Long before the Cost Sharing Reduction (CSR) subsidies accessed by more than half of enrollees in the ACA marketplace became a political battleground zero, I was preoccupied with CSR as the marketplace's primary (and too limited) defense against underinsurance. In dozens of posts, I explored what leads people to accept or reject CSR, i.e. to buy or forego silver plans if they qualify for the benefit (as CSR is available only with silver plans). Among the most basic conclusions:

1. Although a large body of research suggests that health insurance shoppers often make the wrong choice when faced with relatively small tradeoffs between premium and out-of-pocket costs, a large majority of CSR-eligible marketplace enrollees make the right choice That is, they choose not to leave a large subsidy on the table, despite the fact that silver premiums can be a strain on income and bronze plans temptingly cheap. Over 80% of enrollees eligible for strong CSR -- i.e., enrollees with incomes below 201% of the Federal Poverty Level (FPL) -- choose silver plans.

2. CSR takeup declines in step with the weakening of the benefit at higher income levels, with a sharp drop at 201% FPL, where the benefit weakens almost to insignificance. Based on data released by CMS in July 2016, the chart below shows the takeup rates in the 38 states that used healthcare.gov in 2016. The rates are inflated by probably about 2 percentage points, for reasons explained in this post. The numbers attached to "Silver" under coverage level are the CSR-enhanced actuarial value of silver at each level.

CSR Takeup: HealthCare.gov states, 2016

3. As the CSR subsidy rendering high-AV coverage affordable phases out at 201% FPL, so, most likely, does satisfaction with marketplace coverage drop off at that level.

4. Where CSR is available at a discount -- that is, when the cheapest silver plan available in a given area is significantly cheaper than the benchmark -- CSR takeup is higher than where there is no such discount. Similarly, CSR takeup is higher in regions where the spread between cheapest silver and cheapest bronze is narrower. A tale of two contiguous counties in California illustrates this nicely.

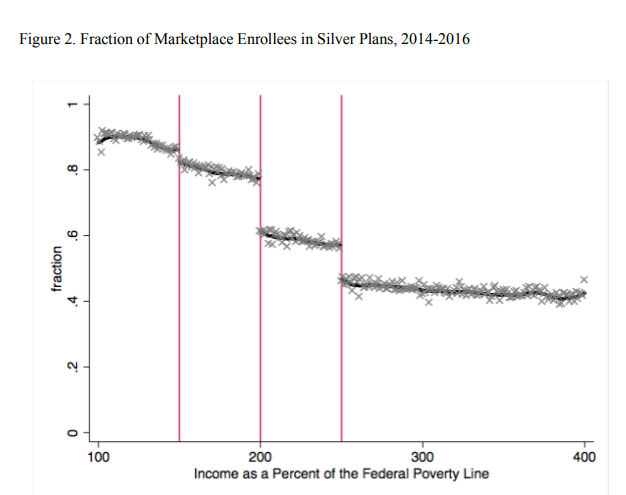

This month, a sophisticated regression analysis of enrollment data from healthcare.gov for the years 2014-2016 published in the Journal of Health Economics confirms the most basic of these conclusions: that most enrollees faced with the CSR choice chose wisely, and that CSR takeup is highly responsive to the strength of the benefit.

The study,** by Thomas DeLeire, Andre Chappel, Kenneth Finegold, and Emily Gee (of CAP fame), examined plan choices by 22 million enrollees over three years. The authors focused on differences in plan choices at each of the income points at which CSR ratchets down. CSR boosts the actuarial value of a silver plan from a baseline of 70% to 94% for those with incomes up to 150% FPL; to 87% for those in the 150-200% FPL range; and to just 73% for those from 200-250% FPL. The study compared the metal level selections of enrollees within ten percentage points of each income threshold, on either side of it. The question: to what extent did a reduction in available CSR value affect takeup (via silver selection)? The result:

CSR falls off a cliff at 201% FPL. And lo, so does silver selection (as the prior chart above also notes). That's rational. The more "free" benefit there is, the more people will stretch their budgets to get the disproportionate value attached to silver. For those with incomes up to 200% FPL, CSR makes platinum-equivalent coverage (plus or minus a bit) available for the price of silver. Most buyers figure that out, counterintuitive though it may be that silver is more valuable than higher metal levels.

The authors also note that very few CSR-eligible enrollees make the mistake of paying more for lower actuarial value by buying gold or platinum. Just 1.5% buy "dominated" plans -- a lower AV for a higher premium. That's in contrast to the choices made by enrollees faced with more subtly dominated plans, as reflected in studies of enrollees in employer sponsored plans.

The study does isolate more cleanly than my simpler parsings of enrollment data the relationship between CSR strength and metal level selection:

The authors write that their "analysis shows that consumers are highly sensitive to the value of CSRs when deciding whether to take-up CSRs" and that "the program is well designed to account for any lack of health insurance literacy among consumers of ACA Marketplace insurance."

I would add that the design could certainly be worse, but the fact that 15-plus percent of enrollees with incomes up to 200% FPL end up in bronze plans, and steadily rising percentages at higher income levels, is a problem -- as are takeup levels that diminish as income rises, which is outside the focus of this study.

--

* Well, not entirely. But I can't resist that song when it comes to mind.

** DeLeire, Thomas, Chappel, Andre, Finegold, Kenneth, Gee, Emily, Do Individuals Respond to Cost-Sharing Subsidies in their Selections of Marketplace Health Insurance Plans?. Journal of Health Economics http://dx.doi.org/10.1016/j.jhealeco.2017.09.008

1. Although a large body of research suggests that health insurance shoppers often make the wrong choice when faced with relatively small tradeoffs between premium and out-of-pocket costs, a large majority of CSR-eligible marketplace enrollees make the right choice That is, they choose not to leave a large subsidy on the table, despite the fact that silver premiums can be a strain on income and bronze plans temptingly cheap. Over 80% of enrollees eligible for strong CSR -- i.e., enrollees with incomes below 201% of the Federal Poverty Level (FPL) -- choose silver plans.

