Subscribe to xpostfactoid in box at right. It's free, won't clutter your mailbox, won't invade your privacy and takes two seconds.

From the beginning, the ACA's apparent Achilles heel has been the plight of those who must look to the individual market for coverage but earn too much to qualify for subsidies.

I say "apparent" because the marketplace is not exactly a roaring success among those eligible for subsidies. But bear with me through a short history of the highly visible plight of the unsubsidized.

Pre-ACA, about a third of those who looked to the pre-ACA individual market were shut out because of pre-existing conditions, and a third of those who were offered insurance in that market were charged above-market rates, while another substantial percentage (perhaps 6-15%) were offered insurance only with coverage for their pre-existing conditions excluded.* But there were still several million relatively content enrollees who faced steep premium hikes when they received cancellation notices in advance of the ACA marketplace's launch in January 2014. They screamed bloody murder, their voices eagerly amplified and sometimes distorted by right wing (largely Koch-funded) groups. The resulting "grandmothering" of pre-ACA plans in many states took many of them out of the risk pool and so further drove up premiums in those states, while their very real complaints tainted public perception of the ACA.

In 2015, Urban Institute scholars Linda Blumberg and John Holahan proposed capping premiums at 8.5% of income with no eligibility cutoff, along with improvements to ACA subsidies at lower income levels. They pointed out that people just over the subsidy threshold, at 400-500% FPL, were paying the highest percentage of income for individual market coverage:

That was before the steep premium hikes of 2017 (due mainly to a needed market correction and the expiration of the ACA's three-year reinsurance program) and 2018 (due mainly to multi-front Republican sabotage). Now, here cometh the Kaiser Family Foundation to detail the extent to which the market for the unsubsidized has deteriorated since 2016. Here are a few snapshots (augmented with the Kaiser subsidy calculator):

Several states with Democratic governors and legislatures are looking at various ways to reduce the ranks of the uninsured and under-insured. The genuinely ill-served and relatively powerful unsubsidized cohort might seem to be an obvious target for state investment -- whether via reinsurance, which lowers unsubsidized premiums and for which the federal government has shown willingness to foot 50-80% of the bill, or via direct subsidy, which Minnesota offered temporarily and may do again.

Before committing resources, however, state governments should consider: nationally, people with incomes over 400% FPL constitute about 41% of the population but just 20% of the uninsured (per U.S. Census as of 2017 -- see p. 28). People with incomes under 200% FPL make up 30% of the population -- and 49% of the uninsured. The uninsured rate at 100-200% FPL is triple that of the rate among those with incomes over 400% FPL (12.8% vs. 4.3%, again as of 2017).

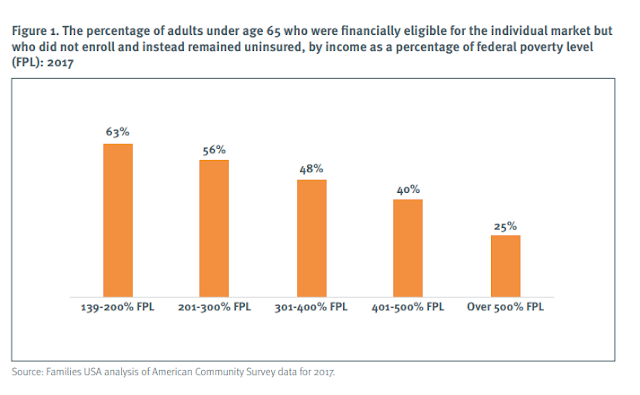

A Families USA report by Stan Dorn urges state governments to improve subsidies for low income enrollees -- that is to "wrap" state subsidies around the federal offering. One finding: 74% of individual market enrollees with incomes too high to qualify for subsidies have incomes over 500% FPL (though perhaps that percentage would be higher if so many people in the 400-500% FPL price range weren't priced out). Here's the broader case for concentrating on low income potential enrollees:

In 2016, the Kaiser Family Foundation estimated that 64% of those eligible for ACA subsidies were enrolled. But marketplace enrollment has shrunk 10% since 2016, due in large part to the Trump administration's massive cuts in advertising and enrollment assistance, repeal of the individual mandate, encouragement of barely regulated short-term plans and sustained verbal assault. Kaiser, moreover, has changed the basis of its analysis of the eligible population, further pushing down its estimate of takeup among the subsidy-eligible, which it now pegs at a dismal 46%.

