Those of us who have been anticipating the paradoxical effects for subsidized ACA marketplace shoppers of Trump's cutoff of CSR reimbursement have to split our gaze more between shiny objects.

Designed as an add-on benefit, CSR (Cost Sharing Reduction) radically reduces out-of-pocket costs for silver plan enrollees with incomes under 200% of the Federal Poverty Level (and much more modestly for enrollees in the 200-250% FPL range). Until this month, the federal government reimbursed insurers for the extra benefit. In 2018, insurers will price it in.

What excited folks like David Anderson, Charles Gaba and I* (though we're also appalled by the premium hikes for the unsubsidized) was the prospect that in many states and regions, gold plans would be cheaper than silver. That's because 38 states (according to Charles Gaba's tracking) instructed insurers to load the cost of CSR onto silver plans only, since CSR is only available in silver plans.

This has, um, panned out -- as we now know, since prices have been posted for almost all states. The cheapest gold plan is cheaper than the cheapest silver plan in Pennsylvania, Kansas, New Mexico, Wyoming, most of Texas and Wisconsin, much of Michigan and Florida (including Miami, which has the heaviest concentration of marketplace enrollees in the country), much of California, and parts of several other states. In other regions, the price of gold plans is closer to the price of silver plans than it used to be.

Cheap gold amounts to a kind of back-door CSR for enrollees with incomes over 200% FPL. For a price lower than or close to the benchmark deemed "affordable" at their income level, they can get a plan designed to cover 80% of the average user's costs (its "actuarial value") rather than the 70% AV offered by silver plans. Broadly, that translates to a cut in the average per-person deductible from $3572 for silver (with no CSR) to $1197 for gold, according to HealthPocket (for 2017).

For enrollees under 200% FPL, CSR boosts silver plan AV to 94% or 87%, so silver is still a better deal than comparably priced gold for them. Average deductibles at those CSR levels this year are $255 and $809 respectively, according to the Kaiser Family Foundation.

A spin around the country on HealthCare.gov's plan preview tool (and Covered California's) shows an at least equally salient fact, though: bronze plans are free to large numbers of subsidized enrollees. In today's Wall Street Journal, Anna Wilde Mathews reports that insurers are jumping on this, planning to advertising it. (For price spreads from the benchmark for each metal level, see David Anderson's map.)

In 2017, silver plans attracted 71% of all marketplace enrollment, compared to 23% for bronze plans and 4% for gold. Among those who switch out of silver this year, will more be pulled to bronze or gold?

The silver-heavy top line notwithstanding, both bronze and gold takeup increase with income. The table below shows the metal level selection breakdown at each income level in the 38 states that used the federal HealthCare.gov platform in 2017. The "other" income category is mainly comprised of enrollees who earned too much to qualify for subsidies, though about a quarter of the million-plus people in that category had incomes under 100% FPL (a category that HHS broke out in past years but not in 2017).

Keep in mind the AV offered by silver at different income levels: 94% for the 100-150% FPL band, 87% at 150-200% FPL, 73% at 200-250% FPL, and 70% for those over 250% FPL. Bronze plans have 60% AV and gold, 80%. I've highlighted the likeliest switchers

Derived from CMS public use files for 2017

Bronze has always been a terrible deal below the 200% FPL threshold, because it's priced as if it offers just 10 percentage points less of AV than silver plans, whereas with CSR included it offers about 30 AV points less (34 or 27 points less, depending on income level). In deductible terms, that's $0 --$1000 for silver vs $6000-plus for bronze. But in 2018, the bronze discount will reduce that value difference. Free bronze or ultra low-cost bronze may be tempting to a good number of low income enrollees (In 2017, about 60% of enrollees in HealthCare.gov states had incomes under 200% FPL**). In some bronze plans, doctor visits, generic drugs, and some other services are not subject to the deductible, though copays are generally higher than in silver plans.

