Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up.

|

| The Trump administration stretched the clock for short-term, limited duration health plans |

This post is Part 2 of an assessment of Trump administration policy with respect to the ACA, most specifically the ACA marketplace. Part 1 overviewed the administration’s early encouragement of state reinsurance programs, Trump’s cutoff of direct reimbursement of insurers for Cost Sharing Reduction subsidies, and the defunding of the Navigator enrollment assister program, paired with considerable support for health insurance brokers.

Below, we’ll look at the effective repeal of the individual mandate penalty (the one legislative initiative considered), and regulations designed to boost an alternative market of ACA-noncompliant plans.

As each part keeps ballooning as I write it, we’ll leave other administrative changes, loosening requirements on insurers and tightening them on prospective enrollees, to a Part 3.

Zeroing out the individual mandate penalty. After the Republican Senate in the summer of 2017 declined to take up the ACA “repeal and replace” bill passed by the House and then failed to pass its own repeal/replace alternative, John McCain famously scotched a final attempt to pass a “skinny” repeal bill that would have simply repealed the individual mandate and brought the Senate into conference with the House, perhaps to make one more run at a more comprehensive repeal/replace alternative. Following those failures, Republicans reduced the mandate penalty to zero in their massive tax cut bill passed in December 2017.

As an expression of intent to dismantle the ACA, the zero-penalty mandate’s chief function was to enable Republicans’ final attempt to void the ACA through the courts. In February 2018, a group of 20 states, led by Texas, sued to have the mandate declared unconstitutional, and the entire ACA statute voided. The suit sought ACA nullification on the ridiculous grounds that a) the 2012 Supreme Court decision upholding the constitutionality of the mandate did so only on the basis that the mandate is a tax, and within Congress’s taxing power; b) a zeroed-out mandate is no longer a tax; and c) since the Democratic Congress passed a resolution in 2010 declaring that the mandate was an “essential part” of the ACA’s overall “regulation of economic activity,” the whole law (including myriad parts unconnected with the ACA marketplace) had to be vacated. In June 2021 a 7-2 Supreme Court majority dismissed the suit, finding that the plaintiffs did not have standing because no one was harmed by a $0 penalty. The litigation did enable the Trump administration, 20 Republican attorneys general, and 126 House Republicans who signed an amicus brief in support of the plaintiffs to display root-and-branch opposition to the ACA for another three years after the legislative repeal drive failed.

Negation of the mandate was expected to drive healthier enrollees out of the market, raising premiums and thus further reducing enrollment. In 2019, CBO forecast (p. 11) that the $0 mandate penalty would increase the uninsured population by 7 million, or a bit more than 2%, and reduce marketplace enrollment by 4 million.

The eliminated penalty did doubtless induce some people to forego health coverage. But after the first zero-penalty year, the zeroed-out penalty collided first with the pandemic and ensuing massive (short-term) job losses, which stimulated off-season enrollment in Medicaid and the marketplace in 2020, and then the moratorium on Medicaid disenrollments (via the Families First and Coronavirus Response Act) and the enhanced marketplace premium subsidies enacted as part of the American Rescue Plan Act (ARPA) in March 2020 — as well as a sharply rebounding economy that swiftly erased the job losses of spring 2020. As a result, Medicaid enrollment increased by more than 20 million from March 2020 to March 2023 (an effect now unwinding swiftly if not quite completely) and marketplace enrollment almost doubled from 2020 to 2024, increasing by 10 million. The national uninsured rate reached an all-time low of 7.7% in early 2023.

To some extent, market response to the ARPA subsidy boosts bears out Obama’s anti-mandate stance during the 2008 presidential campaign: “the problem,” he said in one debate, “is not that folks are trying to avoid getting health care. The problem is they can't afford it. And that's why my plan emphasizes lowering costs."

Whatever its effect on the uninsured rate and marketplace enrollment and premiums, the mandate’s negation drained much of the poison from Republicans’ dead-end opposition to the ACA (the doomed lawsuit notwithstanding). Trump effectively made that argument in his 2018 State of the Union Address, asserting, “We repealed the core of disastrous Obamacare — the individual mandate is now gone.”

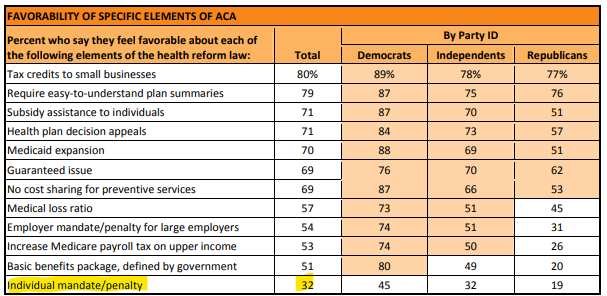

Declare victory and get out. On the political front, however — regardless of the policy fallout — mandate negation was a major boost to acceptance of the ACA by the public. Obama himself ran against forcing people to buy private insurance in 2007/8 before embracing a mandate in 2009; it had been a major Republican attack point since it first appeared in the legislation that became the ACA; and it was consistently the least approved feature of the law. Results in a 2012 KFF survey are typical:

As evidence of the extent to which Republican hostility to the ACA marketplace has moderated in at least some quarters, see my account of how a bill mandating strict “premium alignment” (pricing gold plans well below silver) won support — and a unanimous vote in favor — in the Texas legislature in 2022. The bill was co-sponsored by arch-conservative rep. Tom Oliverson, a physician and chair of the Texas House Insurance Committee. Oliverson acknowledged that it was a worthy goal to “make the marketplace work as well as it can” and told me, “I think we’re all strongly opposed to single-payer, see it as a dead-end street. We need a competitive, robust marketplace and want those options to be as attractive and competitive as it can be.”