Families USA further argues that most of the young uninsured are low income, and that concentrating additional aid at low incomes -- while also boosting outreach -- will thus improve the risk pool. (Conversely, more affluent people tend to be healthier, so the question of risk pool composition is somewhat murky.)

FUSA holds up Massachusetts as a model: in the state marketplace, enrollees with incomes up to 150% FPL pay no premiums; for those up to 300% FPL there are no deductibles; and benchmark premiums require a lower percentage of income at 150-300% FPL. Massachusetts has the lowest uninsured rate in the country. Kaiser estimates that 95% of those eligible for marketplace subsidies in the state are enrolled. And despite having the second highest healthcare spending per capita among states, Massachusett also has the second lowest benchmark premiums. Of course, Massachusetts has also had both a subsidized marketplace and a state individual mandate since 2006, when its pioneering ACA prototype launched with bipartisan support. And with a state-based marketplace, MA also has dedicated funds for advertising and outreach, unaffected by HHS cutbacks on that front.

On the other hand, it should be noted that people in the 100-400% FPL income range do have aid available to them, many if by no means all to levels that can be considered affordable, whereas as coverage is literally unaffordable for a significant number of people above the 400% FPL cutoff.

Pumping the base for future innovation waivers

There is a further consideration for progressive states deliberating where to allocate any resources devoted to expanding coverage. Many are looking ahead to 2021 in hopes that there may be a Democratic administration to which they may apply for ACA "innovation waivers," which allow states to propose alterations of ACA marketplace design. Those proposals have to be deficit-neutral: the pool of money available depends on federal spending in the state marketplace in the year prior to proposal. Increased enrollment now increases the pot of money available; somewhat paradoxically, decreased premiums reduce the pot, because they reduce federal subsidies.

Thus reinsurance programs, which the Trump administration has supported via innovation waiver and largely funded for seven states, may reduce the waiver pot, since any enrollment boost it generates will be concentrated among the uninsured. Wraparound subsidies for low income enrollees, on the other hand, may reduce premiums, and so per-person subsdies, but they would also increase the number of subsidized enrollees.

Most states don't have funds available to throw at the ACA marketplace. But so do -- e.g., California, Minnesota and New Mexico. Effective investments now may increase the federal funding available in 2021 and beyond. That is, if we still have a democracy and a habitable planet.

Update: initially I posted the wrong chart from the Urban Institute report, now corrected.

Update, 3/7: I have been mulling the Families USA chart used above, and the results are curious -- showing a trend opposite to research in past years. Specifically, in 2015 Avalere Health reported marketplace takeup sharply descending as income rose, per below. It's undeniable, however, that uninsured rates fall steadily with income and that the uninsured are heavily concentrated at lower income levels.

Update, 3/8: Stan Dorn points out to me that the discrepancy at higher income levels is due to Avalere considering on-exchange only. And I can add, after further mulling, that the high takeup tracked by Avalere at 100-150% FPL is almost entirely attributable to those in nonexpansion states with incomes between 100-138% FPL, at which level benchmark silver costs just 2% of income. These are not included in the FUSA analysis. Further, as I've noted in prior posts, in 2018, enrollment in HealthCare.gov states was down 7.5% at 100-200% FPL -- and up 10% at 300-400% FPL. Further, as noted above, Kaiser has changed its methodology in analyzing Census survey data in a way that increases estimates of the subsidy-eligible uninsured; perhaps others have too. Put it all together and the starkly different charts are not inconsistent.

-----

* Sources for those estimates are provided in this post.

** In 2016, I sketched out similar examples of subsidies that would cap premiums at 8.5% of income for all comers -- e.g., for two 64 year-olds with an income of $240,000.

From the beginning, the ACA's apparent Achilles heel has been the plight of those who must look to the individual market for coverage but earn too much to qualify for subsidies.

I say "apparent" because the marketplace is not exactly a roaring success among those eligible for subsidies. But bear with me through a short history of the highly visible plight of the unsubsidized.

