Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up!

|

| A rickety but serviceable connector |

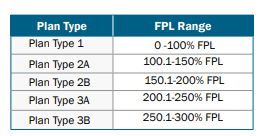

In a two-year pilot program beginning in 2024, Massachusetts has extended eligibility for ConnectorCare, the state’s alternative to a standard ACA marketplace that features standardized plans with low out-of-pocket costs, to applicants with incomes up to 500% of the Federal Poverty Level (FPL), or $72,900 for an individual in 2024. Since the ACA marketplace’s 2014 inception, ConnectorCare has been the (only) option for applicants with income ranging from 138% FPL, the Medicaid eligibility threshold, to 300% FPL. The extension means that almost all subsidy-eligible marketplace enrollees will get a standardized ConnectorCare plan, at least through 2025.

All insurers who offer plans in Massachusetts’ regular ACA exchange (available through this year to enrollees with income over 300% FPL) will be required for the first time to offer ConnectorCare plans in 2024. Importantly, since ConnectorCare plans are in a single risk pool with the insurer’s offerings in the higher income marketplace, extending eligibility to 500% FPL should not cannibalize the Health Connector market plans offered to enrollees with income above that threshold. That is, the extension should not drive up premiums for those who get no subsidy or minimal subsidy.

The Massachusetts legislature included such an extension in its budget passed in August 2022, but Republican Governor Charlie Baker vetoed it. Last month, Democratic Governor Maura Healy, inaugurated this past January, signed the eligibility extension into law.

In a pair of posts published last November, I described the current ConnectorCare program, its history and financing, and the proposed extension, and the case for extending eligibility to 500% FPL as made by Alex Sheff, policy director at nonprofit Health Care For All Massachusetts, a prime mover of the proposal. In brief: Massachusetts is a relatively wealthy state; nearly half of marketplace enrollees have incomes over 300% FPL; research shows that middle-income insured state residents have trouble paying healthcare costs; underinsurance is a bigger problem than lack of insurance, as 97.5% of state residents are insured; and the 300% FPL ConnectorCare eligibility threshold created a sharp “benefit cliff,” as out-of-pocket costs are radically lower in ConnectorCare than in regular marketplace plans. In ConnectorCare, the actuarial value of the standardized plans ranges from 99.6% to 92% (descending as income rises), whereas most enrollees in the upper-income marketplace obtain silver or bronze plans with AV of 60-70%.

ConnectorCare: Low out-of-pocket costs and standard plans to 500% FPL

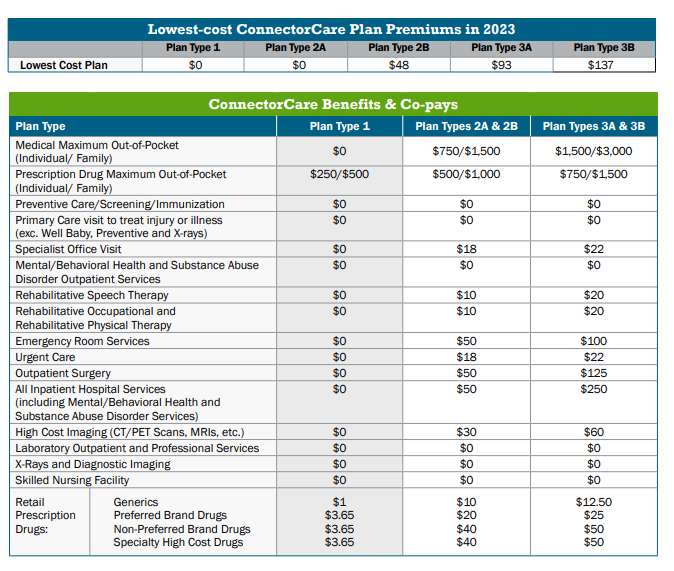

Below is the benefit structure for ConnectorCare plans at different income levels in 2023. It will be unchanged in 2024, according to Jason Lefferts, chief of communications for the Massachusetts Health Connector, and the type 3 benefits listed in the far right column will be offered to enrollees in the 300-500% FPL range. According to Marissa Woltmann, chief of policy for the Connector, the lowest-cost plan will cost $219 per month for a single enrollee with an income in the 300-400% FPL range, and $255 per month for those with income in the 400-500% range.

