While the ACA has reduced the ranks of the U.S. uninsured by some 17 million, and currently subsidizes private health insurance plans for about 9.4 million* people, it has also raised the price of health insurance for most of those who have to buy their own insurance and don't qualify for ACA premium subsidies.

The latest Kaiser Family Foundation latest survey of enrollees in the individual market suggests that 64% of those enrollees obtained their plans in the ACA marketplace, which means that 53% of current individual market enrollees are subsidized. Borrowing Charles Gaba's estimate of 11.3 million current marketplace enrollees indicates a total individual market enrollment of 17.7 million, about 8.3 million of whom do not get premium subsidies. Some of those full-freight enrollees may be caught in the ACA's family glitch -- that is, an employer offers insurance that's deemed affordable for the employee and so disqualifies her from subsidies, even though family coverage may be far from affordable. Most, though, presumably earn too much to qualify for subsidies.

Those who buy their insurance in the individual market and get no subsidy at all are the only insured Americans whose insurance is unsubsidized, and they are a tiny minority of the insured population. 147 million people who get their insurance through an employer are subsidized via the tax exclusion for employer-sponsored health insurance. 72.4 million Medicaid enrollees and 55.5 million Medicare enrollees are subsidized, as are about 9 million VA-enrolled veterans and, again, 9.4 million ACA marketplace enrollees.

Urban Institute healthcare scholars Linda Blumberg and John Holahan have calculated that individual market enrollees with incomes modestly above the ACA subsidy cutoff, 400% of the Federal Poverty Level (FPL), pay a higher percentage of their income for health insurance and health care than any other income group -- a median of 18.1% for enrollees with incomes in 400-500% FPL. Blumberg and Holahan propose capping premiums for all enrollees in the individual market at 8.5%, a proposal adopted by Hillary Clinton. Others have also proposed subsidies for those beyond the ACA cutoff. In his ebook ObamaCare is a Great Mess, IBD reporter Jed Graham suggests a tax credit for the unsubsidized, worth 20% of the cost of the benchmark silver plan in that person's region. Harold Pollack and Timothy Jost recently cited fixed dollar tax credits as one potentially viable way to help those shut out of current ACA subsidies.

In fact, one substantial chunk of those who are shut out of marketplace subsidies do have access to a tax credit: the self-employed health insurance tax deduction, which can be claimed by any self-employed person with a positive net income. If that income exceeds the cost of insurance purchased in the individual market, the whole premium paid for insurance is deductible.

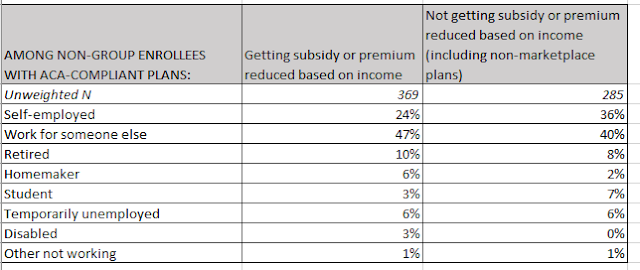

I have long wondered what percentage of individual market enrollees who don't get ACA subsidies are self-employed -- and now I have some data, albeit in a small sample, from Kaiser's 2016 survey referenced above. Liz Hamel, Kaiser's director of survey research, provided me with the following breakout:

If indeed 36% of individual market enrollees who don't get ACA credits are self-employed, approximately 3 million of them should be eligible for the self-employment health insurance deduction, the value of which varies according to income.That leaves about 5.3 million current enrollees without access to any subsidy at all. Some enrollees at any income level may also benefit from the medical expenses deduction, allowing a taxpayer to deduct medical expenses that exceed 10% of income.

One relatively simple way to help the currently unsubsidized would be to simply extend the self-employed health insurance deduction anyone who buys insurance in the individual market and does not qualify for the ACA premium tax credit. If the deduction were capped at 20% -- so that someone in, say, a 39% bracket could only deduct 20% of the cost of insurance from their tax bill -- that would help pay for the eligibility expansion, since some self-employed are presumably taking the deduction at top tax rates.

Among the uninsured, 5.6 million had incomes above 400% FPL in 2014, according to the Census Bureau's Current Population Survey. Another 3.4 million had incomes in the 300-399% range, some of whom also don't qualify for ACA subsidies -- though only if the premium for the benchmark silver plan in their area does not exceed 9.7% of income (an awfully big chunk, TBH). To hazard a guess, perhaps a quarter of the country's 28 million uninsured have incomes outside of subsidy range. Extending the health insurance deduction to those among them who are not self-employed might entice more into the market, improving the risk pool.

