Subscribe to xpostfactoid via box at top right (requires only an email address; you'll get 2-3 emails per week on average)

Florida's ACA marketplace has benefitted from silver loading. But not as much as it should.

("Silver loading" refers to the pricing of Cost Sharing Reduction subsidies into silver plans only, creating discounts in bronze and gold plans. The practice began in 2018 after Trump cut off direct reimbursement to insurers for CSR. See note at bottom for a fuller explanation.)

Florida has more marketplace enrollees than any state -- and has marginally increased enrollment since 2016 (up 2%) while enrollment has dropped 10% nationally and 14% in the 39 states on the federal exchange, HealthCare.gov. There are several reasons for that:

Florida's ACA marketplace has benefitted from silver loading. But not as much as it should.

("Silver loading" refers to the pricing of Cost Sharing Reduction subsidies into silver plans only, creating discounts in bronze and gold plans. The practice began in 2018 after Trump cut off direct reimbursement to insurers for CSR. See note at bottom for a fuller explanation.)

Florida has more marketplace enrollees than any state -- and has marginally increased enrollment since 2016 (up 2%) while enrollment has dropped 10% nationally and 14% in the 39 states on the federal exchange, HealthCare.gov. There are several reasons for that:

- The state refused to implement the ACA Medicaid expansion, so marketplace income eligibility begins at 100% of the Federal Poverty Level, rather than at 138% FPL as in expansion states. Enrollees at 100-138% FPL pay just 2% of income for a benchmark silver plan.

- At that income level (and up to 150% FPL) Cost Sharing Reduction (CSR) raises the actuarial value of a silver plan to 94% - which translates to a deductible in the $0-250 range and a yearly out-of-pocket maximum under $1500 (in Florida).

- Florida nonprofits and brokerages have developed a strong infrastructure to provide enrollment assistance to low income enrollees, particularly in the Miami-Dade area.

- In 2018 and 2019, silver loading made gold and bronze plans more affordable.

The intense need of low income Floridians for healthcare access, driven by the state's failure to expand Medicaid eligibility, coupled with plentiful enrollment assistance, has generated an enormous "silver load" in Florida's enrollment. That is, almost everyone who enrolls in silver in the state qualifies for CSR that raises the silver plan AV to 94% or 87%. An astonishing 72% of the state's 1.2 million silver plan enrollees have incomes under 151% FPL, which means they get 94% AV silver. Another 20% are in the 151-200% FPL income range and so access 87% AV silver.

This means that in Florida, the average benefit level obtained by silver plan enrollees is platinum-plus. The average AV of a silver plan purchased on-exchange in Florida is 91.5%. Gold plans are 80% AV, and platinum plans are 90%.

Florida insurers have indeed discounted bronze and gold plans since 2018 -- but nowhere near proportionate to silver's real actuarial value, at least where gold plans are concerned. In fact the discounts shrank modestly in 2019.

Compare the relative pricing of bronze, silver and gold in 2017 -- pre silver loading, when silver was priced as if its AV was just 70% -- with pricing in 2018 and 2019. Recall that the AV for all silver plan enrollees taken together was over 90% in 2019.

ACA premium subsidies are calculated so that the enrollee pays a fixed percentage of income for the benchmark (second cheapest) silver plan. On average each year, benchmark silver was about $15/month more expensive for a 40 year-old than cheapest silver. Cheapest gold was 126% of the benchmark in 2017, 104% in 2018, and 105% in 2019.

Averages can be deceptive, as there's considerable -- sometimes huge -- premium variation by rating area. As it turns out, the spreads in Miami-Dade and Broward counties, which have the same pricing and account of 37% of all enrollment, are fairly close to the state averages:

Cheapest Plan by Metal Level, Miami-Dade and Broward, 2019

Monthly premiums for unsubsidized 40 year-old

Silver loading chiefly benefits enrollees with incomes in the 200-400% FPL range. Below 200% FPL, the value of CSR outstrips the value of bronze/gold discounts created by silver loading, and in Florida, 83% of enrollees at the 100-200% FPL level selected silver plans. At incomes in the 200-400% FPL range, in contrast, the bottom has dropped out on silver enrollment -- mostly in favor of bronze. Enrollment in this income range has risen 11% in Florida since 2017.

