Subscribe to xpostfactoid via box at top right. You'll get 2-3 posts per week, mostly re ACA.

As tens of millions of Americans lose job-based health insurance, the heavyweight in reducing the ranks of the newly uninsured is going to be Medicaid -- at least, in the 36 states that have enacted the Medicaid expansion (and if Democrats don't push through a 100% COBRA subsidy). Medicaid will far outweigh the ACA marketplace for several reasons:

Related:

As tens of millions of Americans lose job-based health insurance, the heavyweight in reducing the ranks of the newly uninsured is going to be Medicaid -- at least, in the 36 states that have enacted the Medicaid expansion (and if Democrats don't push through a 100% COBRA subsidy). Medicaid will far outweigh the ACA marketplace for several reasons:

- Medicaid eligibility is based on monthly income, whereas marketplace subsidy eligibility is based on annual income. Mid-year, marketplace subsidies are therefore weakened by income earned year-to-date.

- The average normal unemployment benefit nationally is $378 per week* -- close to the Medicaid eligibility threshold in expansion states for a single person ($1468/month) and well below the threshold for any larger family.

- The extra $600/week UI benefit provided for up to 4 months by the CARES Act does not count as income for Medicaid eligibility purposes, but it does count toward subsidy eligibility in the ACA marketplace.

These facts explain why Health Management Associates projects an increase of 17 million in Medicaid enrollment in its mid-range forecast, while marketplace enrollment remains more or less flat, as some few millions come in while others exit into Medicaid.

From this perspective, making Medicaid enrollment as easy as possible matters more than opening an emergency Special Enrollment Period in the ACA marketplace, as 13 state-based marketplaces have done and as CMS has refused to do for the 38 states that use HealthCare.gov, the federal exchange.

The emergency SEP still does matter very much -- chiefly, perhaps, in sending a nationwide message that coverage is available for the uninsured, including in Medicaid. It matters especially in the 14 states that have refused to enact the ACA Medicaid expansion, where hundreds of thousands may newly qualify for marketplace subsidies.**

But what may matter more is whether the ACA exchanges -- including HealthCare.gov -- are retooled to consistently recognize and properly process Medicaid eligibility. There are two challenges here. First, an exchange has to recognize the $600/week extra UI benefit in calculating marketplace eligibility but discount it in calculating Medicaid eligibility. [UPDATE, 4/23/20: CMS tells me it will update HealthCare.gov to achieve this.] (This is also a key challenge for state Medicaid agencies and websites -- and, as Jason Levitis points out, requires state UI agencies to clearly differentiate the $600/wk benefit in unemployment checks or stubs.)

Second, it has to recognize Medicaid eligibility on the basis of monthly income going forward even if money earned year-to-date is above the annual threshold for Medicaid eligibility, or would push annual income above the threshold when UI income is figured in. [UPDATE, 4/23/20: CMS tells me that HealthCare.gov can do this, though I have found that navigators prefer to apply directly to state Medicaid agencies in this situation.]

Second, it has to recognize Medicaid eligibility on the basis of monthly income going forward even if money earned year-to-date is above the annual threshold for Medicaid eligibility, or would push annual income above the threshold when UI income is figured in. [UPDATE, 4/23/20: CMS tells me that HealthCare.gov can do this, though I have found that navigators prefer to apply directly to state Medicaid agencies in this situation.]

One step in the right direction on HealthCare.gov right now is pretty clear messaging from the home page forward on Medicaid eligibility. If you click on "see if I can enroll" on the home page, the next screen presents checking on Medicaid eligibility as one option of three.

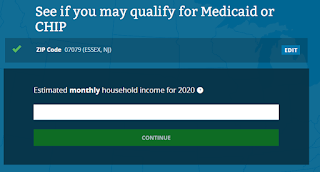

Provide a zip code, and the next screen starts very much in the right place -- though CMS should add "if you are receiving enhanced unemployment benefits, do not count the extra $600/week" or words to that effect.

Add in the number of people in the household and their ages, and the process works:

If only the actual application were close to that simple! The goal should be to get as close as possible.

Unfortunately, if you check your likelihood of Medicaid eligibility from a different path on HealthCare.gov, you may get a different answer. The Covid-19 information page includes a link to check if you're eligible for Medicaid. That path takes you to this screen, which appears to be primarily a screen for marketplace subsidy calculation:

Annual income, as we've seen, can you lead you to the wrong answer.*** Getting to this screen from the Medicaid prompts is a routing problem.