The Kaiser data suggests that almost half of employed unsubsidized individual market enrollees are self-employed. Since the unsubsidized total includes lower income enrollees caught in the family glitch, perhaps the percentage is somewhat higher among those who earn too much to qualify for subsidies.

The latest Kaiser Family Foundation latest survey of enrollees in the individual market suggests that 64% of those enrollees obtained their plans in the ACA marketplace, which means that 53% of current individual market enrollees are subsidized. Borrowing Charles Gaba's estimate of 11.3 million current marketplace enrollees indicates a total individual market enrollment of 17.7 million, about 8.3 million of whom do not get premium subsidies. Some of those full-freight enrollees may be caught in the ACA's family glitch -- that is, an employer offers insurance that's deemed affordable for the employee and so disqualifies her from subsidies, even though family coverage may be far from affordable. Most, though, presumably earn too much to qualify for subsidies.

Those who buy their insurance in the individual market and get no subsidy at all are the only insured Americans whose insurance is unsubsidized, and they are a tiny minority of the insured population. 147 million people who get their insurance through an employer are subsidized via the tax exclusion for employer-sponsored health insurance. 72.4 million Medicaid enrollees and 55.5 million Medicare enrollees are subsidized, as are about 9 million VA-enrolled veterans and, again, 9.4 million ACA marketplace enrollees.

Urban Institute healthcare scholars Linda Blumberg and John Holahan have calculated that individual market enrollees with incomes modestly above the ACA subsidy cutoff, 400% of the Federal Poverty Level (FPL), pay a higher percentage of their income for health insurance and health care than any other income group -- a median of 18.1% for enrollees with incomes in 400-500% FPL. Blumberg and Holahan propose capping premiums for all enrollees in the individual market at 8.5%, a proposal adopted by Hillary Clinton. Others have also proposed subsidies for those beyond the ACA cutoff. In his ebook ObamaCare is a Great Mess, IBD reporter Jed Graham suggests a tax credit for the unsubsidized, worth 20% of the cost of the benchmark silver plan in that person's region. Harold Pollack and Timothy Jost recently cited fixed dollar tax credits as one potentially viable way to help those shut out of current ACA subsidies.

In fact, one substantial chunk of those who are shut out of marketplace subsidies do have access to a tax credit: the self-employed health insurance tax deduction, which can be claimed by any self-employed person with a positive net income. If that income exceeds the cost of insurance purchased in the individual market, the whole premium paid for insurance is deductible.

I have long wondered what percentage of individual market enrollees who don't get ACA subsidies are self-employed -- and now I have some data, albeit in a small sample, from Kaiser's 2016 survey referenced above. Liz Hamel, Kaiser's director of survey research, provided me with the following breakout:

If indeed 36% of individual market enrollees who don't get ACA credits are self-employed, approximately 3 million of them should be eligible for the self-employment health insurance deduction, the value of which varies according to income.That leaves about 5.3 million current enrollees without access to any subsidy at all. Some enrollees at any income level may also benefit from the medical expenses deduction, allowing a taxpayer to deduct medical expenses that exceed 10% of income.

One relatively simple way to help the currently unsubsidized would be to simply extend the self-employed health insurance deduction anyone who buys insurance in the individual market and does not qualify for the ACA premium tax credit. If the deduction were capped at 20% -- so that someone in, say, a 39% bracket could only deduct 20% of the cost of insurance from their tax bill -- that would help pay for the eligibility expansion, since some self-employed are presumably taking the deduction at top tax rates.

Among the uninsured, 5.6 million had incomes above 400% FPL in 2014, according to the Census Bureau's Current Population Survey. Another 3.4 million had incomes in the 300-399% range, some of whom also don't qualify for ACA subsidies -- though only if the premium for the benchmark silver plan in their area does not exceed 9.7% of income (an awfully big chunk, TBH). To hazard a guess, perhaps a quarter of the country's 28 million uninsured have incomes outside of subsidy range. Extending the health insurance deduction to those among them who are not self-employed might entice more into the market, improving the risk pool.

The Kaiser data suggests that almost half of employed unsubsidized individual market enrollees are self-employed. Since the unsubsidized total includes lower income enrollees caught in the family glitch, perhaps the percentage is somewhat higher among those who earn too much to qualify for subsidies.

No comments:

Post a Comment