Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up!

|

| Greener pastures for New Yorkers of a certain income |

New York has a pending ACA Section 1332 updated waiver proposal to CMS that would extend eligibility for the Essential Plan, the state’s zero-premium, low-out-of-pocket cost health insurance program, to applicants with incomes up to 250% of the Federal Poverty Level ($36,450 for an individual, $75,000 for a family of four) in April 2024.

The economics of the program appear to defy gravity, and perhaps suggest lessons as to the public funding of health benefits in the United States.

Shedding “Medicaid-ish” payment rates

As currently structured, New York's Essential Plan is a Basic Health Program, an option for states established by Section 1331 the Affordable Care Act. A BHP is a health coverage program for state residents with incomes up to 200% FPL offered in place of standard ACA marketplace coverage. The implicit premise of Section 1331 is that BHPs will pay lower rates to providers and plow those savings into reducing premiums and out-of-pocket costs for enrollees — rather like Medicaid.

The Essential Plan currently provides coverage with an actuarial value of 98% to enrollees with income up to 150% FPL, compared to 94% for benchmark silver coverage in conventional marketplaces, and an AV of 92% to enrollees in the 150-200% FPL income bracket, compared to 87% in the marketplace. The plan has no deductibles at any income level and includes dental and vision coverage. Plan benefits are standardized.

Originally, the Essential Plan directed participating insurers — a group all but identical to those providing ACA marketplace coverage to New Yorkers at higher incomes — to pay providers Medicaid rates plus 20% for enrollees in the 139-200% FPL income range — i.e., those who would be in the marketplace if not for the EP. For enrollees with income below 139% FPL, the EP paid Medicaid rates. This enrollment group is comprised of legally present noncitizens subject to the federal “5-year bar” to federal Medicaid funding for legally present non-citizens. Prior to the BHP launch in April 2015, New York had been fully funding Medicaid enrollment for these immigrants without federal contribution since 2001, in accordance with a state court order. The ACA’s funding of marketplace or BHP coverage for those subject to the 5-year bar was a huge windfall and a major impetus for creating a BHP; upon launch of the EP, 225,000 state-funded Medicaid enrollees were immediately transferred to the program.

Those original payment rates were what one might expect of a BHP. In June 2021, however, New York increased reimbursement rates in the EP plan versions offered at the two higher income levels (139-150% FPL and 150-200% FPL) to 225% of Medicare for hospital inpatient and outpatient services, budgeting $420 million in FY 2022 for the increased payments, while eliminating the prior $20/month premium for enrollees with income above 139% FPL. In June 2023, the state extended the 225% of Medicare payment rate to versions of the EP offered at lower incomes (0-100% FPL and 101-138% FPL) and included physician services in the increased rate, budgeting an additional $800 million annually.

The proposed waiver would extend BP eligibility with the enhanced payment rates and zero premium to enrollees with income up to 250% FPL. Since a Basic Health Program by statute can only be offered to enrollees with income up to 200% FPL, the proposed extension is via an ACA Section 1332 “innovation waiver,” by which a state can propose alternative structures to the standard ACA marketplace. These proposals must offer equally comprehensive coverage equally affordably to at least as many people as the standard marketplace — and they must not increase the federal deficit, i.e., they must cost the federal government an amount equivalent to what the standard marketplace would cost. Under the waiver, the Essential Plan would lose — or rather “suspend” — BHP status for the 5-year duration of the waiver — which means that federal funding would rise from 95% of the estimated cost of a conventional marketplace to 100%.

Giving enrollees more for less

In a standard (and New York’s current) ACA marketplace, a benchmark silver plan for for enrollees in the 200-250% FPL income bracket has an actuarial value of 73%. The benchmark plan (the second cheapest silver plan) determines the federal premium subsidy, as enrollees pay a fixed percentage of income on a sliding income scale for the benchmark. Enrollees pay premiums that vary according to their income and plan choice; at an income of $36,000, just under 250% FPL, a single enrollee would pay $116 per month for the benchmark, with the federal government kicking in $688/month. The proposed EP extension would instead provide enrollees in this income bracket with 92% AV coverage for zero premium — at avowedly no additional cost to the federal government. In the 200-250% FPL income bracket, a marketplace silver plan can have an out-of-pocket maximum as high as $7,550 per adult in 2024. The EP OOP max at this income level is just $2,000.

The state estimates that transition to the EP will save the average enrollee in the 200-250% FPL income bracket $4,600* annually, split nearly evenly between premiums and out-of-pocket costs (updated waiver proposal, p. 48). The proposal forecasts a slight net enrollment increase, with a reduction in 2024 of about 71,000 enrollees in the marketplace and an increase of about 89,000 in the EP — which, with its zero premium, has higher takeup rates. By 2028, the net enrollment increase is forecast to rise to about 28,000, or 2%.

