The growth in Medicaid enrollment stimulated by the pandemic -- and by the pause in disenrollments mandated by the Families First Act -- appears not to have slowed in October, or not appreciably.

In the 29 states for which October numbers are recorded below, enrollment is up 1.2% in September. As usual, slow growth in California will probably drag the national rate down. In fact, California's September total is also tentative, for reasons explained at bottom. Illinois' September total remains estimated.

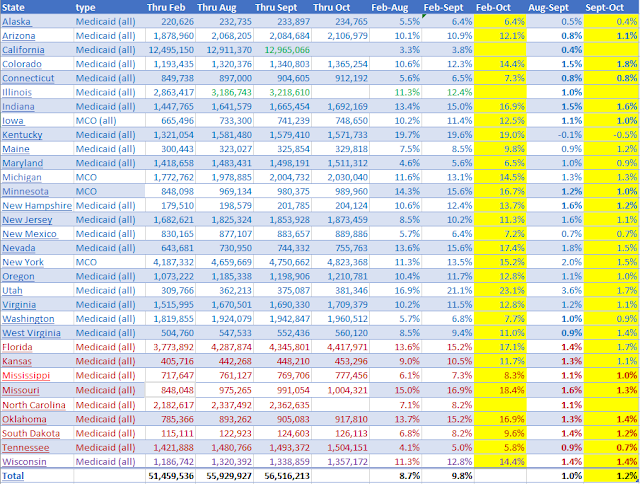

When all the October numbers are in, the 32-state sample below, based on state-published monthly reports, will probably show a 10.7% increase nationally since February. As I detailed in my last post, CMS's official tallies, now posted through July and updated through June, indicate a slightly slower growth rate -- 6.8% compared to my 7.4% tally for July. A similar gap for October would suggest 9.8% growth since February, and a national enrollment total through October of 78.2 million nationally.

Subscribe to xpostfactoid

The enrollment increase recorded in the CMS report for these 32 states from February to July is essentially the same as for all 50 states (6.8% vs. 6.9%), so this sample appears to be representative to the extent it's accurate.

Medicaid enrollment in 32 states, February-July 2020

Now about California. The state publishes and updates monthly a database of "certified eligible individuals," broken down by region and program into about 360 separate batches. Until this month, a user could get the all-state total for each month simply by adding all these separate (contiguous) reports together -- I was able to check the results against state-published totals. As of this month, however, the database includes subtotals that make simple addition of all rows impossible. There is, however, a statewide subtotal that's approximately 200,000 larger in each month than previously published and updated monthly totals. Apparently a state program (or programs) not previously figured into the totals has been added. (As California provides Medi-Cal to some enrollment groups on its own dime, its monthly tallies exceeded CMS's by about one million -- prior to the recent change in the database.)

The current September subtotal is 53,696 larger than the August subtotal, so I've added that amount to the August total for my September estimate. Previously, the September total was about 100,000 below the August total -- but that is par for the course, as each month's totals are updated in the the two months following. The state Dept. of Health Care Services explains:

Some presented eligible counts are considered preliminary and subject to change. Eligibility for Medi-Cal may occur retroactively and it may take time for eligibility determinations to be processed and reported to DHCS. As such, eligibility data is approximately 96% complete for the current month, 98% complete within one month, and over 99% complete within 2 months. Eligibility counts for a specific month are considered complete for statistical reporting purposes 12 months after the reporting month's end.

With disenrollments paused during the pandemic emergency, the monthly updates consistently increase totals. The low percentage increase reflected in my September estimate (derived from the updated September total) is in line with increases in recent months. I will be querying the CA Dept. of Health Care Services as to the apparent methodological changes that have boosted statewide totals.

As for Illinois, it is simply lagging, lagging, lagging. I've estimated September's increase at approximately the same rate as August's, but I didn't want to do that for two months running. Any error in the September total for the state would not have much impact on the 32-state total.