Enrollees in the 200-250% FPL range could break pretty strongly for gold plans where they're at a relative discount. 68% of enrollees in this income group went for silver in HealthCare.gov states this year. (That's a surprisingly high percentage, based on past and current state exchange breakouts. This year in California, just 57% in the 200-250% FPL selected silver.) To select cheapest or second-cheapest (benchmark) silver in this income range generally entails paying somewhere between $130 and $200 per adult per month -- a lot of money at an income of $25-30,000 per year for an individual, especially for coverage with a deductible in the $3,000 range.

Kansas is a solidly "gold" state in 2018 -- i.e., one where the cheapest gold plan is cheaper than the cheapest silver statewide. Let's look at how the choices play out for a solo 40 year-old with an income of $25,000 in Wichita.

Here is the benchmark silver plan, against which the subsidy is calculated:

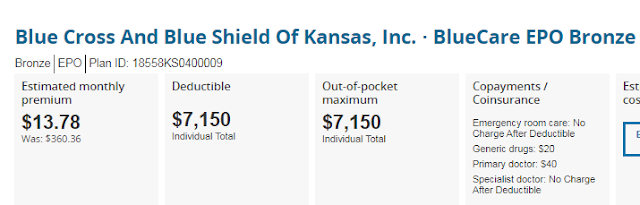

This is a pretty representative weak-CSR silver plan. The cheapest silver plan is just $5 per month less, and lacks the array of services not subject to the deductible.

How does the gold compare?

Better deal (with the same provider network).

Bronze? The cheapest offering is.. free, with a $6,500 deductible and out-of-pocket max, and all basic services subject to it -- also in the same Blue Cross network. For $14 per month, Blue Cross bronze is available with doctor visits and generic drugs not subject to the deductible:

The bronze - gold choice may actually be a fairly balanced one here, dependent on health, savings and cash flow. Silver should be out of the running.

If the same 40 year-old in Wichita has an income of $31,000, slightly above 250% FPL, the cheapest bronze plan is $75 per month, the gold, $175, and the silver, $210. The choice is roughly proportionate to that of the lower income level. But for an older shopper at the same income, the equation changes.

At 55, income $31k in Wichita the cheapest bronze plan is again free, while the cheapest gold is $146 per month (and the cheapest silver, out of the running, is $207). The bronze is free because the premium subsidy has risen to cost the higher price of benchmark silver for an older enrollee. The spread between bronze and gold has grown considerably. The increased spread may push older buyers toward bronze -- but conversely, the higher average need for medical care at older ages may make many willing to pay more to obtain a deductible spread ranging from $5000 to $5650.

Since the launch of the ACA marketplace in 2014, takeup has been poor among subsidy eligible people who don't qualify for strong CSR -- that is, for people in the 200-400% FPL income range. Silver plans, unenhanced by CSR or only by the weakest level of CSR, do not have a particularly attractive premium/out-of-pocket mix, and bronze plans offer only effectively catastrophic coverage. As CBO forecast, offerings in many states and regions should be more attractive in this income range than in the past -- at least the most recent past (out-of-pocket costs have risen considerably since 2014). At the same time, many unsubsidized individual market enrollees may be priced out of coverage altogether. But modest gains among the subsidized may at least offset losses driven by massive cutbacks in outreach and enrollment assistance.

Update, 10/29: This look at metal level selections by income in 2017 made me realize that CSR takeup seems to have been particularly high in 2017. Overall, in HealthCare.gov states, 80% of those with incomes under 251% FPL are in CSR-enhanced plans. An extraordinarily high 87% of those with incomes up to 200% FPL, i.e. those eligible for strong CSR, accessed the benefit. I'll do a separate post about that. The high availability of cheap-to-free bronze plans for those with incomes up to 200% FPL and cheap gold and bronze for those in the 200-250% FPL band should erode that takeup in 2018.

---

* I would like to add Louise Norris to the list, as she has been relentlessly tracking states' CSR pricing strategies and reporting effects to her readers, but Louise is not as given to enthusiasm as the others named here.

