Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up.

|

| ARPA subsidy boosts going, going... |

I’d like here to highlight some factors that will affect how much ACA marketplace enrollment is likely to shrink if Republicans decline to extend the increases to ACA marketplace premium subsidies and eligibility first enacted by the American Rescue Plan Act (ARPA) in March 2021, and later extended through 2025 by the Inflation Reduction Act. I’ll assume no other major changes to the ACA (perhaps a dubious assumption).

The ARPA subsidy boosts made benchmark silver plan coverage free for enrollees with income up to 150% of the Federal Poverty Level (FPL), removed the ACA’s notorious income cap on subsidy eligibility (400% FPL), reduced the percentage of income required for a benchmark silver plan at all income levels between 150-400% FPL, and capped benchmark silver premiums at 8.5% of income for those with income above 400% FPL.

Since the Open Enrollment Period (OEP) for 2021, the last OEP before the ARPA subsidies took effect, ACA marketplace enrollment increased by 79% (9.4 million) through OEP 2024 (see Table 1 below). That enrollment growth was overwhelmingly concentrated at the 100-150% FPL income bracket, where silver coverage with strong Cost Sharing Reduction (CSR) is available for $0 premium, and in the ten states that have refused to date to enact the ACA Medicaid expansion. In those “nonexpansion” states, eligibility for marketplace subsidies begins at 100% FPL, whereas in the expansion states it begins at 138% FPL, the Medicaid eligibility threshold for almost all lawfully present adults.

The Urban Institute estimates that in 2025, the total number of people with subsidized marketplace enrollment (92% of total enrollment) will be 7.2 million higher than it would be without without the ARPA subsidy boosts. One might assume a similar drop in enrollment in years following 2025 if the ARPA enhancements expire. Urban further estimates, “In 2025…household net premiums will be lower by 50 to 100 percent for the lowest income groups under a policy of enhanced PTCs compared with a policy of original PTCs. Net premiums will be lower by about one-quarter for people with higher incomes who receive subsidized Marketplace coverage.” Reverse that for the effects of ARPA expiration.

Without venturing an overall estimate, I want to highlight the concentration of marketplace enrollment (and post-ARPA enrollment growth) at low incomes and the extent to which zero-premium coverage will still be available to low-income enrollees (albeit with lower actuarial value). I assume that Urban’s estimates of premium impact are for benchmark silver premiums, not premiums for plans actually selected, which will change if the ARPA enhancements expire.

Consider the following as to the makeup of current marketplace enrollment:

From OEP 2021 to OEP 2024, enrollment nationwide increased by 79%, from 12.0 million to 21.4 million.

59% of that growth was in the 100-150% FPL income bracket, where benchmark silver coverage was rendered free by ARPA (see Table 1 below).

In 2024, 73% of enrollment in the 100-150% FPL income bracket was in the 10 nonexpansion states (78% if you count North Carolina, which enacted a Medicaid expansion on 12/1/23*). In 2024, 6.9 million enrollees in nonexpansion states (excluding NC) had income in the 100-150% FPL range.

In OEP 2021, enrollment was flat nationwide except for in the nonexpansion states, where it increased 10%. Since OEP 2020, enrollment growth in nonexpansion states has accounted for 74% of enrollment growth nationwide.

Before ARPA passed, the ACA’s income cap on subsidy eligibility was politically fraught, as the ACA’s guaranteed issue and Essential Health Benefits requirements raised premiums, and, after steep premium hikes in 2017 and 2018 ,several million subsidy-ineligible people were priced out of the market. Removing the income cap on subsidies went a long way toward fulfilling the ACA’s promise of “affordable care.” For all that, in 2024, enrollment of those who reported income higher than 400% FPL (i.e., expected premium subsidies) was 1.5 million, about 7% of total on-exchange enrollment. Another 856,000 enrollees did not report income and so paid full price (Table 1).

Keeping in mind the heavy concentration of ACA enrollment at low incomes, various factors will preserve some availability of zero-premium coverage for most enrollees with income up to 150% FPL, and often well beyond, or foster enrollment in other ways. These include:

Silver loading, Part I. In October 2017, Trump cut off federal reimbursement of insurers for providing the Cost Sharing Reduction (CSR) subsidies mandated by the ACA to low-income enrollees in silver plan. (His basis: while the ACA mandated this reimbursement, it left funding those reimbursements up to Congress, and Republican Congresses declined to do so. The Obama administration had found reimbursement funds in couch cushions.) CSR increases the value of a silver plan to a roughly platinum level for enrollees with income up to 200% FPL. The move had been anticipated, and most state regulators responded by allowing or encouraging insurers to price CSR directly into silver plans, since CSR is available only with silver plans. Since ACA income-adjusted premium subsidies are set to a silver benchmark, this “silver loading” led to sharp reductions in net-of-subsidy premiums for bronze and gold plans (and less often, for the one silver plan priced below the benchmark in each market). As a result, the Kaiser Family Foundation (KFF) calculated that beginning in 2018, most enrollees with income up to 150% FPL, and a good number with higher incomes, had access to $0 premium bronze plans.

