for primary care doctors, specialists, and hospitals. I'm not quite sure how to read this measure, and some odd results put its reliability in question (to my mind). But in each of these markets, while Ambetter shows an above-average supply of primary care doctors, its ratings for specialists and hospitals are dramatically, sometimes incredibly, low. UHC is positive on almost every rating and in several markets appears to be credited with two, three or four times as many hospitals as the norm.

United Healthcare has been a cautious and ambivalent participant in the ACA marketplace. I'd be curious to learn why it doesn't act more like the MCO that it in part is.

---

The Kaiser chart linked to above shows UHC selling QHPs in 23 states and marks the company as inactive in the Washington marketplace, but UHC is in fact selling there.

It would appear that if an insurer creates a superior product (in terms of network access), then the insurer will be punished with expensive customers.

ReplyDeleteYet another example of what a strange market health insurance is. In other industries, more customers means more profits. In health insurance, some customers are money losers.

This also shows why risk adjustment is necessary. The juvenile Republican cutoff of risk adjustment funds shows a complete misunderstanding of the government support that is required in any guaranteed issue environment.