While the exchanges are supposed to offer a "no wrong door" path to whatever aid a person is eligible for (or a determination of no aid), state Medicaid offices and online applications may still be the primary gateway to Medicaid enrollment. Enrollment assisters in many states prefer this more direct route. State government messaging has a decision to make as to whether to route people to state Medicaid websites like NJ FamilyCare or the state marketplace exchange. State agencies may also be split between a desire to cover as many people as possible and horror at the deficits being wracked up as revenues collapse. If they're committed to insuring as many as possible, the best tool may be a Section 1135 waiver enabling streamlined Medicaid application.

As for HealthCare.gov, if CMS really wanted to make it a route to covering as many of the newly unemployed as possible, that might require tilting messaging and processing toward Medicaid enrollment. The screenshot path shown above is not too far from that. Whether the application process streamlines the path to Medicaid enrollment is a different story.

A staggering 22 million people have lost their jobs this month. We may be heading into a full-scale Depression -- who knows how soon we'll be insulated from Covid-19 and how soon the economy can recover if/when we are? If we do get stuck with mass unemployment, we may also get pushed toward Medicaid for all. That would be an ironic path to coverage for post-Reagan America -- an adjustment to a 40-year hollowing out of the middle class.

UPDATE, 4/21/20: In a CCIO webinar for enrollment assisters just now, a moderator said that for marketplace applicants seeking a Special Enrollment Period because they have lost health insurance, the marketplace is not requiring documentation of loss of coverage --only an attestation to that effect. That's very good news and should smooth the path to marketplace enrollment for those who have recently lost job-based coverage.

UPDATE, 4/21/20: In a CCIO webinar for enrollment assisters just now, a moderator said that for marketplace applicants seeking a Special Enrollment Period because they have lost health insurance, the marketplace is not requiring documentation of loss of coverage --only an attestation to that effect. That's very good news and should smooth the path to marketplace enrollment for those who have recently lost job-based coverage.

ACA enrollment train wreck coming

Our emerging public option: Medicaid

CARES Act may reduce coverage gap in states that refused to expand Medicaid

Enhanced unemployment benefit will skew marketplace enrollment

Emergency special enrollment periods in 12 states: How easy?

How about an emergency Special Enrollment Period for the ACA marketplace?

Our emerging public option: Medicaid

CARES Act may reduce coverage gap in states that refused to expand Medicaid

Enhanced unemployment benefit will skew marketplace enrollment

Emergency special enrollment periods in 12 states: How easy?

How about an emergency Special Enrollment Period for the ACA marketplace?

---

* State unemployment benefits vary widely. The average weekly benefit ranges from $213/week in Mississippi to $533/week Hawaii. See page 3 here. For low wage workers UI benefits are of course far below the average. In Texas, as I noted here, a minimum wage worker who averages 30 hours per week would get $190/week in UI benefits.

** In the nonexpansion states, the $600/week UI benefit, which counts as income in marketplace subsidy calculations, could lift hundreds of thousands out of the "coverage gap" -- that is, those whose household income is below the 100% FPL threshold for marketplace subsidies. It's true that those who are newly eligible for subsidies are also eligible for a SEP without a general emergency SEP being opened (that is, they can enroll outside of Open Enrollment season if they become newly eligible for subsidies). But applying for that cause-based SEP is an administrative hurdle, and as veteran enrollment assister Shelli Quenga told me, front-line help desk assisters working for HealthCare.gov generally don't understand that this SEP is available.

*** In fact, an applicant can be eligible for both subsidized marketplace coverage and Medicaid -- one on an annual basis, the other on a monthly. An application won't be recognized as eligible for both. But a knowledgeable or skillfully assisted applicant can have an effective choice.

Thank you very much for pushing through the fog on enrollment rules.

ReplyDeleteI think the only answer for the next few years is to have a virtual army of insurance navigators. And then another small army of unemployment insurance navigators.

This cannot be done all online. That was the hideous error in the ACA rollout of 2013. You need people at desks.

Medicaid can make retroactive payments. This can help "flatten the (enrollment) curve" until state Medicaid agencies are better prepared.

ReplyDelete