Setting up a parallel market. The Trump administration also strove to undermine the ACA’s establishment of a nationwide individual market for comprehensive health insurance providing guaranteed issue (premiums varying only by age and location, not by individual medical history) and standardized Essential Health Benefits, with annual out-of-pocket maximums and no annual or lifetime caps on coverage. By administrative rule in 2018, HHS, DOL and Treasury stood up a parallel market of lightly-regulated, medically underwritten plans that did not offer a full suite of EHBs (with drug and substance abuse coverage generally lacking, and pregnancy never covered) and that often exposed (and still expose) enrollees to extensive balance billing. They did this by extending the allowable term of existing, lightly regulated Short Term, Limited Duration (STLD) plans to a full year, renewable up to three years.

This parallel market stimulated a rash of unscrupulous brokers and online “lead generators” to steer insurance seekers away from the ACA-compliant market. As Dylan Scott of Vox pointed out in 2020 (citing RWJF research), almost any online search for health insurance would lead the seeker primarily to the lead generators. (This does not seem to be the case at present, at least on my browser; CMS, state regulators, and Google and other search engines have played whack-a-mole with the lead generators for years.) As insurers pulled away from the ACA marketplace in 2017-18, broker commissions for ACA-compliant plans, never generous, shrank, and commissions for STLD plans are far more lucrative. (That’s because STLD plans are more lucrative for insurers, as they are not constrained by the ACA’s minimum MLR requirements and sometimes spend little more than half of premiums on claims.)

The administration also loosened the rules under which various entities could form association health plans that qualified as large group plans (i.e. less tightly regulated, and exempt from most state oversight and regulation). AHPs had proved a rich breeding ground for fraud in past decades. In March 2019 a federal district court in D.C. struck down the Trump administration rule. The administration appealed; the Biden administration requested a stay while it revealed the rule; and in December 2023 the Dept. of Labor proposed to rescind the Trump-era rule.

Negation of the individual mandate was a lynchpin of this parallel market, as choosing an ACA-noncompliant plan would no longer result in a tax penalty for failing to maintain “minimum essential coverage.”

To further stimulate the parallel market, CMS administrator Seema Verma proposed loosening the requirements for state “innovation waiver” proposals authorized under ACA Section 1332 and issued a set of “waiver concepts” inviting states to propose schemes that would enable ACA-noncompliant plans to access federal premium subsidies. Georgia was the only state to partially accept the invitation, filing a waiver proposal in late 2020 that, along with establishing a reinsurance program, would eliminate a centralized state-sponsored exchange, establish a “copper” plan level with an actuarial value below the minimum required by the ACA statute, and, in one early iteration, allow plans that did not include all EHBs (that provision was cut from the submitted waiver). While the Trump administration approved the waiver in November 2020, the Biden administration suspended approval of all but the reinsurance program, pending redesign. Georgia is now seeking to open a convention state-base marketplace, albeit the first to enable Enhanced Direct Enrollment on commercial sites (see the previous post for a discussion of EDE).

Taking the short term and limited duration out of Short Term Limited Duration insurance was a bad solution to a real problem. The Affordable Care Act promised to make adequate, affordable insurance available to all, via public program or private insurance, but under-subsidization meant that the program fell far short of that promise. Most acutely, the income cap on subsidy eligibility ensured that minimum essential coverage was unaffordable to several million people (as the ACA’s guaranteed issue and EHB requirements had raised the price of coverage). In the most extreme case, a pair of 64 year-olds in Nebraska with an income of $67,000 — just over the 400% FPL threshold n 2018— would have to pay an average of $2,667 per month for the lowest-cost bronze plan available. That year, the average bronze plan single-person deductible was $6,002. More broadly, in August 2015 Urban Institute scholars Linda Blumberg and John Holahan calculated, in a proposal for ACA reform, that marketplace enrollees in the 400-500% FPL range would pay 18% of income for marketplace premiums and out-of-pocket costs at the median and 25% of income at the 90th percentile.*

Takeup of STLD plans appears to have been far more limited than some market watchers feared or CBO predicted in the wake of the Trump rule. That’s in part because more than half of states either limit STLD terms on their own (as the Trump administration rule permitted) or ban them altogether. A recent Commonwealth Fund analysis concluded:

A modest number of people — no more than one-fifth of the 1.5 million the CBO projected — are likely to have enrolled in STLDI plans that became available after the Trump administration’s regulatory change. This enrollment mainly appears to have displaced marketplace coverage. There is no evidence that the broader availability of STLDI plans had any meaningful effect on nongroup coverage in general or on uninsurance.

The expanded STLD plan market at least potentially degraded ACA marketplace risk pools and left some people with illusory insurance that failed them when they needed it, as several news accounts related.

That said, the extended-term STLD market provided at least some protection to some subsidy-ineligible people who were priced out of the ACA marketplace. (In late 2019, my son plugged a coverage hole of several months with an STLD plan from UHC that had a maximum out-of-pocket cap and a decent provider network.)

Stay tuned next week for an overview of Trump administration regulations affecting marketplace plan design and enrollment procedures.

- - -

*Blumberg and Holahan accordingly proposed subsidy enhancements that seemed like a progressive impossible dream at the time, but in 2021 the American Rescue Plan Act, under cover of pandemic emergency, boosted premium subsidies even further, albeit on a temporary basis, extended by the Inflation Reduction Act through 2025. ARPA did not boost the benchmark to gold as Blumberg and Holahan proposed, however — perhaps because Trump’s CSR cutoff and the ensuing silver loading at least potentially sets gold premiums below benchmark, as outlined in Part 1.)

No comments:

Post a Comment