Note: Free xpostfactoid subscription is available on Substack alone, though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up.

|

| Downhill slope: gradual or steep? |

While the ACA marketplace’s Open Enrollment Period (OEP) for 2026 is wrapping up with a relatively modest drop of about 5% from OEP 2025, marketplace observers expect the losses to deepen as the year progresses. That’s primarily for two reasons: 1) most subsidized enrollees are facing steep premium increases because the enhanced subsidies funded through 2025 have not been extended, and 2) a June 2025 CMS rule effectively ratified in HR1, the Republican megabill enacted last July, ended year-round enrollment for low-income enrollees.

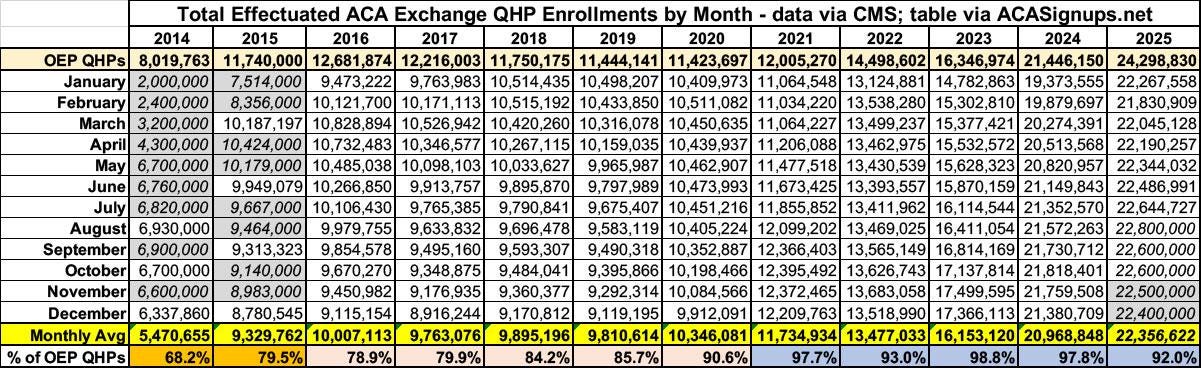

The most complete measure of enrollment in a given year is average monthly enrollment (AME), which takes into account both retention and the conditions under which people enroll when OEP is finished. The gap between enrollment* totals as of the end of OEP and AME has varied considerably over the marketplace’s 13-year existence. To scope out the likely range of enrollment losses through the full 2026 plan year, Charles Gaba has tabulated the OEP-AME gap for every plan year through 2025.

The gap shrank during the first Trump administration, both because enrollment barriers the administration threw up (shortened OEP, sharply reduced funding for enrollment assistance and marketing) weeded out less motivated enrollees, and because the advent of silver loading after Trump cut off direct CSR payments to insurers made zero-premium coverage newly available to millions, and people don’t tend to drop zero-premium coverage. The gap shrank further during the Biden years, as the enhanced premium subsidies enacted in March 2021 as part of the American Rescue Plan Act (ARPA) further expanded the availability of zero-premium (and low-premium) coverage, and as year-round enrollment for enrollees with income under 150% FPL was implemented in early 2022. (In 2025, 47% of all enrollment was at incomes below the 150% FPL threshold.) The Medicaid unwinding — that is, the resumption of Medicaid redeterminations and disenrollments in spring 2023 after a 3-year pandemic induced moratorium — reduced the OEP-AME gap to near-nothing in 2023 and 2024, as millions transitioned from Medicaid to the marketplace.

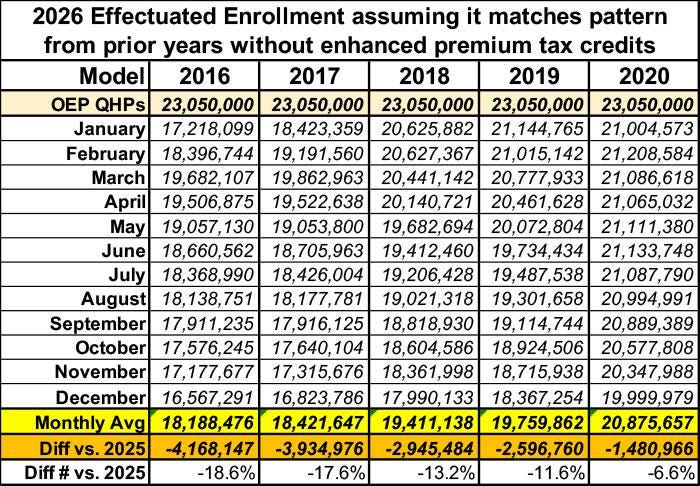

Gaba further uses the OEP/AME ratios in the pre-ARPA years to project a range of possible enrollment losses in 2026:

Of course we can’t know whether enrollment losses will be within this range. There are reasons to believe that attrition will exceed the 2016 peak (excluding 2014, when the marketplace was immature), but there are also mitigating factors. Let’s look at both sides of the equation.

Factors that may trigger major attrition

Unprecedented net-of-subsidy premium hikes. Prior to OEP 2026, marketplace premium subsidies have never lost value (or rather, never lost more than a few of tenths of a percentage point, as the “applicable percentages” of income required for a benchmark silver plan at each income level were adjusted modestly for inflation in the years prior to enactment of the enhanced subsidies, and again in 2026). By KFF’s estimate, in 2026, net-of-subsidy premiums for a benchmark silver plan rose by an average of114% for the 92% of 2025 enrollees who were subsidy-eligible.

