CMS announced today that plan selections for 2022 in the ACA marketplace have reached an all-time high of 13.6 million. That's up from 12.0 million as of the end of Open Enrollment (OE) for 2021, a 13% increase so far. [Update: Per Charles Gaba, the total as of Dec. 15 last year was 11.6 million, as most of the 15 SBEs' Open Enrollment seasons did not end on Dec. 15. See note at bottom]

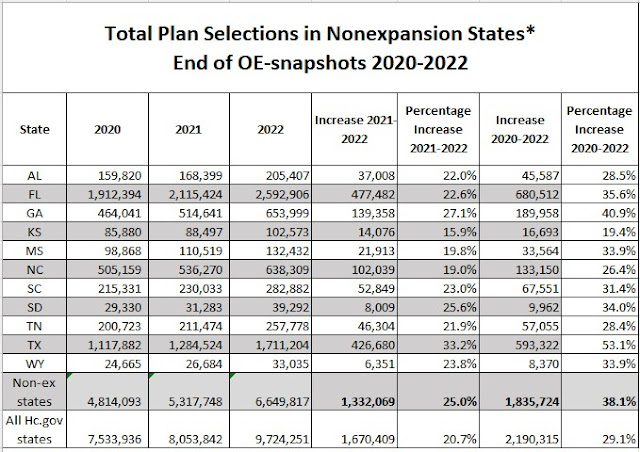

As in last year's OE and this year's emergency SEP, enrollment growth was overwhelmingly concentrated in states that have refused to enact the ACA Medicaid expansion. Enrollment increased by 1.7 million in 33 states using HealthCare.gov, the federal exchange -- and 1.3 million of that increase was in the 11 remaining holdout states (excluding Wisconsin, which has no coverage gap), a 25% year-over-year increase in those states. Enrollment in Florida and Texas increased by 900,000.

Over two years, from OE for 2020 to OE through Dec. 15 for 2022, enrollment in these 11 states has increased by 1.8 million, or 38%.

*Nonexpansion states as of OE 2022, excluding Wisconsin, which has no coverage gap. HealthCare.gov all-state totals are for the 33 states using the federal exchange this year.

In nonexpansion states, eligibility for marketplace subsidies begins at incomes of 100% of the Federal Poverty Level, as opposed to 138% FPL, the Medicaid eligibility threshold, in expansion states. Since the American Rescue Plan Act passed last March, benchmark silver coverage with strong Cost Sharing Reduction has been free to enrollees with incomes up to 150% FPL. During the emergency Special Enrollment Period that ran from Feb. 15 through Aug. 15 this year on HealthCare.gov (the federal exchange, used by all nonexpansion states), fully half of enrollees in nonexpansion states had income under 150% FPL. As of the end of August of this year, enrollment in 13 nonexpansion states (including Oklahoma, which expanded as of July 1 this year, and Missouri, which opened the gates on Oct. 1) was up 44% over enrollment in August 2019.

I have many times reviewed the myriad forces pushing enrollment in nonexpansion states during the pandemic: the fear of being uninsured; the supplemental unemployment income provided by the March 2020 CARES Act, which probably pushed many incomes over the 100% FPL eligibility threshold; the free coverage offered to anyone who received any UI income in 2021; and the massive subsidy boosts in the American Rescue Plan Act, which, as noted above, made high-value coverage free at incomes up to 150% FPL and very affordable (no more than 2% of income for a benchmark silver plan) up to 200% FPL. A fuller discussion is here.

Conversely, Jenny Chumbley Hogue, a broker based near Dallas, notes:

In my little corner of Texas, its not the 100%'ers that moved back, its the people who were getting killed with the subsidy cap pre-ARPA. A lot of conversations started with "is it true I can get a subsidy if my wife and I make more than $70K?".

A broker's clients are likely to be more affluent than average marketplace enrollees, I think. During the emergency SEP, 12% of new enrollees in HealthCare.gov states had incomes over 400% FPL, the pre-ARPA cutoff point for subsidy eligibility. The final enrollment report, released in the spring will break out enrollment by income.

Note that while the Trump administration cut the OE period in HealthCare.gov states to six weeks, Nov. 1 -- December 15, the Biden administration has extended the deadline to Jan. 15. Thus this year's OE is still not over (and most state-based exchanges also extend OE into January). Note also that "plan selections" in OE are not all effectuated; the year's first "effectuated enrollment" total, as of February or March, has historically run from 6% to 18% below the OE signup total. During the Trump years, this attrition declined, perhaps because those who sign up during the shorter OE are more motivated than the latecomers who select plans after the deadline for Jan. 1 coverage (Dec. 15) has passed, in years when that is possible.

---

Correction: As noted above, as of Dec. 15, total enrollment in marketplace plans is up by 2.0 million year-over-year. The tables above are apples-to-apples, because OE for 2021 ended on December 15 in HealthCare.gov states, but the 12.0 million total for all states in 2021 that I originally cited, taken from the Public Use Files published in the spring, includes subsequent enrollments in the state-based marketplaces. Charles Gaba has totals for the SBEs dating from 12/15 last year, and on that basis, enrollment in this year's SBEs (3 of which were on HealthCare.gov last year) is also up by several hundred thousand. Measured from 12/15/20 to 12/15/21, the increase in the nonexpansion states accounts for 2/3 of the national total, not 80% as I first stated.

No comments:

Post a Comment