Pre-ACA, about a third of those who looked to the pre-ACA individual market were shut out because of pre-existing conditions, and a third of those who were offered insurance in that market were charged above-market rates, while another substantial percentage (perhaps 6-15%) were offered insurance only with coverage for their pre-existing conditions excluded.* But there were still several million relatively content enrollees who faced steep premium hikes when they received cancellation notices in advance of the ACA marketplace's launch in January 2014. They screamed bloody murder, their voices eagerly amplified and sometimes distorted by right wing (largely Koch-funded) groups. The resulting "grandmothering" of pre-ACA plans in many states took many of them out of the risk pool and so further drove up premiums in those states, while their very real complaints tainted public perception of the ACA.

In 2015, Urban Institute scholars Linda Blumberg and John Holahan proposed capping premiums at 8.5% of income with no eligibility cutoff, along with improvements to ACA subsidies at lower income levels. They pointed out that people just over the subsidy threshold, at 400-500% FPL, were paying the highest percentage of income for individual market coverage:

That was before the steep premium hikes of 2017 (due mainly to a needed market correction and the expiration of the ACA's three-year reinsurance program) and 2018 (due mainly to multi-front Republican sabotage). Now, here cometh the Kaiser Family Foundation to detail the extent to which the market for the unsubsidized has deteriorated since 2016. Here are a few snapshots (augmented with the Kaiser subsidy calculator):

- Unsubsidized enrollment dropped 43% from 6.8 million in Q1 2016 to 3.9 million in Q1 2018 (that one's actually from here).

- The average solo 60 year-old with an income of $50k (slightly over the 400% FPL cutoff) would have to pay 17% of income to obtain the cheapest available bronze plan in her rating area, and 23% of income for cheapest silver. Bronze plan deductibles average $6,258; silver, $4,375. At age 55, benchmark silver (2nd cheapest) costs 20% of income on average. At age 50, 16%.

- In much of the country, especially rural regions, unsubsidized premiums are considerably higher than average. "In 25% of non-metropolitan counties (weighted by enrollment), a 40-year-old making $50,000 would spend more than 10% of their income on premiums for the cheapest plan available, compared with only 5% of people in metropolitan counties."

- "On average nationally, tax credits would need to extend to nearly 800% FPL to bring 2019 bronze premium payments down to 10% of income for a single 64-year-old, or just over 1,100% FPL to accomplish the same for silver premiums."**

Several states with Democratic governors and legislatures are looking at various ways to reduce the ranks of the uninsured and under-insured. The genuinely ill-served and relatively powerful unsubsidized cohort might seem to be an obvious target for state investment -- whether via reinsurance, which lowers unsubsidized premiums and for which the federal government has shown willingness to foot 50-80% of the bill, or via direct subsidy, which Minnesota offered temporarily and may do again.

Before committing resources, however, state governments should consider: nationally, people with incomes over 400% FPL constitute about 41% of the population but just 20% of the uninsured (per U.S. Census as of 2017 -- see p. 28). People with incomes under 200% FPL make up 30% of the population -- and 49% of the uninsured. The uninsured rate at 100-200% FPL is triple that of the rate among those with incomes over 400% FPL (12.8% vs. 4.3%, again as of 2017).

In 2016, the Kaiser Family Foundation estimated that 64% of those eligible for ACA subsidies were enrolled. But marketplace enrollment has shrunk 10% since 2016, due in large part to the Trump administration's massive cuts in advertising and enrollment assistance, repeal of the individual mandate, encouragement of barely regulated short-term plans and sustained verbal assault. Kaiser, moreover, has changed the basis of its analysis of the eligible population, further pushing down its estimate of takeup among the subsidy-eligible, which it now pegs at a dismal 46%.

Families USA further argues that most of the young uninsured are low income, and that concentrating additional aid at low incomes -- while also boosting outreach -- will thus improve the risk pool. (Conversely, more affluent people tend to be healthier, so the question of risk pool composition is somewhat murky.)

FUSA holds up Massachusetts as a model: in the state marketplace, enrollees with incomes up to 150% FPL pay no premiums; for those up to 300% FPL there are no deductibles; and benchmark premiums require a lower percentage of income at 150-300% FPL. Massachusetts has the lowest uninsured rate in the country. Kaiser estimates that 95% of those eligible for marketplace subsidies in the state are enrolled. And despite having the second highest healthcare spending per capita among states, Massachusett also has the second lowest benchmark premiums. Of course, Massachusetts has also had both a subsidized marketplace and a state individual mandate since 2006, when its pioneering ACA prototype launched with bipartisan support. And with a state-based marketplace, MA also has dedicated funds for advertising and outreach, unaffected by HHS cutbacks on that front.

