Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up!

|

| Gold skies, but almost no gold Obamacare, in New Jersey |

On May 22, New Jersey state Senator Joseph Vitale, chair of the Health, Human Services, and Seniors Committee, introduced a bill (S3896) that mandates “premium alignment” — a.k.a. strict silver loading — in the state’s individual and small group health insurance markets. That is, insurers would be required to comply with the letter of the ACA statute that requires them to price plans at different metal levels in strict proportion to the actuarial value of each metal level. (Actuarial value refers to the percentage of the average enrollee’s costs the plan is designed to pay for, according to a formula promulgated by CMS.)

In effect, mandating that strict proportionality means pricing gold plans below silver plans with the same network (or, in New Jersey in the first year after enactment, roughly at par with silver plans, as explained below). That’s been the case since 2018, the first plan year after Trump cut off direct reimbursement of insurers for the value of Cost Sharing Reduction (CSR) subsidies, which attach to silver plans only. The cutoff induced most states to direct insurers to price CSR into silver plan premiums only, a practice that came to be known as silver loading. CSR raises the actuarial value of a silver plan to a roughly platinum level** for enrollees with income up to 200% of the Federal Poverty Level — — that is, for about 80% of on-exchange silver plan enrollees nationally (though far less in New Jersey, as discussed below). In 2023, the average actuarial value among silver plan enrollees on all ACA exchanges was about 87%, compared to 80% for gold plans.*

Strict silver loading increases silver plan premiums and, consequently, premium subsidies, which are set to a silver benchmark (all enrollees with the same income pay the same premium for the benchmark (second cheapest) silver plan). For subsidized enrollees, the increased subsidy creates bargains in bronze as well as gold plans.

If enacted, S3896 would make New Jersey the eighth state to mandate strict silver loading — fully pricing the value of CSR into silver plans — by statute or regulation. Left to their own devices, insurers tend to underprice silver plans, because a) silver remains the dominant metal level choice among enrollees with income below 200% FPL, who qualify for strong CSR — a majority of enrollees — and b) the ACA’s risk adjustment program, which transfers money from plans with healthier-than-average enrollees to plans with sicker-than-average enrollees, tends to favor silver plans, by overestimating the impact of CSR on utilization, according to several analyses.

New Jersey is in dire need of “premium alignment,” because metal level pricing in the state is more unaligned than in any other state. Specifically, gold plans in New Jersey are priced out of reach. In the 51 states (including D.C.) together, the lowest-lowest cost gold plan is on average priced 5% above the lowest-cost silver plan (and slightly closer to the benchmark second-cheapest silver plan). In New Jersey the lowest-cost gold plans are priced 55% above lowest-cost silver on average. Bronze plans in New Jersey are also overpriced compared to the rest of the country, though to a lesser degree. The lowest-cost bronze plan in New Jersey is priced 18% below lowest-cost silver, compared to 24% nationally.