Increased auto-reenrollment. In HealthCare.gov states, passive auto-reenrollment spiked from 30% of reenrollments in 2024 to 46% in 2025 (see public use files here). Many of those auto reenrollees may be unaware of the degree to which their premiums have spiked in 2026 (not only because of reduced subsidies, but because of annual shifts in the benchmark plan and its premium). If many of the auto-reenrollees have incomes below 150% FPL (as did more than half of enrollees in HealthCare.gov states in 2025), they will also have lost the ability to switch to a less expensive plan when they discover the premium spike. Which brings back to…

No more monthly SEPs at low incomes. In February 2022, the Biden administration implemented a monthly Special Enrollment Period (SEP) for enrollees with income up to 150% FPL, for whom the enhanced subsidies created in March 2021 had rendered benchmark silver coverage free. Year-round SEPs have given average monthly enrollment a major boost, as Gaba’s tables show (2021 enrollment was boosted by a six-month SEP for all comers in the wake of the enhanced subsidies enacted in March of that year). As noted above, the year-round SEP also enabled passive reenrollees stung by an unexpected premium hike to switch into a less expensive plan. The current Trump administration ended the monthly SEP by administrative rule, effective last August, and the HR1 megabill effectively codified the rule by making subsidies unavailable for SEPs granted on the basis of low income.

SEP verification. CMS’s Program Integrity Rule finalized in June 2025 tightened verification requirements for life changes (such as loss of employment) that trigger a SEP, requiring verification for 75% of SEPs beginning in 2026.

Factors that may mitigate attrition

Silver loading. After Trump abruptly cut off direct reimbursement of insurers for the Cost Sharing Reduction (CSR) subsidies that attach to silver plans for low-income enrollees, most states allowed or encouraged insurers to price CSR directly into silver plans only. That raised benchmark premiums and therefore subsidies and raised the premiums for silver plans relative to bronze and gold plans, as CSR makes silver plans roughly platinum-equivalent for enrollees with income up to 200% FPL (i.e., for most silver plan enrollees). Silver loading made zero-premium bronze plans available to millions more enrollees than previously, boosting not only enrollment (by perhaps 5% in 2019) but retention. Logically speaking, silver loading should have made gold plans consistently cheaper than silver plans, as CMS noted in a December 2015 memo. While that did not happen, as insurers have various incentives to underprice silver plans, over time an increasing number of states have mandated more strict silver loading - -and in some cases, most notably in Texas — required insurers to price silver plans as if they are platinum (Arkansas, Illinois and Washington did this in advance of OEP 2026). Silver loading’s impact on gold premiums is consequently more intense in 2026 than in Trump 1.0 years — when, per Gaba’s table above, those effects probably had a major role in reducing attrition. In 2018, the average lowest-cost gold premium nationally was 109% of the benchmark (second cheapest) silver premium, whereas in 2026, lowest-cost gold on average is 98% of the benchmark. Cheap gold plans will have a particularly strong effect in Texas, where $0 premium gold plans will be available to about 2.5 million enrollees with income under 150% FPL, and to many older enrollees with income near 200% FPL. Zero premium bronze plans will be available to far more enrollees than that.

Broker participation and public awareness. In the pre-ARPA era, when marketplace AME was stuck at around 10 million, the marketplace was hampered not only by subsidies that many found inadequate but also by widespread ignorance of marketplace offerings. For years, enrollment assistors told me that many people thought the program had been repealed (even in 2024), and Republican hostility to “Obamacare” remained a factor. While the first Trump administration did gut funding for nonprofit enrollment assistance, however, it also encouraged and marketed broker participation and continued the development of commercial e-broker platforms (a.k.a. enhanced direct enrollment, or EDE, platforms) that make brokers’ jobs much easier. As enrollment soared after the ARPA subsidies were implemented, so did broker participation, rising from 49,000 in 2018 to 83,000 in early 2024. While brokers’ too-easy access to enrollees’ accounts via EDE platforms sparked a plague of fraud and low-quality brokerage, broker outreach plainly reached deep into low-income areas, particularly in states that had refused to expand Medicaid, where marketplace subsidy eligibility begins at incomes of 100% FPL, as opposed to 138% FPL in expansion states (and again, CSR-enhanced silver coverage was available for free at incomes up to 150% FPL). In addition to providing sometimes-expert help, brokers have a strong motive to keep clients enrolled, and they have likely steered many clients into lower-premium plans to mitigate the impact of average net-of-subsidy premium hikes. In 2024, about 80% of enrollments in HealthCare.gov states were broker-assisted.

Habit. Coverage is tough to lose, and about 12 million more people signed up for marketplace coverage in OEP 2025 than in OEP 2020. While many may drop coverage as higher premiums bite — or as they try to use plans with $8,000 deductibles — many more will do what they can stay covered.

So there you have it. I’m not going to venture a prediction. We’ll have a better sense of what AME is likely to look like when the first effectuated enrollment snapshot, showing paid-up enrollment as of February, is published in June or July. But that snapshot will not show the coverage drop for re-enrollees who have not paid their first premium, as enrollees are generally granted a 3-month grace period. CMS is currently publishing effectuated enrollment with a three-month lag as part of its monthly snapshots of Medicaid/CHIP enrollment, so we may have a clearer picture by June or July (a half-year effectuated enrollment snapshot usually comes out in the fall). Full AME for 2026 won’t be published until mid-2027, if current practice holds. But who knows where this country — and the marketplace — will be by then.

P.S. Any measure of coverage losses in the post-ARPA era (if it lasts more than a few weeks or months) should incorporate a loss in average actuarial value, as low-income enrollees exchange high-CSR silver for bronze or even gold plans. See my post on a proposed measure: Total AV for the whole marketplace.

- - -

*Technically, “plan selections” tallied as of the end of OEP are not “enrollments,” as some will never be effectuated.

No comments:

Post a Comment