On the other hand, it should be noted that people in the 100-400% FPL income range do have aid available to them, many if by no means all to levels that can be considered affordable, whereas as coverage is literally unaffordable for a significant number of people above the 400% FPL cutoff.

Pumping the base for future innovation waivers

There is a further consideration for progressive states deliberating where to allocate any resources devoted to expanding coverage. Many are looking ahead to 2021 in hopes that there may be a Democratic administration to which they may apply for ACA "innovation waivers," which allow states to propose alterations of ACA marketplace design. Those proposals have to be deficit-neutral: the pool of money available depends on federal spending in the state marketplace in the year prior to proposal. Increased enrollment now increases the pot of money available; somewhat paradoxically, decreased premiums reduce the pot, because they reduce federal subsidies.

Thus reinsurance programs, which the Trump administration has supported via innovation waiver and largely funded for seven states, may reduce the waiver pot, since any enrollment boost it generates will be concentrated among the uninsured. Wraparound subsidies for low income enrollees, on the other hand, may reduce premiums, and so per-person subsdies, but they would also increase the number of subsidized enrollees.

Most states don't have funds available to throw at the ACA marketplace. But so do -- e.g., California, Minnesota and New Mexico. Effective investments now may increase the federal funding available in 2021 and beyond. That is, if we still have a democracy and a habitable planet.

Update: initially I posted the wrong chart from the Urban Institute report, now corrected.

Update, 3/7: I have been mulling the Families USA chart used above, and the results are curious -- showing a trend opposite to research in past years. Specifically, in 2015 Avalere Health reported marketplace takeup sharply descending as income rose, per below. It's undeniable, however, that uninsured rates fall steadily with income and that the uninsured are heavily concentrated at lower income levels.

Update, 3/8: Stan Dorn points out to me that the discrepancy at higher income levels is due to Avalere considering on-exchange only. And I can add, after further mulling, that the high takeup tracked by Avalere at 100-150% FPL is almost entirely attributable to those in nonexpansion states with incomes between 100-138% FPL, at which level benchmark silver costs just 2% of income. These are not included in the FUSA analysis. Further, as I've noted in prior posts, in 2018, enrollment in HealthCare.gov states was down 7.5% at 100-200% FPL -- and up 10% at 300-400% FPL. Further, as noted above, Kaiser has changed its methodology in analyzing Census survey data in a way that increases estimates of the subsidy-eligible uninsured; perhaps others have too. Put it all together and the starkly different charts are not inconsistent.

-----

* Sources for those estimates are provided in this post.

** In 2016, I sketched out similar examples of subsidies that would cap premiums at 8.5% of income for all comers -- e.g., for two 64 year-olds with an income of $240,000.

Thanks for demonstrating the evil nature of the cliff.

ReplyDeleteYou showed how a bronze plan could cost 17% of income for a 60 year old if no subsidies are available.

A bronze plan might have a $6250 deductible -- and the deductible would likely apply to drugs also.

So, our unsubsidized person earning $50,000 would pay $8500 in annual premiums and another $6250 in deductibles before the insurance company paid one nickel. This kind of rip off is a disgrace, and has really discredited the ACA.

There are at least two reasons why Congress has not smoothed out the cliff.

One of course is that this would make the ACA more popular and harder to overturn.

The other is that levelling the cliff costs money. Not end of the world money but not pennies either. Just to use rough numbers, let's say that 3 million persons who today get nothing start getting subsidies of $4500 each. That is $13.5 billion a year. It is peanuts in terms of overall federal health spending, but this Congress will fight hard over smaller amounts than that.

In health spending, seniors get what they need, but for others, nickels are treated like manhole covers.

I think it's about the money, for two reasons. First, lifting the 400% FPL cap would provide a lot of financial help to people above 400% FPL, cutting down their premium payments for benchmark coverage to 10% of income. Second, as subsidies go up the income scale, CBO finds that employer-sponsored coverage erodes, dumping costs into the publicly-funded system.

Delete