For an enrollee with an income just over 300% FPL, the chief advantage of the ConnectorCare expansion is relief in out-of-pocket costs. In 2023, in Jamaica Plain, a Boston neighborhood, the lowest-cost silver plan for a 43 year-old single enrollee (roughly median age for the ACA marketplace) with an income just over 300% FPL in 2023 ($40,800) would cost $197 per month, and the lowest-cost bronze plan would be available for $131/month. Using the FPL scale that will be in place for 2024, raising the just-over-300% FPL income to $42,750, the enrollee would pay $220 for lowest-cost silver (virtually identical to what she’ll pay for the lowest-cost ConnectorCare plan) or $154/month for bronze. The silver plan would have a deductible of $2,000 and the bronze plan, $2,850 — compared to zero deductible in ConnectorCare. (The current lowest-cost silver and bronze plans quoted above are standardized models, as are most but not all plans offered in the Health Connector.)

Even more dramatic is the difference in maximum out-of-cost exposure. In Massachusetts’ standardized “high bronze” and silver plans alike in 2023, the single-person out-of-pocket maximum is $9,100. In ConnectorCare, the combined medical/drug OOP max for the 300-500% FPL bracket will be $2,225 in 2024. An emergency room visit will cost $100 in ConnectorCare, compared to $350 after the deductible in the current lowest-cost silver plan ($2000 deductible) and $400 after the deductible in the lowest-cost non-HSA bronze plan ($2,850 deductible).

Tradeoffs

It is conceivable that some enrollees with income just over the 300% FPL threshold would prefer paying about $65/month less for a bronze plan. “There are some tradeoffs with regard to premium versus cost-sharing — if you think about bronze deductibles and how many services are subject to that deductible,” Woltmann told me. “We’re still in process of determining eligibilities for 2024 and looking at where people are today to understand what those member impacts might be - -some people will see premiums come down, some people might see something slightly higher.”

At the upper end of the expanded eligibility scale, premiums are likely to be considerably lower in ConnectorCare than they would have been in the Health Connector (the conventional ACA marketplace). A 43 year old in Jamaica Plain earning $72,800 this year — just under 500% FPL in the 2024 marketplace — would pay $417/month this year for lowest-cost silver and $351/month for lowest-cost bronze, compared to $255/month in 2024 for the lowest-cost ConnectorCare plan. (Historically, premiums for ConnectorCare plans other than the lowest-cost plan have varied only minimally, with the exception of one broad-network carrier. With all state marketplace insurers required to offer ConnectorCare plans in 2024, perhaps that will change.) In fact, a person earning just under 500% FPL will pay a smaller percentage of income for the lowest-cost ConnectorCare plan, 4.2%, than a person earning just over 300% FPL, who will pay 6%. At just over 400% FPL, the required percentage is 5.2%.

Easing the Medicaid Unwinding

Since implementing its health reform plan — the ACA’s precursor — in 2006, Massachusetts has had the lowest uninsured rate in the nation — 2.5% uninsured in 2021, compared to 8.6% for the country as a whole. Thanks to Medicaid expansion and ConnectorCare, zero-cost high-AV coverage is available for free at incomes up to 200% FPL, while zero-deductible low-cost coverage has been available to 300% FPL. In the pandemic, however, total marketplace enrollment in Massachusetts has declined — mainly, according to Woltmann, because the 3-year pause in Medicaid disenrollments implemented as a pandemic emergency measure in March 2020 froze the usual churn between MassHealth, the state Medicaid program, and ConnectorCare.

ConnectorCare enrollment declined from 207,000 in January 2020 to 148,000 in January 2022 and 122,000 in January 2023. Since the Medicaid “unwinding” — the resumption of eligibility redeterminations — kicked off in May of this year, however, Woltmann pointed out, ConnectorCare enrollment has rebounded 143,000, with net new enrollment accelerating in July and August. The ConnectorCare expansion may help broaden and deepen that rebound in 2024 as Medicaid redeterminations continue. Alex Sheff of HCFA told me last November that HCFA’s experience with phone enrollment assistance indicates that many people who were “frozen” in Medicaid enrollment during the pandemic likely have income in the 300-500% FPL range in high-income Massachusetts.

Freedom from “choice”

One of the less tangible benefits of offering all but the most affluent enrollees in a state individual market the standardized ConnectorCare plans is freeing enrollees from the proliferation of meaningless and bewildering choice that plagues most state ACA marketplaces. ACA marketplace enrollees in 2023 are confronted with an average of 114 plans to choose from, with some insurers flooding the zone with more than a dozen plans in one metal level, many with only minimal differences in benefits. ConnectorCare plans have uniform benefits — and the out-of-pockets costs are uniformly low. The country would be better off if the entire market nationally were remade in ConnectorCare’s image.

No comments:

Post a Comment