2. CSR takeup declines in step with the weakening of the benefit at higher income levels, with a sharp drop at 201% FPL, where the benefit weakens almost to insignificance. Based on data released by CMS in July 2016, the chart below shows the takeup rates in the 38 states that used healthcare.gov in 2016. The rates are inflated by probably about 2 percentage points, for reasons explained in this post. The numbers attached to "Silver" under coverage level are the CSR-enhanced actuarial value of silver at each level.

CSR Takeup: HealthCare.gov states, 2016

Income

range

|

CSR

coverage

level

|

Enrollees

in income

range

|

Enrollees

With

CSR

|

Takeup

Percent-

age

|

0-150% FPL

|

Silver94

|

3.64m

|

3.18m

|

87%

|

151-200% FPL

|

Silver87

|

2.21m

|

1.83m

|

83%

|

201-250% FPL

|

Silver 73

|

1.33m

|

866k

|

65%

|

3. As the CSR subsidy rendering high-AV coverage affordable phases out at 201% FPL, so, most likely, does satisfaction with marketplace coverage drop off at that level.

4. Where CSR is available at a discount -- that is, when the cheapest silver plan available in a given area is significantly cheaper than the benchmark -- CSR takeup is higher than where there is no such discount. Similarly, CSR takeup is higher in regions where the spread between cheapest silver and cheapest bronze is narrower. A tale of two contiguous counties in California illustrates this nicely.

This month, a sophisticated regression analysis of enrollment data from healthcare.gov for the years 2014-2016 published in the Journal of Health Economics confirms the most basic of these conclusions: that most enrollees faced with the CSR choice chose wisely, and that CSR takeup is highly responsive to the strength of the benefit.

The study,** by Thomas DeLeire, Andre Chappel, Kenneth Finegold, and Emily Gee (of CAP fame), examined plan choices by 22 million enrollees over three years. The authors focused on differences in plan choices at each of the income points at which CSR ratchets down. CSR boosts the actuarial value of a silver plan from a baseline of 70% to 94% for those with incomes up to 150% FPL; to 87% for those in the 150-200% FPL range; and to just 73% for those from 200-250% FPL. The study compared the metal level selections of enrollees within ten percentage points of each income threshold, on either side of it. The question: to what extent did a reduction in available CSR value affect takeup (via silver selection)? The result:

CSR falls off a cliff at 201% FPL. And lo, so does silver selection (as the prior chart above also notes). That's rational. The more "free" benefit there is, the more people will stretch their budgets to get the disproportionate value attached to silver. For those with incomes up to 200% FPL, CSR makes platinum-equivalent coverage (plus or minus a bit) available for the price of silver. Most buyers figure that out, counterintuitive though it may be that silver is more valuable than higher metal levels.

The authors also note that very few CSR-eligible enrollees make the mistake of paying more for lower actuarial value by buying gold or platinum. Just 1.5% buy "dominated" plans -- a lower AV for a higher premium. That's in contrast to the choices made by enrollees faced with more subtly dominated plans, as reflected in studies of enrollees in employer sponsored plans.

The study does isolate more cleanly than my simpler parsings of enrollment data the relationship between CSR strength and metal level selection:

RD design enjoys a distinct advantage over simple comparisons of enrollees by level of CSR eligibility. Since the income thresholds used to determine CSR eligibility are somewhat arbitrary and since net premiums do not vary discontinuously over these income ranges, it is reasonable to assume that enrollees with incomes just below the eligibility thresholds are very similar to those with incomes just above the eligibility thresholds.But the results are pretty much the same.

The authors write that their "analysis shows that consumers are highly sensitive to the value of CSRs when deciding whether to take-up CSRs" and that "the program is well designed to account for any lack of health insurance literacy among consumers of ACA Marketplace insurance."

I would add that the design could certainly be worse, but the fact that 15-plus percent of enrollees with incomes up to 200% FPL end up in bronze plans, and steadily rising percentages at higher income levels, is a problem -- as are takeup levels that diminish as income rises, which is outside the focus of this study.

--

* Well, not entirely. But I can't resist that song when it comes to mind.

** DeLeire, Thomas, Chappel, Andre, Finegold, Kenneth, Gee, Emily, Do Individuals Respond to Cost-Sharing Subsidies in their Selections of Marketplace Health Insurance Plans?. Journal of Health Economics http://dx.doi.org/10.1016/j.jhealeco.2017.09.008

The cost sharing reductions actually kind of enrage the people who make a little too much to receive them.

ReplyDeleteIf your income is $19,000, you might get health insurance for about $50 a month net cost, and with CSR's you have a deductible of about $250.

But if you make $24,000, not exactly Rockefeller, your health insurance costs $125 a month and your deductible is $3500.

Welcome to the terrible world of income-based benefits and stark cut-offs.

Hillary Clinton had a decent solution in one of her campaign proposals. If anybody faced out of pocket costs over 5% of their income, then a subsidy kicked in. This would have also helped persons with skimpy employer coverage.

Now this would cost a lot more than the current CSR's in the federal budget, but it would actually work.

Agreed, Bob. The ACA marketplace is under-subsidized, and the cliff is at 201% FPL. Clinton, following Urban Institute scholars Blumberg and Holahan, also proposed a cap on premiums as a percentage of income.

ReplyDelete