Update, 12/3/20: I am here replacing a section of this post that relayed a warning by an author team led by Sara Rosenbaum in Health Affairs that an interim final rule interpreting healthcare-related provisions of the CARES Act and the Families First Act, published by CMS on October 28, could force states to retroactively reassess whether Medicaid enrollees currently benefiting from the continuous enrollment protection provided by the Families First Act, jeopardizing that protection. The rule in question allows states to disenroll people whom it determines were not "validly enrolled," defined as follows:

A beneficiary is not validly enrolled, and therefore not entitled to FFCRA if the agency determines the eligibility was erroneously granted at the most recent determination, redetermination, or renewal of eligibility (if such last redetermination or renewal was completed prior to March 18 2020) because of agency error or fraud (as evidenced by a fraud conviction) or abuse (as determined following completion of an investigation. . . ) attributed to the beneficiary or the beneficiary’s representative, which was material to the determination of eligibility.

Rosenbaum et al. argue, "Under the rule, states would be obligated to review all enrollments and renewals prior to March 18, reopening all cases and reexamining them for evidence of agency “error” or fraud and abuse." But a slide presentation to state officials specifies (p.8), "Beneficiaries are generally considered to be validly enrolled," so there may in fact be no onus on states to audit prior enrollments. Perhaps, though, the updated rule creates an opportunity for states eager to cut Medicaid costs (pushed by the severe pandemic-induced revenue crunch) to seek enrollments that can be cut.

Related: State Medicaid enrollment totals in light of CMS's (lagging) reports

ACA Medicaid expansion enrollment continues to swell as pandemic surges

Let me post my frequent observation that the enrollment in expanded Medicaid comes with a financial bomb for many people, and is part of why our current ACA is still pretty bad.

ReplyDeleteIn 10-14 states, the interaction of Federal options given to states for Medicaid estate recovery, and the state-exercised option to estate recovery non-long-term-care Medicaids, including ACA expanded Medicaid, has it so that in these 10-14 states, including blue NJ, MA, and MD, all medical bills paid out for a person 55 or older

are subject to estate recovery. (The person has no insurance at all--just a loan until death for medical expenses!)

This is a pathetic second-class treatment of a group of citizens (income to 138% of FPL without asset cap) more or less presumed (often falsely) to be financially pathetic and incapable of saving at all.

It also seems to be unique to the U.S. among developed countries (e.g. Canada and the U.K. don't demand medical expenses paid back at death from the estate). Further, this second-class treatment affects African-Americans disproportionately, and prevents accumulation of modest amounts of intergenerational wealth.

For those unfamiliar, Let me direct those curious about it the Wikipedia article on Medicaid estate recovery (which I wrote). (People shouldn't trust me, nor Wikipedia alone, but can quickly check on the realness of the issue from the on-line references there.)

Also, try these:

2014 W Post Article:

https://web.archive.org/web/20170213022927/https://www.washingtonpost.com/national/health-science/little-known-aspect-of-medicaid-now-causing-people-to-avoid-coverage/2014/01/23/deda52e2-794e-11e3-8963-b4b654bcc9b2_story.html

The Atlantic in 2014:

https://www.theatlantic.com/politics/archive/2014/01/can-medicaid-really-come-after-you-house-when-you-die/357357/

Seattle Times (late 2013):

https://web.archive.org/web/20150409115216/https://www.seattletimes.com/seattle-news/expanded-medicaidrsquos-fine-print-holds-surprise-lsquopaybackrsquo-from-estate-after-death/

Which actually led, in just a few days, to Washington State fixing, as here:

https://web.archive.org/web/20131221123317/http://blogs.seattletimes.com/healthcarecheckup/2013/12/16/state-will-change-asset-recovery-policy-for-medicaid-enrollees/

MN corrected in 2017

https://web.archive.org/web/20190806154942/https://www.mlstargazette.com/story/2017/05/18/news/minnesota-ma-estate-liens-put-to-final-rest/2269.html

Also, a post here in xpostfactoid from about a year ago.

https://xpostfactoid.blogspot.com/2019/06/aca-medicaid-expansion-lien-on-me.html

--

I note that although Biden seems dead in the water on improving an ACA highly-inadequate in its current form, and 12 red states won't expand Medicaid, the estate recovery on ACA expanded Medicaid in at least the 3 or so blue states that do that--MA, NJ, MD--possibly others I haven't examined--is possible now at the state level, and does not need a Democratic Senate.