Source: CMS State-level Public Use Files, 2017, 2018, 2019

Discounted bronze plans are something of a mixed blessing. For healthy people with some resources, bronze priced proportionately below silver is a rational choice -- but people in the 200-400% FPL range are hardly wealthy, and bronze deductibles are very high - $7,900 for the two cheapest plans in Miami. What's missing from the Florida picture is stronger gold discounts.

Compared to 2017, gold plans are offered at a significant discount in Florida in 2019. The cheapest gold plan is on average 108% of cheapest silver and 105% of the benchmark this year, compared to 132% and 126% in 2017. But as noted above, almost everyone who buys silver in Florida is getting 94% or 87% AV. Silver in Florida is effectively platinum. Yet the premium for the cheapest silver plan in Miami is just 60% of the cheapest platinum plan ($440 per month vs. $730 for an unsubsidized 40 year-old).

As I've noted in several recent posts (1,2,3) the actuaries Greg Fann and Daniel Cruz have called on state insurance regulators to require insurers to price plans more proportionately to actuarial value, which entails taking the real aggregate actuarial value obtained by their silver plan enrollees into account. Their most radical proposal is to require insurers to price silver plans as if all enrollees obtain 94% or 87% AV -- which should then become a self-fulfilling prophecy, as no one with an income over 200% FPL will then buy silver. In Florida, that assumption would not be far from the current truth -- 92% of silver plan enrollees have 94% or 87% AV. Gold should be priced below silver.

In 2017, 55% of Florida enrollees in the 200-400% FPL income band selected silver plans. If gold were priced properly in 2019, the percentage of upper-bracket subsidy-eligible enrollees choosing gold might well be at least that high. While silver enrollment at this income level has collapsed to 22%, bronze has taken up too much of the slack.

If silver loading effects and potential interest you, state case studies and other explorations are indexed here.

Postscript: since premium spreads vary by county, I'd like to offer a bit of semi-digested data showing spreads in the twelve Florida counties with highest enrollment. I've set those spreads beside metal level selection, and added a crucial additional factor: the share of total enrollment held be enrollees with incomes in the 200-400% FPL range. In Florida counties, this percentage is on average quite small -- and as noted above, most enrollees below that level stick with silver (a good number of enrollees are also unknown or other FPL, and most of those are unsubsidized). The percentage selecting gold and bronze is only relevant in light of the percentage with incomes over 200% FPL, but the county level files don't break out metal level selection by income. So these figures are merely suggestive (or perhaps can be crunched to better effect than I've done): sometimes the percentage of enrollees at 200-400% FPL is the main determinate of bronze and gold takeup,,while in a few cases unusual pricing has a major impact. The two columns on the far right show a pretty clear relationship between the percentage of enrollees in the 200-400% FPL range and the percentage selecting bronze or gold.

Cheapest Plans by Metal Level, Top Florida Counties, Plus Percentage at 200-400% FPL

40 year-old, income $30,000

Source: CMS County-level Public Use Files, 2019, and Kaiser Family Foundation premiums by county, 2019

Below, the percentage of enrollment in each county that's in the 200-400% FPL range is plotted against the percentage of bronze-plus-gold takeup. The outliers at bottom right, Lee and Collier, both have very cheap bronze but also cheap silver.

---

Silver loading is the byproduct of Trump's October 2017 cutoff of direct federal reimbursement to insurers for the Cost Sharing Reduction (CSR) subsidies they are required to provide to low income marketplace enrollees who select silver plans. Faced with the cutoff at the brink of open enrollment for 2018, most state insurance departments allowed or encouraged insurers to price CSR into silver premiums only. Since premium subsidies, designed so that the enrollee pays a fixed percentage of income, are set to a silver plan benchmark, inflated silver premiums create discounts for subsidized buyers in bronze and gold plans.

For enrollees whose incomes are too high to qualify for CSR, a silver plan has an actuarial value of about 70%. Prior to Trump's CSR reimbursement cutoff, silver plans were priced as if they were 70% AV. But CSR raises the AV of a silver plan to 94% for enrollees with incomes up to 150% of the Federal Poverty Level, and to 87% for those with incomes in the 150-200% FPL range. The more low income enrollees a state has, the higher silver's "real" AV, and the more expensive it should be.