Despite all these reductions in cost for enrollees in the 200-250% FPL income bracket who move from marketplace to EP, the waiver proposal shows a lower premium per month per person (PMPM) for the EP than for qualified health plans (QHPs) in the marketplace. For 2024, the November update to the proposal estimates a $761 PMPM average premium for subsidized QHP enrollees, versus $629 PMPM for the EP. The original proposal, from May 2023, broke out the provider payment boosts as a separate line item, $800 million per year (the boost is capped at that amount and would be reduced if that ceiling is reached), and so showed an even sharper premium difference: $740 PMPM for subsidized marketplace coverage compared to $569 PMPM for the EP. The provider payment increase is estimated to add about 10% to the EP premium. Also broken out separately is a proposed $100 million to reduce enrollee cost sharing at higher income levels in 2024, trended forward every year. In the November update, both costs are incorporated in the EP premium.

It seems natural to wonder: how can New York eliminate premiums paid by enrollees in a given income bracket (200-250% FPL), provide 92% AV coverage in that bracket, mandate provider payment rates that match or exceed national average commercial rates by most estimates**, and provide dental and visual coverage — all at a cost to the federal government below the cost of subsidizing 73% AV marketplace coverage in this income bracket?

I posed this question to Elisabeth Benjamin. VP of Health Benefits at New York’s Community Service Society and a primary architect of the Essential Plan (and co-author of a pre-ACA blueprint for a state universal coverage plan that presages many EP features). For starters, Benjamin told me, the increased provider payment rates are still lower than those paid in New York’s individual market (by the same insurers). Further, enrollees in the Essential Plan are both healthier and use less healthcare services (utilization is generally lower at lower incomes, even adjusting for health status). While the 200-250% FPL population might be expected to have higher utilization than the current income groups, the much higher takeup of the EP than of marketplace coverage (97% vs. 72% among those qualified for coverage in the two programs, according to a 2023 enrollment update) should reduce per-person utilization in this income group when it moves to the EP. Finally, the EP requires a medical loss ratio no lower than 86% — that is, insurers must spend 86% of premium revenue on enrollees’ medical claims. In 2022, the average MLR for QHPs in the New York marketplace in the 200-250% FPL bracket was 79.2% (just below the ACA’s 80% statutory minimum), according to the original waiver proposal.

That low MLR in the 200-250% FPL bracket is in marked contrast to an average MLR of 94.6% for New York enrollees at incomes above 250% FPL — underscoring the extent to which utilization rises with income (partly because higher income enrollees tend to be older). The waiver proposal could, theoretically, have bid to reduce marketplace premiums by combining the EP and marketplace risk pools, as Massachusetts does with the BHP-like ConnectorCare and the “regular” marketplace available at higher incomes. The single risk pool has paved the way for Massachusetts to extend ConnectorCare eligibility to 500% FPL this year without cannibalizing the marketplace for higher-income residents. By statute, a BHP must maintain a separate risk pool, but the waiver proposal would suspend the EP’s BHP status. But unification cuts two ways: it would raise premiums in the EP and reduce federal funding by reducing premiums for the benchmark silver plan, which determines subsidies. The same is true for a state reinsurance program, which would also reduce benchmark premiums and so subsidies. Instead, New York proposes to compensate insurers separately for removal of the lower-cost enrollees in the 200-250% FPL bracket from the QHP risk pool.

Converting high QHP premiums to (federal) gold

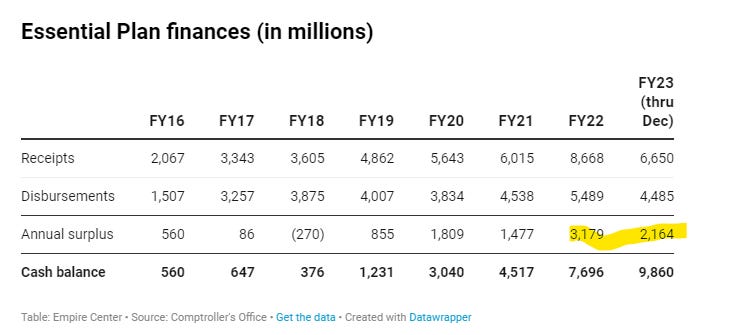

Benjamin also told me that the $800 million allocated annually to boosting provider payment will come out of the surplus in the EP’s trust fund, which, as Bill Hammond of the Empire Center has pointed out, has grown to enormous proportions, topping $10 billion in 2023. That surplus is the result of the difference between premiums for the EP and benchmark silver plans in the state’s ACA marketplace — which, as Hammond notes in a subsequent post, exceed national average benchmark premiums by 54%. The enhanced marketplace subsidies provided in March 2021 by the American Rescue Plan Act have further fueled the annual surplus, as Hammond’s table below shows (my emphasis):

According to the 2023 enrollment report cited above, ARPA increased federal payments to the Essential Plan by $800-900 million per year.

