Attention xpostfactoid readers: All subscriptions are now through Substack alone (still free). I will continue to cross-post on this site, but I've cancelled the follow.it feed (it is an excellent free service, but Substack pulls in new subscribers). If you're not subscribed, please visit xpostfactoid on Substack and sign up!

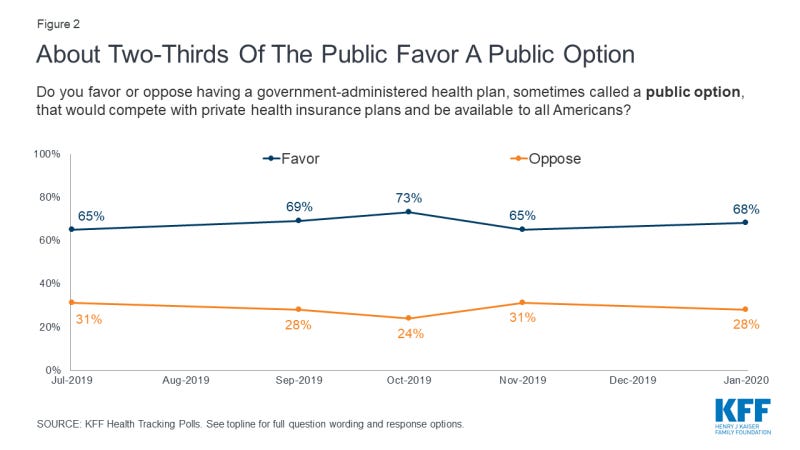

In polling about U.S. healthcare, the prospect of a “public option” for health insurance, open to all Americans regardless of whether they have access to employer-sponsored insurance, generally scores high. Here is the top-line response to a Kaiser Family Foundation tracking poll conducted in January 2020:

Looking beneath the hood of that apparent relative consensus, a research team led by Adrianna McIntyre of Harvard’s Chan School of Public Health conducted a poll in November/December 2020 that probed attitudes toward government that underlie responses to health reforms including a public option — specifically, a Medicare buy-in for people under age 65. The researchers published an analysis* in Milbank Quarterly this month. While top-line results were similar to KFF’s, the researchers note:

An overwhelming majority of Democrats (86%) report believing that it is the government’s responsibility to ensure universal health insurance coverage; only 11% of Republicans hold the same view. Most Democrats (71%) also report that they would prefer a health insurance system run mostly by the government, while a similar share of Republicans (78%) would prefer a system based mostly on private health insurance. Two-thirds of Democrats (67%) believe the federal government should be more involved in health care in the future, but over half of their Republican counterparts (56%) believe it should be less involved. Prior work has also found that while a large majority of Democrats (65%) believe the government would do a better job than private health insurance plans at reducing the nation’s health care costs, significantly fewer Republicans (25%) hold that view.