Note: Free xpostfactoid subscription is available on Substack alone, though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up.

|

| A man may smile, and smile (sort of)... |

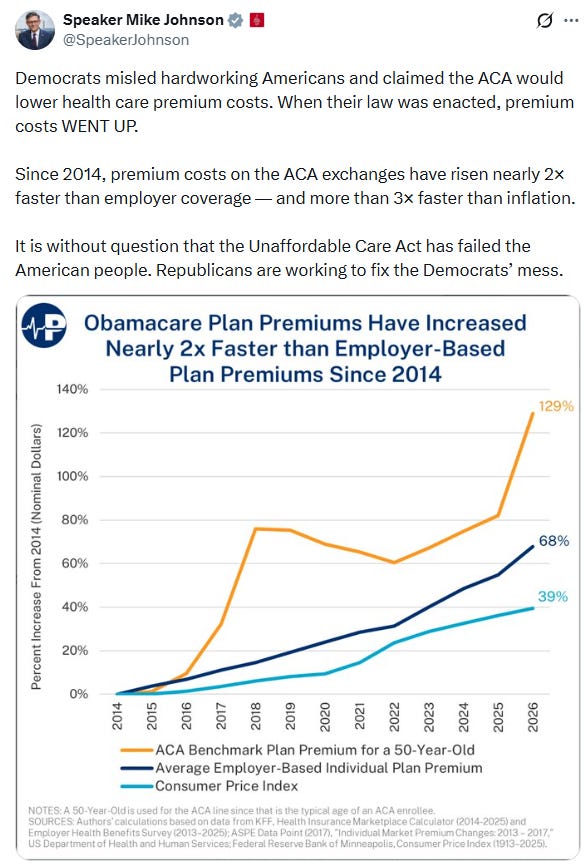

Multiple Republican senators and House reps, psyching themselves up for electoral suicide, are sharing this messaging from the Koch-funded Paragon Health Institute, where virtually all their ACA-related talking points originate:

There are of course lies, damned lies, statistics, and Koch-funded talking points designed to strip Americans of healthcare access to help fund tax cuts for the wealthy.

Look at the mid-section of Johnson chart above, from 2018 to 2025 (there should be a sharp spike from 2017 to 2018, but never mind). There is barely any premium increase in that long stretch, during which average premiums for employer-sponsored insurance rose far more quickly. Here is the comparison in the National Health Estimate Accounts, published in June of this year (see Table 17 in NHE Projections - Tables, here)

From 2018 through 2023, the last year for which the NHE has data, premiums in the individual market (“direct purchase” above) were up 13% — while premiums in the employer-sponsored market rose 29%. From 2023-2025, average ACA benchmark silver premiums rose 9% (from $456/month to $497/month), while average ESI premiums rose 11% (from $8,435/year to $9,325/year) for single coverage according to KFF’s annual employer benefits survey. As of 2025, ESI premiums remained considerably higher than marketplace premiums, though the difference is probably in line with differences in network quality and actuarial value (a measure of the level of out-of-pocket exposure).

Am I cherry-picking years? No. The ACA marketplace has had three years in which premiums spiked sharply, and two of them were largely a result of Republican action or inaction. Let’s look at each in turn. Keep in mind that insurer pricing processes begin in the spring prior to the Plan Year in question.

Plan Year 2017: Market correction. When the ACA marketplace launched in November 2013 (selling plans effective in 2014), premiums came in lower than expected, as insurers jockeyed for position in a new market. Premium growth was modest through 2016. In 2017, however, a three-year federally funded reinsurance program established by the ACA expired, and concurrently, insurers had enough data to recognize that they had underpriced initial offerings, as the risk pools were smaller, older and sicker than anticipated. A sharp correction ensued, with benchmark silver premiums increasing by an average of 20% from 2016 to 2017. That correction should have organically served its purpose; in July 2017, KFF reported that marketplace insurers had returned to profitability. By that point, however, the Republican Congress’s ACA repeal drive and the Trump administration’s regulatory assault were in full swing, leading to…

Plan Year 2018: Panic. In 2017, the Republican Congress came in preparing to “repeal and replace” the ACA, while Trump came in threatening to cut off reimbursement of insurers for providing the Cost Sharing Reduction (CSR) subsidies that raise the actuarial value of a silver plan to a roughly platinum level for low-income enrollees — i.e., for most enrollees. While the ACA statute mandated such reimbursement, the drafters neglected to make the funding mandatory, and the Republican Congress had never allocated the necessary funds. The Obama administration made the payments anyway; the Republican House sued; a district court upheld the suit but stayed its ruling pending appeal; and Trump came into office vowing to cut the funds off. Also in 2017, CMS under Trump radically cut the ACA Open Enrollment Period and gutted funding for nonprofit enrollment assistance and marketing —as well as denigrating marketplace offerings in its public statements and online messaging. Insurers, understandably spooked, raised benchmark premiums an average of 34% in advance of OEP 2018.