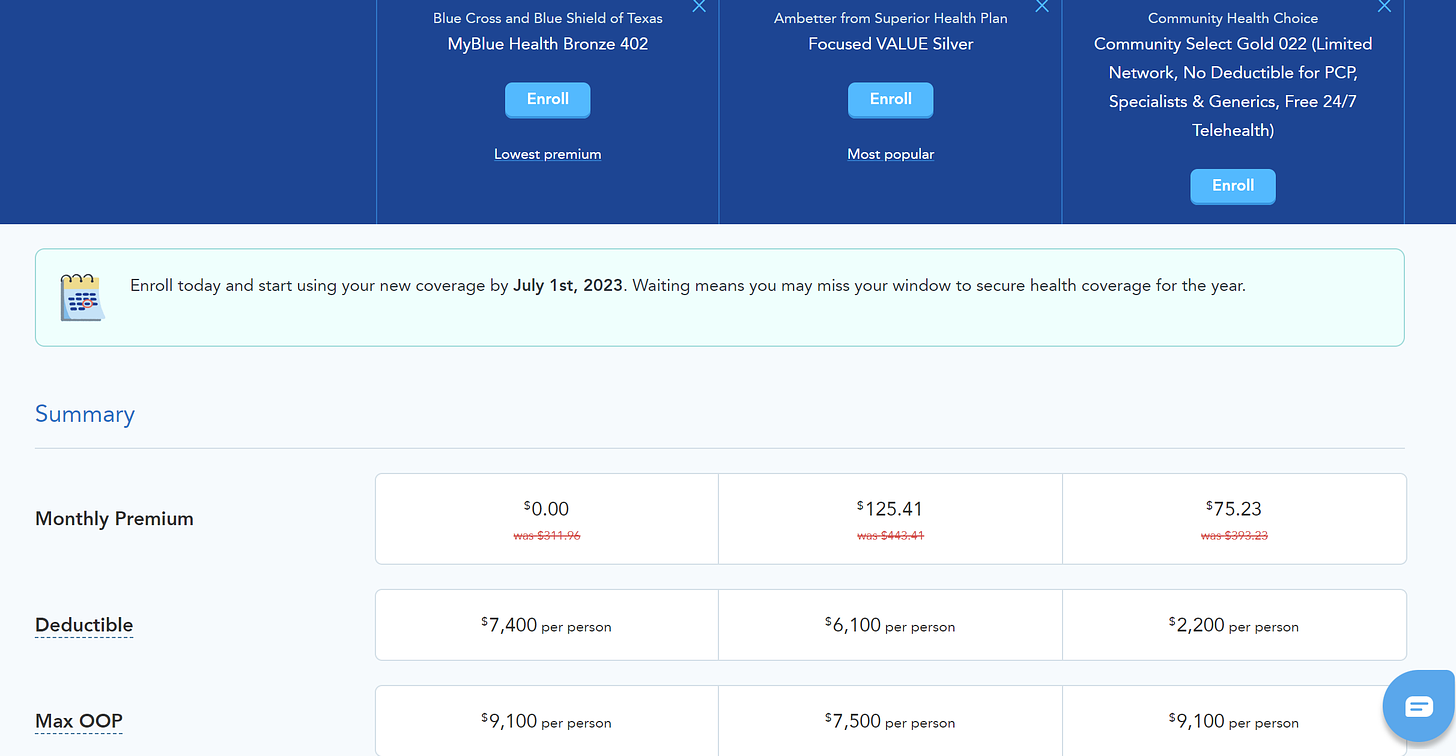

For a 40 year-old with an annual income of $35,000 in Essex County, NJ in 2023, here is the price lineup for the lowest-cost bronze, silver, and gold plans, once the subsidy (including NJ’s supplemental state subsidy) is figured in:

As a consequence of this price imbalance, New Jersey has the lowest gold plan selection in the nation. Nationally, in 2023, 11.9% of ACA enrollees selected gold plans — while just 1.5% of New Jersey enrollees selected gold.

The lack of viable gold plan options is particularly a problem for enrollees with income above 200% of the Federal Poverty Level, as well as for employer sponsors and enrollees in the small group market. Below that income level (in the individual market), Cost Sharing Reduction (CSR) raises the actuarial value of a silver plan from its baseline of 70% to a roughly platinum level (94% at incomes up to 150% FPL; 87% at incomes in the 150-200% FPL range). Silver is almost always the best choice at that income level — particularly in New Jersey, where supplemental state subsidies render benchmark silver plans free, or very close to free, all the way up to 200% FPL. But at incomes above 200% FPL, silver plans generally expose enrollees to high out-of-pocket costs — though admittedly, silver plan deductibles in NJ are generally well below the national average, topping out at $2,500 compared to a national average of $4,890.

Cheap gold plans can therefore be a major boon at incomes above 200% FPL, and this is reflected in metal level selection in states where gold plans are priced below or at near-par with silver. Among enrollees who reported income above 200% FPL in 2022, according to an analysis of mine, 17% of enrollees nationally selected gold, compared to 1.6% in New Jersey. In 11 states where the lowest-cost gold plan was priced below the benchmark (second cheapest) silver plan, according to that analysis, 48% of enrollees who reported income above 200% FPL chose gold plans.

S3896, Senator Vitale’s bill, introduces strict silver loading in two phases (though the time frame seems a bit Utopian, given that insurers are preparing their rate requests for 2024 now). In 2024, the bill directs insurers to price silver in accordance with the average actuarial value obtained by the total statewide distribution of silver plan enrollees at various CSR levels (including no CSR) as of 2022. As noted above, that average is much lower in NJ than in the nation as a whole, 80% vs. 87% — placing gold plan premiums roughly at par with silver, rather than below. That’s in part because, a) at incomes above 200% FPL, New Jersey’s supplemental state subsidies make silver plans more affordable relative to bronze plans than in most states (note the very low silver premium in the chart above), and b) gold plans are priced so high as to not be an option for 98% of enrollees. In New Jersey, 52% of silver plan enrollees have incomes above 200% FPL***, compared to just 21% nationally.

