Note: All xpostfactoid subscriptions are now through Substack alone (still free), though I will continue to cross-post on this site. If you're not subscribed, please visit xpostfactoid on Substack and sign up!

|

| Will NJ's ACA marketplace glow as goldenly as its rest areas? |

In June, I flagged a bill introduced in the New Jersey legislature this past spring, S3896/A5626, that would require silver plans in the state’s ACA marketplace to be priced roughly on par with gold plans in year 1 and on par with platinum plans in year two — reshaping a market in which gold plans have been priced out of reach for more than 98% of enrollees.

The bill’s logic is simple (though it has a complicated back story): On average, silver plans have a higher actuarial value than gold plans, since most silver plan enrollees qualify for the Cost Sharing Reduction (CSR) that attaches only to silver plans.

The bill was abruptly posted early this month for a December 11 hearing in the Assembly Financial Institutions and Insurance Committee, a committee chaired by one of the bill’s lead sponsors, John McKeon. The bill passed out of committee with no amendments on an 11-0 vote with one abstention. That’s first step in a gauntlet of three Assembly and two Senate committees’ consideration.

I testified in favor on behalf of BlueWave New Jersey, a progressive state advocacy group, along with Laura Waddell of New Jersey Citizen Action. My testimony is below.

- - -

TESTIMONY BEFORE SENATE BUDGET AND APPROPRIATIONS COMMITTEE

December 11, 2023

A5626/S3896 would correct a severe pricing imbalance in New Jersey’s ACA marketplace that weakens coverage for middle-income enrollees in health plans offered on GetCoveredNJ.

New Jersey is unique among U.S. state marketplaces in that in New Jersey gold-level plans – the metal choice that offers a coverage level closest to the average employer-sponsored plans – are priced out of reach for almost all enrollees. In New Jersey in 2023, just 1.5% of on-exchange enrollees selected gold plans, versus a national average of 11.9% (see CMS Public Use Files, Note 3). Nationally, according to tables published by the Kaiser Family Foundation, the lowest-cost gold plan premium in each state market is 4% higher than the lowest-cost silver premium in 2024. In New Jersey, the lowest-cost gold premium is priced 37% above the lowest-cost silver plan.

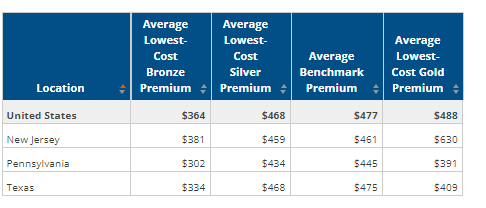

In Pennsylvania and Texas, two states that have taken measures similar to A5266, lowest-cost gold plans are priced well below lowest-cost silver plans, as shown below, and bronze plans are also a relative bargain. A5266 would correct a severe imbalance – and would follow several state governments (e.g., Pennsylvania, Maryland, Virginia, New Mexico, Colorado, and believe it or not, Texas) in making gold plans more affordable than the national average.Average Marketplace Premiums by Metal Tier, 2024 - KFF[1]

Unsubsidized premiums for a 40 year-old

Gold plans (and bronze plans) matter most for middle-income enrollees – those with income above 200% of the Federal Poverty Level (in 2024, that’s $29,160 for an individual, $60,000 for a family of four). Below the 200% FPL threshold, silver plans (and only silver plans) come with Cost Sharing Reduction (CSR), which raises them to an effectively platinum coverage level (an actuarial value of 94% at incomes up to 150% FPL, and 87% at incomes in the 150-200% FPL range). New Jersey’s supplementary premium subsidies make the benchmark silver plan effectively free at incomes all the way up to 200% FPL, and silver plans are usually the best choice up to that income threshold.

Above the 200% FPL level, however, there is a benefit cliff. Silver plans with weak CSR (at incomes in the 200-250% FPL range) or no CSR (at incomes over 250% FPL) expose enrollees to much higher out-of-pocket costs than the average employer-sponsored plan.