** The percentage would be a bit lower with the state-based marketplaces taken into account, probably about 57%.

Designed as an add-on benefit, CSR (Cost Sharing Reduction) radically reduces out-of-pocket costs for silver plan enrollees with incomes under 200% of the Federal Poverty Level (and much more modestly for enrollees in the 200-250% FPL range). Until this month, the federal government reimbursed insurers for the extra benefit. In 2018, insurers will price it in.

What excited folks like David Anderson, Charles Gaba and I* (though we're also appalled by the premium hikes for the unsubsidized) was the prospect that in many states and regions, gold plans would be cheaper than silver. That's because 38 states (according to Charles Gaba's tracking) instructed insurers to load the cost of CSR onto silver plans only, since CSR is only available in silver plans.

This has, um, panned out -- as we now know, since prices have been posted for almost all states. The cheapest gold plan is cheaper than the cheapest silver plan in Pennsylvania, Kansas, New Mexico, Wyoming, most of Texas and Wisconsin, much of Michigan and Florida (including Miami, which has the heaviest concentration of marketplace enrollees in the country), much of California, and parts of several other states. In other regions, the price of gold plans is closer to the price of silver plans than it used to be.

Cheap gold amounts to a kind of back-door CSR for enrollees with incomes over 200% FPL. For a price lower than or close to the benchmark deemed "affordable" at their income level, they can get a plan designed to cover 80% of the average user's costs (its "actuarial value") rather than the 70% AV offered by silver plans. Broadly, that translates to a cut in the average per-person deductible from $3572 for silver (with no CSR) to $1197 for gold, according to HealthPocket (for 2017).

For enrollees under 200% FPL, CSR boosts silver plan AV to 94% or 87%, so silver is still a better deal than comparably priced gold for them. Average deductibles at those CSR levels this year are $255 and $809 respectively, according to the Kaiser Family Foundation.

A spin around the country on HealthCare.gov's plan preview tool (and Covered California's) shows an at least equally salient fact, though: bronze plans are free to large numbers of subsidized enrollees. In today's Wall Street Journal, Anna Wilde Mathews reports that insurers are jumping on this, planning to advertising it. (For price spreads from the benchmark for each metal level, see David Anderson's map.)

In 2017, silver plans attracted 71% of all marketplace enrollment, compared to 23% for bronze plans and 4% for gold. Among those who switch out of silver this year, will more be pulled to bronze or gold?

The silver-heavy top line notwithstanding, both bronze and gold takeup increase with income. The table below shows the metal level selection breakdown at each income level in the 38 states that used the federal HealthCare.gov platform in 2017. The "other" income category is mainly comprised of enrollees who earned too much to qualify for subsidies, though about a quarter of the million-plus people in that category had incomes under 100% FPL (a category that HHS broke out in past years but not in 2017).

Keep in mind the AV offered by silver at different income levels: 94% for the 100-150% FPL band, 87% at 150-200% FPL, 73% at 200-250% FPL, and 70% for those over 250% FPL. Bronze plans have 60% AV and gold, 80%. I've highlighted the likeliest switchers

Metal Level

Selections at Different Income Levels (% FPL)

HealthCare.gov states, 2017

Strong CSR Weak CSR No CSR

Metal level

|

100-150%

|

150-200%

|

200-250%

|

250-300%

|

300-400%

|

Other

|

Total

|

bronze

|

9.2%

|

14.4%

|

27.1%

|

39.4%

|

40.2%

|

36.2%

|

21.5%

|

silver

|

89.4%

|

83.2%

|

67.6%

|

54.4%

|

52.0%

|

43.7%

|

74.2%

|

gold

|

< 1%

|

1-2%

|

4-5%

|

5-6%

|

~ 7%

|

19%

|

3-4%

|

Derived from CMS public use files for 2017

Bronze has always been a terrible deal below the 200% FPL threshold, because it's priced as if it offers just 10 percentage points less of AV than silver plans, whereas with CSR included it offers about 30 AV points less (34 or 27 points less, depending on income level). In deductible terms, that's $0 --$1000 for silver vs $6000-plus for bronze. But in 2018, the bronze discount will reduce that value difference. Free bronze or ultra low-cost bronze may be tempting to a good number of low income enrollees (In 2017, about 60% of enrollees in HealthCare.gov states had incomes under 200% FPL**). In some bronze plans, doctor visits, generic drugs, and some other services are not subject to the deductible, though copays are generally higher than in silver plans.