ACA repeal failed, of course, and while Trump did cut off direct CSR reimbursement in October 2017, he had waited too long to spark the mass exodus of insurers that might have happened had he cut the payments off, in, say, May. As the move had long been anticipated, regulators were prepared, and in most states allowed or encouraged insurers to price CSR directly into silver plans should a cutoff occur, since CSR is available only with silver plans. Since income adjusted premiums are set to a silver benchmark, increasing silver premiums increases subsidies, and the resulting “silver loading” made zero-premium plans available to millions more prospective enrollees than previously, helping to offset enrollment losses that other Trump administration moves might have caused (boosting enrollment by about 5%, by one estimate). While Trump did stiff insurers for the CSR they provided in the last months of 2017 (with CSR priced in for 2018), insurers were cut off for only a couple of months, rather than for the better part of a year, as they would have been had Trump cut off CSR payments in, say, May — which, as David Anderson pointed out in May 2017, might really have sparked a mass exodus. Eventually, the sued successfully to cut off the CSR funds they were unable to recoup in premiums in 2017.

Premiums stabilized after 2018. With repeal off the table, some CMS initiatives in the Trump years helped, including encouraging state reinsurance programs and providing tech and marketing support for agents and brokers. Per above, premiums in the ACA marketplace rose much more slowly than in the employer market through 2025. Which brings us to

Plan Year 2026: Political and economic turmoil. 2026 is a tough year for health insurance enrollees. Overall inflation remains elevated; tariffs are affecting the costs of drugs and medical devices; healthcare industry consolidation continues apace; GLP-1 weight loss and other blockbuster drugs are driving up the cost of drug coverage. Employment benefit consultant Mercer estimates that total plan costs per employee in the employer market will rise 9% in 2026; next September, we’ll see what kind of increase for 2026 the annual KFF employer health benefit survey finds. Meanwhile, in the ACA marketplace base premiums (subsidies aside) are up 26% on average. In their filings, insurers estimate that four percentage points of that increase (15%) are due to the anticipated expiration of the enhanced premium subsidies that Republicans refuse to extend into 2026 and beyond.

I suspect that political turmoil is inducing insurers to overreact, as they did in 2018. The ACA stipulates that marketplace insurers spend at least 80% of premium revenue on medical care; to the extent their “medical loss ratio” (MLR) falls short of 80%, they must rebate the difference to enrollees, with the MLR calculated as a 3-year average. In 2017, those rebates in the ACA marketplace (for 2014-2016) totaled $132.5 million. In 2018, with the 2017 premium spike figuring in, MLR rebates jumped to $769,000 million. In 2019, with a two-year 62% increase in benchmark premiums included in the 3-year total, rebates more than doubled to $1.7 billion. Barring other seismic changes, or a thousand effective cuts by a Republican Congress and CMS, I suspect MLR rebates will spike again after 2026.

* * *

Republican claims that the ACA marketplace as currently constructed in unsustainable adheres to their perpetual formula: sabotage, then denigrate. ACA premiums are “unaffordable” because Republicans cut taxes by twelve times as much as the enhanced subsidies will cost over ten years. Marketplace fraud, which did proliferate in 2023-2024, and is used by Republicans to discredit zero-premium coverage in particular, can be easily shut down by cracking down on the brokers that perpetrate it and by effectively limiting their access to client accounts without client signoff, as the state-based marketplaces do. The lightly regulated alternative markets Republicans seek once again to stimulate (association health plans, medically underwritten short-term plans) address a real need (badly) only if the ACA marketplace is once again undersubsidized.

Meanwhile, Republicans are seizing Paragon talking points to arm their electoral death march.

Update, 12/17: Writing in the New York Times, Zack Cooper, a Yale healthcare economist who’s done pioneering work on the effects of hospital system consolidation on costs, explains the overall structural dysfunction of the U.S. healthcare system. Along the way, he puts the rise of premiums in the ACA marketplace as compared to the employer market in perspective:

Next year insurance premiums will increase 10 percent for employer-sponsored plans and 18 percent for individual plans on the exchanges compared with 2025. In both markets, they’re going up because the price of medical care is rising (think hospital mergers, staffing shortages and tariffs that make drugs and devices more expensive) and Americans are increasingly using expensive weight loss and diabetes drugs known as GLP-1s. The exchange plans are seeing a sharper increase than employer plans because of the uncertainty lawmakers created over whether the Affordable Care Act subsidies would be extended. Insurers had to factor in the risk that healthier people would be less likely to buy insurance if the subsidies expired, which would lead to a sicker insurance risk pool and higher costs.

No comments:

Post a Comment