* Note re gold enrollment at 200-400% FPL in 2017: In 2017, CMS did not break out gold enrollment by income. Catastrophic and platinum enrollment at all income levels totaled 17, 591. Non-silver enrollment at 200-400% FPL was 32,828 (based on the whole percentages provided in the metal level by income breakout). To estimate the gold total, I used the 2018 percentage of non-silver enrollment at 200-400% FPL that was gold (76.2%).

Florida insurers have indeed discounted bronze and gold plans since 2018 -- but nowhere near proportionate to silver's real actuarial value, at least where gold plans are concerned. In fact the discounts shrank modestly in 2019.

Compare the relative pricing of bronze, silver and gold in 2017 -- pre silver loading, when silver was priced as if its AV was just 70% -- with pricing in 2018 and 2019. Recall that the AV for all silver plan enrollees taken together was over 90% in 2019.

Average Cheapest

Plans by Metal Level - Florida 2017-2019

Monthly premiums for

unsubsidized 40 year-old

Year

|

Bronze

|

Silver

|

Gold

|

Br % Silv

|

Gold % Silv

|

2017

|

$287

|

$317

|

$417

|

91%

|

132%

|

2018

|

$313

|

$450

|

$479

|

70%

|

106%

|

2019

|

$345

|

$461

|

$502

|

75%

|

109%

|

Source: Kaiser

Family Foundation

ACA premium subsidies are calculated so that the enrollee pays a fixed percentage of income for the benchmark (second cheapest) silver plan. On average each year, benchmark silver was about $15/month more expensive for a 40 year-old than cheapest silver. Cheapest gold was 126% of the benchmark in 2017, 104% in 2018, and 105% in 2019.

Averages can be deceptive, as there's considerable -- sometimes huge -- premium variation by rating area. As it turns out, the spreads in Miami-Dade and Broward counties, which have the same pricing and account of 37% of all enrollment, are fairly close to the state averages:

Cheapest Plan by Metal Level, Miami-Dade and Broward, 2019

Monthly premiums for unsubsidized 40 year-old

Year

|

Bronze

|

Silver

|

Gold

|

Br % Silv

|

Gold % Silv

|

2019

|

$355

|

$440

|

$476

|

81%

|

108%

|

Silver loading chiefly benefits enrollees with incomes in the 200-400% FPL range. Below 200% FPL, the value of CSR outstrips the value of bronze/gold discounts created by silver loading, and in Florida, 83% of enrollees at the 100-200% FPL level selected silver plans. At incomes in the 200-400% FPL range, in contrast, the bottom has dropped out on silver enrollment -- mostly in favor of bronze. Enrollment in this income range has risen 11% in Florida since 2017.

Enrollment by Metal

Level at 200-400% FPL -- Florida

Year

|

Total enrollment

|

Bronze

|

Silver

|

Gold

|

% Bronze

|

% Silver

|

% Gold

|

2017

|

335,811

|

119,786

|

183,197

|

25,030*

|

36%

|

55%

|

7%*

|

2018

|

353,510

|

224,376

|

81,528

|

36,239

|

64%

|

23%

|

10%

|

2019

|

375,741

|

255,969

|

83,472

|

39,474

|

68%

|

22%

|

10%

|

Discounted bronze plans are something of a mixed blessing. For healthy people with some resources, bronze priced proportionately below silver is a rational choice -- but people in the 200-400% FPL range are hardly wealthy, and bronze deductibles are very high - $7,900 for the two cheapest plans in Miami. What's missing from the Florida picture is stronger gold discounts.

Compared to 2017, gold plans are offered at a significant discount in Florida in 2019. The cheapest gold plan is on average 108% of cheapest silver and 105% of the benchmark this year, compared to 132% and 126% in 2017. But as noted above, almost everyone who buys silver in Florida is getting 94% or 87% AV. Silver in Florida is effectively platinum. Yet the premium for the cheapest silver plan in Miami is just 60% of the cheapest platinum plan ($440 per month vs. $730 for an unsubsidized 40 year-old).