Enrollees in the 200-250% FPL range could break pretty strongly for gold plans where they're at a relative discount. 68% of enrollees in this income group went for silver in HealthCare.gov states this year. (That's a surprisingly high percentage, based on past and current state exchange breakouts. This year in California, just 57% in the 200-250% FPL selected silver.) To select cheapest or second-cheapest (benchmark) silver in this income range generally entails paying somewhere between $130 and $200 per adult per month -- a lot of money at an income of $25-30,000 per year for an individual, especially for coverage with a deductible in the $3,000 range.

Kansas is a solidly "gold" state in 2018 -- i.e., one where the cheapest gold plan is cheaper than the cheapest silver statewide. Let's look at how the choices play out for a solo 40 year-old with an income of $25,000 in Wichita.

Here is the benchmark silver plan, against which the subsidy is calculated:

This is a pretty representative weak-CSR silver plan. The cheapest silver plan is just $5 per month less, and lacks the array of services not subject to the deductible.

How does the gold compare?

Better deal (with the same provider network).

Bronze? The cheapest offering is.. free, with a $6,500 deductible and out-of-pocket max, and all basic services subject to it -- also in the same Blue Cross network. For $14 per month, Blue Cross bronze is available with doctor visits and generic drugs not subject to the deductible:

The bronze - gold choice may actually be a fairly balanced one here, dependent on health, savings and cash flow. Silver should be out of the running.

If the same 40 year-old in Wichita has an income of $31,000, slightly above 250% FPL, the cheapest bronze plan is $75 per month, the gold, $175, and the silver, $210. The choice is roughly proportionate to that of the lower income level. But for an older shopper at the same income, the equation changes.

At 55, income $31k in Wichita the cheapest bronze plan is again free, while the cheapest gold is $146 per month (and the cheapest silver, out of the running, is $207). The bronze is free because the premium subsidy has risen to cost the higher price of benchmark silver for an older enrollee. The spread between bronze and gold has grown considerably. The increased spread may push older buyers toward bronze -- but conversely, the higher average need for medical care at older ages may make many willing to pay more to obtain a deductible spread ranging from $5000 to $5650.

Since the launch of the ACA marketplace in 2014, takeup has been poor among subsidy eligible people who don't qualify for strong CSR -- that is, for people in the 200-400% FPL income range. Silver plans, unenhanced by CSR or only by the weakest level of CSR, do not have a particularly attractive premium/out-of-pocket mix, and bronze plans offer only effectively catastrophic coverage. As CBO forecast, offerings in many states and regions should be more attractive in this income range than in the past -- at least the most recent past (out-of-pocket costs have risen considerably since 2014). At the same time, many unsubsidized individual market enrollees may be priced out of coverage altogether. But modest gains among the subsidized may at least offset losses driven by massive cutbacks in outreach and enrollment assistance.

Update, 10/29: This look at metal level selections by income in 2017 made me realize that CSR takeup seems to have been particularly high in 2017. Overall, in HealthCare.gov states, 80% of those with incomes under 251% FPL are in CSR-enhanced plans. An extraordinarily high 87% of those with incomes up to 200% FPL, i.e. those eligible for strong CSR, accessed the benefit. I'll do a separate post about that. The high availability of cheap-to-free bronze plans for those with incomes up to 200% FPL and cheap gold and bronze for those in the 200-250% FPL band should erode that takeup in 2018.

---

* I would like to add Louise Norris to the list, as she has been relentlessly tracking states' CSR pricing strategies and reporting effects to her readers, but Louise is not as given to enthusiasm as the others named here.