Silver loading, Part II. As direct CSR reimbursement had been contested from the start, prior to Trump’s cutoff, analysts at CMS, the Urban Institute, and CBO had anticipated the effects of pricing CSR into silver premiums. All three analyses anticipated that gold plans would be priced below silver plans, because most silver plan enrollees have incomes qualifying for strong CSR, and silver plan enrollees on average therefore obtain higher actuarial value than gold plan enrollees. It mostly didn’t shake out that way, as insurers have strong incentives to underprice silver plans. In about fifteen states, however, varying by year, gold plans are available at premiums below benchmark silver, sometimes by regulatory or statutory requirement, and sometimes by insurer choice (usually of a dominant insurer). Most notably — and astonishingly — Texas enacted a law requiring marketplace insurers to price gold plans far below silver. (That makes sense, since 75% of enrollees in Texas have income below 200% FPL, and the average actuarial value of a silver plan in the state is over 90%, compared to 80% for gold plans.) Accordingly, Texas’s 2.2 million enrollees with income under 150% FPL will have access to $0 premium gold plans if the ARPA subsidy boosts expire, barring other changes.

Zero-deductible bronze plans. While median bronze plan deductibles were $7,200 for a single enrollee in 2023, bronze plans with $0 medical deductibles have become an increasingly common marketplace option. At low incomes, the premium is often $0 as well. These plans have their coverage traps, like a $3,000 drug deductible (usually not applicable to generics) or a $1,500 first-day hospital inpatient copay, but they can be attractive to healthy enrollees, or those willing to trade risk and out-of-pocket cost for a more expansive provider network and doctor visits not subject to the deductible.

Agent/broker commitment. The first Trump administration cut ACA marketplace advertising and nonprofit enrollment assistance, but they did cater to and encourage participation from agents and brokers — implementing a “help on demand” feature on HealthCare.gov, and encouraging development of commercial “enhanced direct enrollment” (EDE) platforms that streamline brokers’ work and organize their client files. Thanks in part to that support, along with the ARPA subsidy boosts and insurers’ re-commitment to the marketplace, broker registration with HealthCare.gov increased from 49,000 in 2018 to 83,000 in 2024. In OEP 2024, 78% of active enrollments in HealthCare.gov states (which includes all the nonexpansion states) were broker-assisted. This growing broker engagement has been something of a mixed bag, as the widespread availability of free coverage, coupled with inadequately controlled broker access to client data in EDE platforms, has led to a major outbreak of broker fraud and encouraged entry into the market of high-volume, high-speed call centers that likely provide poor service short of outright fraud. Broker participation will probably also be pared back as offerings become less affordable (assuming ARPA subsidy expiration) — e.g., if insurers also pull back and/or reduce broker commissions. But pre-ARPA, one of the marketplace’s chief limitations was the general public’s ignorance of what was on offer. Several years of broker outreach have probably increased awareness and the likelihood of being approached among those who may need coverage.

Year-round enrollment at low incomes. In early 2022, CMS implemented a rule enabling people with income under 150% FPL to enroll year-round, via permanent availability of a monthly “Special Enrollment Period.” The model here was Medicaid; the presumption is that circumstances change often for low-income people. As a result, the gap between marketplace enrollment totals as of the end of OEP and annual “average monthly enrollment” (AME) has narrowed considerably, and AME has grown even more dramatically than end-of-OEP totals (AME was 99% of OEP enrollment in 2023 and may have actually exceeded it in 2024, when the Medicaid unwinding sent a stream of newly uninsured people into the marketplace). This too has been something of a mixed bag, as the monthly SEP has facilitated broker fraud in the form of unauthorized plan-switching of enrollees. Year-round first-time enrollment could be maintained without providing a monthly SEP. More likely, the Trump administration will rescind the rule. (Originally, the rule was contingent on $0 premium silver coverage remaining available at incomes up to 150% FPL, but that condition was later withdrawn.)

A preview of low-income options in a post-ARPA marketplace

Pre-ARPA, enrollees with income up to 138% FPL paid 2% of income for a benchmark silver plan. We can preview what options may look like in this lowest income bracket by looking at what’s available to someone paying 2% of income for benchmark silver in the 2025 marketplace — that is, a single enrollee with an income of $30,000. That’s a shade under 200% FPL, and at that income, benchmark silver is currently $49/month.