In effect, New York is leveraging high costs in the individual market to extend eligibility and improve coverage in the EP — zeroing out premiums, reducing out-of-pocket costs, adding dental and vision care, and boosting provider payment and so, presumably, provider network adequacy. That probably explains why the waiver proposal does not seek to combine the EP and marketplace risk pools (and according to Benjamin, CMS would frown at a request to combine them, as it would spirit of Section 1331). As long as the ARPA-enhanced marketplace subsidy schedule is in effect (which it may not be after 2025), no one who lacks access to other affordable insurance pays more than 8.5% of income for a benchmark silver plan in the marketplace. Thus an increase in unsubsidized premiums hurts no one except federal taxpayers (and, potentially, enrollees who choose plans that cost more than the benchmark, as spreads rise with premiums).

The waiver proposal does take full account of the possibility — perhaps likelihood — that the ARPA subsidy boosts won’t be extended beyond 2025, providing enrollment and spending projections with and without ARPA subsidy extension. It also proposes to suspend rather than absolutely end the Essential Plan’s BHP status, so that the program could revert to BHP status if the 5-year waiver is not renewed. Combining risk pools would complicate a reversion to BHP status, as the risk pools would have to be re-separated.

A better model than the marketplace?

Like Massachusetts’ BHP-like ConnectorCare, for which the state has extended eligibility up to 500% FPL, the Essential Plan suggests a more efficient model for subsidized health coverage than the ACA marketplace, which is essentially a reformed individual market, providing insurers with broad latitude to vary enrollee cost structures within the constraints of a fixed actuarial value. With their standardized benefits, low out-of-pocket costs, and (relatively) low provider payment rates, the Essential Plan, Minnesota’s BHP (MinnesotaCare), and ConnectorCare*** more closely resemble Medicaid managed care programs than the pre-ACA individual market. I have speculated before that if Medicaid eligibility were expanded further up the income chain (Medicaid for All Who Need It?), Medicaid payment rates and provider networks would have to improve. That’s essentially what’s happened with the Essential Plan, albeit with payment rates that would be considered extravagant in most states. Were New York not able to leverage the high provider payment rates prevalent in the state (reflected in the individual market premiums that determine marketplace funding), the payment rates would doubtless be more moderate, as they were in the Essential Plan’s early years.

Postscript: Thanks to Louise Norris for alerting me to a December 18 further update to the waiver proposal, seeking approval to extend eligibility to the state’s Deferred Action for Childhood Arrivals (DACA) population up to 250% FPL. The prior proposal anticipated extending eligibility to DACA recipients when CMS finalizes a rule affirming DACA eligibility for marketplace coverage. Now — prompted by comments submitted in response to the waiver proposal — the state asserts its authority to cover DACA recipients and asks CMS to ratify that in advance of the anticipated April 1 start date for the EP expansion. The state anticipates slightly more than 3,000 DACA enrollees.

—

* I am a bit surprised by the estimate that the average enrollee in the 200-250% FPL bracket will save $2,200 in premiums. In 2024, as noted above, a benchmark silver plan would cost an enrollee with an income just below 250% FPL $116 per month, or $1,392 per year. While premiums will rise over ten years, and FPL brackets will adjust for inflation, the percentage of income required for benchmark silver will not change, at least as projected in the with and without ARPA extension (legislation could also pare back as well as end or maintain the current subsidy schedule as is). In 2023 in New York, 56% of enrollees in the 200-250% FPL bracket selected silver plans, 31% selected bronze, 8% selected gold, probably a bit shy of 4% platinum, and 1% catastrophic (the latter two are not specified by income in the Public Use Files; estimates are based on metal level share in all income brackets). That averages out to an AV of just about 70%. Perhaps silver plans that cost more than the benchmark (second cheapest silver plan) are bought frequently.

** A 2022 CBO report overviewing various studies of commercial payment rates found an average estimate of 240% of Medicare for outpatient services and 182% for inpatient services. Physician rates are usually estimated as closer to Medicare. A 2021 Urban Institute study of various specialties found a weighted average commercial payment rate of 160% of Medicare for seventeen specialties, noting that previous studies generally pegged average rates at 120-140% of Medicare.

***ConnectorCare, unlike the BHPs, does not set capitation rates for participating insurers. Technically the standardized ConnectorCare plans are silver QHPs with supplemental state subsidies that raise AV. The program controls costs by setting enrollee premium levels for the lowest-cost participating plan only, inducing insurers to compete for that quasi-benchmark position.

No comments:

Post a Comment