S3896 stipulates a more radical change for years following 2024. Starting in 2025, in their rate files for silver plans, insurers are directed to “assum[e] that the plan’s enrollees will enroll in plans with an actuarial value of 90 percent.” That’s meant to be a self-fulfilling prophecy. Deeming silver plans 90% AV (platinum level) would place gold premiums well below silver, making silver plan selection illogical (“dominated,” in insurance parlance) for enrollees with income above 200% FPL. Nationally, even without such regulation, on-exchange silver plan AV averages 87%.

New Mexico pioneered such “strict silver loading” in 2022 — and 69% of enrollees with income above 200% FPL selected gold plans. In 2022, Texas (yes, Texas! — in a political miracle of sorts) followed suit, passing a law mandating strict silver loading to a standard roughly comparable to what NJ’s S3896 would require in 2025. Compare lowest-cost bronze, silver and gold in Harris County, home to Houston, to the lineup presented above for Newark, New Jersey:

Note that while the lowest-cost gold plan premium in Houston, TX at this age and income level is less than one third of the lowest-cost gold premium in Newark, NJ, New Jersey’s supplemental state subsidies ($100/month at this income level) wipe out most of the silver plan premium. In fact, notwithstanding the virtual absence of gold plan availability in New Jersey, the state marketplace provides on balance provides more viable and affordable options than most. NJ marketplace strengths include: a) substantial supplemental state subsidies; b) insurers offering relatively robust provider networks, though the affordability of these was modestly undercut in 2023 by Aetna’s entry with low-cost, narrow network plans; and c) silver plan deductibles that top out at less than half the national average for silver plans without CSR.

That said, a low actuarial value will catch up with some enrollees, and the absence in New Jersey of viable options with an AV higher than 70% or 73% for individual market enrollees with income above 200% FPL and all small group enrollees is a major market shortcoming. The average AV of an employer-sponsored plan is about 85%; gold plans at least approach that norm. If enacted as introduced, S3896 would radically transform New Jersey’s individual and small group markets.

It should be noted, too, that unsubsidized enrollees would be shielded from inflated silver premiums by the availability of off-exchange of silver plans that do not have CSR priced in. New Jersey’s Department of Banking and Insurance has encouraged insurers to provide such silver plans off-exchange since 2019, and they are available. Indeed, unusually, they are listed on the state exchange, GetCoveredNJ.

S3896 contains two provisions that would speed the transition to higher AV coverage for many enrollees.

First, “when a carrier makes an individual or small employer health plan and provider network available in a geographic area at either the gold or silver level, the carrier shall offer the plan and provider network in that area at both the gold and silver levels.” Since those plans must be priced proportionate to AV, that guarantees gold plan availability statewide at premiums roughly on par with silver (in 2024) and below silver (in years following).

Second, the bill permits (while not requiring) insurers to auto-re-enroll existing silver plan customers in a gold plan for the coming year if the gold plan has the same provider network and a lower premium than the silver plan. In New Jersey in 2023, more than three quarters (76.4%) of re-enrollees and 59% of all enrollees were auto-re-enrolled. If insurers buy in, this provision could thus trigger a mass migration to gold plans at incomes above 200% FPL.

New Jersey’s supplemental state subsidies are a state expense, albeit funded by replacing the ACA’s repealed national tax on insurers with a similar state tax. The cost of enhancing federal premium subsidies by strict silver loading, on the other hand, is footed by the federal government. New Jersey can further enhance affordability in its individual and small group markets by enacting S3896.

- - - - -

* All enrollment stats in this post are derived from CMS’s public use files for the ACA marketplace unless otherwise specified. I’ve drawn on the 2023 PUF for “State, Metal Level, and Enrollment Status,” which breaks out metal level selection by income, as well as the more general “State-Level” PUF.

** CSR raises the actuarial value (AV) of a silver plan from a baseline of 70% to 94% for enrollees with income up to 150% FPL, to 87% for enrollees in the 150-200% FPL income range, and to 73% for enrollees in the 200-250% FPL range.

*** In NJ, 14% of on-exchange silver plan enrollees have income in the 200-250% FPL range, obtaining “weak” CSR that raises the silver plan AV to 73%, and 38% have income above 250% FPL or did not report income, meaning they are ineligible for subsidies, including CSR. For that 38%, the silver plan AV is 70%. NJ also has a substantial off-exchange ACA-compliant market, though DOBI’s once-diligent tracking of that market has been frozen for three years. In the first quarter of 2020, 95,000 enrollees were off-exchange, and 69% were in silver plans (see program data here). While federal subsidy enhancements in 2021, state subsidies introduced 2021, and subsequent strong on-exchange enrollment growth have probably shrunk the off-exchange market somewhat, whatever remains would further reduce the average AV of silver plan enrollees, as off-exchange and on-exchange enrollees are in a single risk pool.

No comments:

Post a Comment