** The percentage would be a bit lower with the state-based marketplaces taken into account, probably about 57%.

As you point out, the extra benefits for the 'lower middle class' (defined by income) are in contrast to the horrible situation of the unsubsidized market (i.e. the new uninsured) Yesterday I quoted a premium of $1300 a month for a crap ass silver plan for a 60 year old in Iowa who makes $5000 a month before taxes. I advised this person to look for a Christian health plan as he did not have pre existing conditions.

ReplyDeleteAs I look back over the last few years on this issue, I am struck by the lack of proposals to extend the subsidies to all income levels, or at least to 500% or 600% of poverty.

The Republicans in the main are apparently determined that government programs are worthless, and that Obama in particular had to be humbled. The Repubs have done nothing for one of their main constituencies.

The Democrats constantly fell back on the annoying claim (at least annoying to me) that the ACA was helping the poor and therefore it was great.

A program that helps the poor yet hurts the middle class will not survive in the long run. Most Democrats seem not to understand this.

We have no lack of ideology in our national politics. What baffles me is the lack of interest group politics on health care.

Bob, in my experience Dems do not deny that the ACA needs fixing. Everyone from Schumer on down has acknowledged problems. Clinton had a package of proposals to ease out-of-pocket costs and premiums -- including capping premiums as a % of income at all income levels. I think it's a virtual consensus that the ACA has helped the poor and near-poor but fallen short (for a host of reasons in which sabotage looms large) for those over 200% FPL.

ReplyDeleteI never heard Hillary speak loud and clear about capping premiums in a debate or stump speech. I had to search for the proposal on her website.

ReplyDeleteGranted, it was not going to be easy to get an extra $10-$15 billion a year out of a Congress that was busy "repealing" the whole ACA. But I barely heard the effort.

I have read about ten articles about ACA beneficiaries who voted for Trump. In general, these voters were not one bit studious about the law and maybe we can just chalk it up to hillbilly gullibility. However one common theme is that the people with ACA subsidies were deeply jealous of the people on Medicaid. Medicaid has next to zero premiums and no deductibles...that is what the Trump voters actually wanted for themselves.

I sometimes curse the Democrats for passing a program with cliffs! Better a smaller benefit for all citizens, than Cadillacs for the poor and a rusty oxcart for the middle class.

Bob:

ReplyDeleteI do not remember many of the middle class going to war over the uninsured before the ACA. In many cases the attitude was the best expressed the same as Trump's alternative facts lady Kellyanne Conway's "Get a job that has insurance" when such jobs were unavailable. If one could not get a job in my state and you were an adult, there was no healthcare insurance. If you were part of the working poor and eligible, the insurance was limited.

In any case, this is not the reason for their cost issues. There are several factors I believe support your complaint though. The same as working to get Medicaid, there was a mentality of having skin in the game when going for ACA healthcare as if that would cause you to negotiate or not go at all. Raising deductibles and then not being eligible for the negotiated rate till that deductible was satisfied is BS also. I tried that negotiation routine when I had pneumonia with my PCP and had poor insurance. It does not work. One clerk finally told me to go to a private imaging and urine test facility to save the money.

The second emphasis is the cost control which is entirely on the insured through premiums, deductibles, co-payments, exclusions, etc. . Insurance is mostly reflective of the cost (it has its issues). The commercial healthcare industry and the service for fees business model are the majority drivers of cost. If Congress will do it, it is time to visit how healthcare product is costed and delivered.

There are 15 million people in the individuals market above 400% of FPL who I believe are the loudest complainers. If we did raised the subsidy level to 350% and 500%, it would only be good for a little while before deductibles and costs would catch up to those limits either to the government or individuals. It is a temporary fix. We need to move to something better.

I agree with your comment that cost control is placed almost entirely on the patient. Us poor patients are like the kamikaze pilots of cost control. Only if we exhaust ourselves in desperate bargaining, or even harm ourselves by refusing needed care, can we force providers to even consider lowering their prices.

ReplyDeleteThe way to get lower prices in any market is to have the ability to walk away from a bad deal. In medicine that is a very hollow ability.