Let’s look at what’s available for a single 40 year-old at this income in Houston and Miami. (You can replicate these results or look at other markets most easily via HealthSherpa’s plan shopper.) In Florida and Texas combined, as of the end of OEP 2024, 4.1 million enrollees had income in the 100-138% FPL range — about 60% of the 6.9 million enrollees in that income range nationwide.

In Houston in 2025 (zip code 77005), a single 40 year-old earning $30,000 would pay (as noted above) $49/month (1.94% of income) for the benchmark silver plan, which has a $500 deductible and a $3,000 out-of-pocket (OOP) maximum. That’s what enrollees with income up to 138% FPL will pay for benchmark silver if the ARPA subsidy boosts expire and there are no further changes. That premium could be prohibitive at a lower income (100% FPL in this year’s marketplace is slightly over $15,000/year). But in 2025, this same Houstonian also has access to two gold plans for $0 premium, as well as to a bronze plan with a $0 deductible for $15/month (and to the one silver plan below benchmark for $38/month). Both of the $0 premium gold plans are from Blue Cross, a desired brand in Texas, whereas the lowest-cost silver BCBS plan available to this person is $61/month.

Switch the scene to Miami (zip code 33134), and the 40-year old with the $30k income, paying 1.94% of income for the benchmark silver plan, does not have cheap gold available, nor any premium difference between the benchmark and lowest-cost silver (both $49/month). But this Miamian does have access to two $0 deductible bronze plans for $5 or $6/month — not to mention a ridiculous eleven zero-premium bronze plans with high deductibles.

The zero-deductible bronze plans both have OOP maxes of $9,200, whereas the two cheapest silver plans for enrollees with income under 150% FPL in Miami this year have OOP maxes of $1,800 and $2,000 respectively. Forgoing CSR vastly expands financial risk. Nonetheless, in two of the largest ACA markets for people with income that would put them in Medicaid in expansion states, no-premium or ultra low-premium options would be available if they had to pay 2% of income.

Zero premium, but more risk

Expiration of the ARPA subsidy enhancements will exacerbate a negative long-term trend in marketplace coverage: reduced silver plan selection by enrollees with income low enough to qualify for strong CSR, which raises the actuarial value of a silver plan to 94% (at income up to 150% FPL) or 87% (at income from 150-200% FPL). That compares to 60-65% AV for enhanced bronze (the commonest bronze type now) or 80% for gold. Perhaps most damagingly, those who forgo strong CSR give up an OOP max that’s capped at $3,000, and averaged just $1,388 in 2024 at incomes up to 150% FPL), in favor of bronze and gold OOP maxes that usually top $7,000 and are often set at the maximum allowable $9,200.

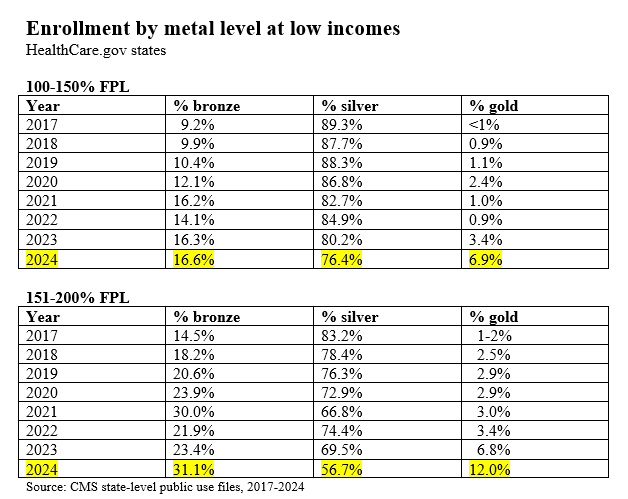

At incomes up to 150% FPL, silver plan selection has dropped from 89% in 2017 to 76% in 2024 (see Table 2 below). At 150-200% FPL, silver selection has plummeted from 83% in 2017 to 57% in 2024. Competition among marketplace insurers to offer lowest-cost coverage has narrowed provider networks over time, and some enrollees may be forgoing CSR to access a lower level of coverage from an insurer with a more robust network. I look at such tradeoffs in specific markets here.

ARPA subsidy expiration will be a major blow to coverage availability for those who lack access to other affordable options. It will probably be combined with other blows: it may be coupled with a major Trump 2.0 effort to stand up and promote an alternative market of medically underwritten, lightly regulated plans, and/or, most damagingly, with major assaults on Medicaid eligibility and funding. “This won’t be the worst harm you suffer” is pretty cold comfort when staring down the barrel of an ignorant, cruel, corrupt government in formation. But the ACA marketplace proved resilient during the Trump 1.0 regime, and it may prove resilient once again.

Table 1: ACA Marketplace Enrollment Growth by Income, 2021-2024

Table 2: Silver Plan Selection at Incomes up to 200% FPL

CMS’s marketplace enrollment Public Use Files are available here.

Photo by cottonbro studio