As I've noted in several recent posts (1,2,3) the actuaries Greg Fann and Daniel Cruz have called on state insurance regulators to require insurers to price plans more proportionately to actuarial value, which entails taking the real aggregate actuarial value obtained by their silver plan enrollees into account. Their most radical proposal is to require insurers to price silver plans as if all enrollees obtain 94% or 87% AV -- which should then become a self-fulfilling prophecy, as no one with an income over 200% FPL will then buy silver. In Florida, that assumption would not be far from the current truth -- 92% of silver plan enrollees have 94% or 87% AV. Gold should be priced below silver.

In 2017, 55% of Florida enrollees in the 200-400% FPL income band selected silver plans. If gold were priced properly in 2019, the percentage of upper-bracket subsidy-eligible enrollees choosing gold might well be at least that high. While silver enrollment at this income level has collapsed to 22%, bronze has taken up too much of the slack.

If silver loading effects and potential interest you, state case studies and other explorations are indexed here.

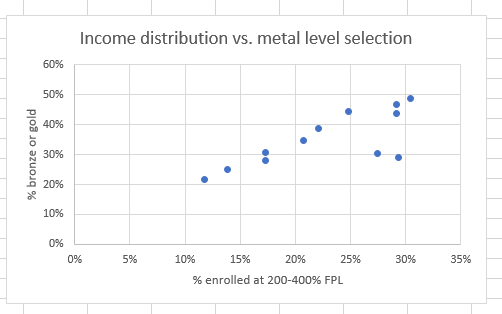

Postscript: since premium spreads vary by county, I'd like to offer a bit of semi-digested data showing spreads in the twelve Florida counties with highest enrollment. I've set those spreads beside metal level selection, and added a crucial additional factor: the share of total enrollment held be enrollees with incomes in the 200-400% FPL range. In Florida counties, this percentage is on average quite small -- and as noted above, most enrollees below that level stick with silver (a good number of enrollees are also unknown or other FPL, and most of those are unsubsidized). The percentage selecting gold and bronze is only relevant in light of the percentage with incomes over 200% FPL, but the county level files don't break out metal level selection by income. So these figures are merely suggestive (or perhaps can be crunched to better effect than I've done): sometimes the percentage of enrollees at 200-400% FPL is the main determinate of bronze and gold takeup,,while in a few cases unusual pricing has a major impact. The two columns on the far right show a pretty clear relationship between the percentage of enrollees in the 200-400% FPL range and the percentage selecting bronze or gold.

Cheapest Plans by Metal Level, Top Florida Counties, Plus Percentage at 200-400% FPL

40 year-old, income $30,000

Source: CMS County-level Public Use Files, 2019, and Kaiser Family Foundation premiums by county, 2019

Below, the percentage of enrollment in each county that's in the 200-400% FPL range is plotted against the percentage of bronze-plus-gold takeup. The outliers at bottom right, Lee and Collier, both have very cheap bronze but also cheap silver.

---

Silver loading is the byproduct of Trump's October 2017 cutoff of direct federal reimbursement to insurers for the Cost Sharing Reduction (CSR) subsidies they are required to provide to low income marketplace enrollees who select silver plans. Faced with the cutoff at the brink of open enrollment for 2018, most state insurance departments allowed or encouraged insurers to price CSR into silver premiums only. Since premium subsidies, designed so that the enrollee pays a fixed percentage of income, are set to a silver plan benchmark, inflated silver premiums create discounts for subsidized buyers in bronze and gold plans.

For enrollees whose incomes are too high to qualify for CSR, a silver plan has an actuarial value of about 70%. Prior to Trump's CSR reimbursement cutoff, silver plans were priced as if they were 70% AV. But CSR raises the AV of a silver plan to 94% for enrollees with incomes up to 150% of the Federal Poverty Level, and to 87% for those with incomes in the 150-200% FPL range. The more low income enrollees a state has, the higher silver's "real" AV, and the more expensive it should be.

* Note re gold enrollment at 200-400% FPL in 2017: In 2017, CMS did not break out gold enrollment by income. Catastrophic and platinum enrollment at all income levels totaled 17, 591. Non-silver enrollment at 200-400% FPL was 32,828 (based on the whole percentages provided in the metal level by income breakout). To estimate the gold total, I used the 2018 percentage of non-silver enrollment at 200-400% FPL that was gold (76.2%).

No comments:

Post a Comment