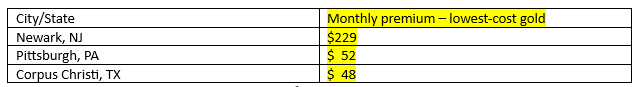

In states that have taken measures similar to A5626, requiring insurers to price gold plans on a par with or below silver plans with the same provider network, enrollees with income above the 200% FPL threshold have the opportunity to reduce their out-of-pocket costs by choosing affordable gold plans. Those states include Pennsylvania and Texas. Compare the premium for the lowest-cost gold plan available in 2023 in three mid-size cities: Newark, Pittsburgh, PA, and Corpus Christi, TX:

Lowest-Cost Gold Plan in three Mid-Sized Cities, 2024

Premium (after subsidy) for single 43 year-old, income $37,000/year

Sources: GetCoveredNJ, Pennie, HealthCare.gov[2]

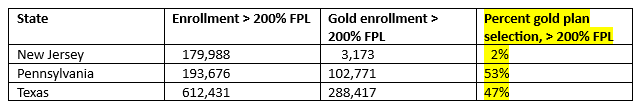

Next, consider the effect on metal level choice in these three states:

Effects of Strictly Aligning Premiums with Actuarial Value – Or Not

ACA Marketplace, 2023

Gold Plan Selection at Incomes Above 200% of Federal Poverty Level, 2023

Source: CMS Public Use Files[3] for the ACA marketplace. Excluded: enrollees with income unknown.

A5626 would pull off a trifecta: It would align plan pricing more strictly with the value each plan offers to enrollees; it would make gold and bronze plans much cheaper for New Jersey enrollees; and it would effectively charge this benefit boost to the federal government. It would do this by ensuring that the full value of Cost Sharing Reduction, which most silver plan enrollees receive, is reflected in silver plan premiums.

In the first year of enactment, A5626 would require that silver plans be priced at the average actuarial value obtained by all silver plan enrollees in the state, including those for whom CSR boosts the AV from the baseline 70% to 73%, 87%, or 94% (the three CSR levels). In New Jersey, that means pricing silver plans roughly on par with gold plans, which have an AV of 80% (close to the average for employer-sponsored plans[4]). In the second year, insurers would be required to price silver plans as if all enrollees obtained strong CSR – that is, to price silver as if the average AV were 90%, or platinum level -- well above gold’s 80% AV. That’s meant to be a self-fulfilling prophecy: If gold plans are cheaper than silver, then no one with an income above 200% FPL should buy silver plans, because gold AV is higher than silver AV at incomes above 200% FPL.

ACA premium subsidies are structured so that enrollees pay a fixed percentage of income for the benchmark (second cheapest) silver plan. When silver plan premiums rise, so do premium subsidies, rendering gold and bronze plans cheaper for enrollees. Those subsidies are funded entirely by the federal government. For those who are ineligible for subsidies, New Jersey offers silver plans off-exchange that do not price in the value of CSR. Thus the premium alignment mandated by A5626 is win-win-win for New Jersey enrollees, insurers, and the state budget.

Thank you for the opportunity to testify today. BlueWaveNJ is a grassroots group committed to helping secure economic justice and equal opportunity for all Americans and all New Jerseyans. We look forward to working with you to make health coverage more affordable for hundreds of thousands of New Jerseyans by passing A5626/S3896 into law. It is imperative to act now, while an administration is in place that will support this legislation.

Notes

[1] KFF, Average Marketplace Premiums by Metal Tier, 2018-2024, https://www.kff.org/health-reform/state-indicator/average-marketplace-premiums-by-metal-tier/?currentTimeframe=0&selectedRows=%7B%22wrapups%22:%7B%22united-states%22:%7B%7D%7D,%22states%22:%7B%22new-jersey%22:%7B%7D,%22texas%22:%7B%7D,%22pennsylvania%22:%7B%7D%7D%7D&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

[2] See the plan-shopping tools offered by each exchange:

https://www.nj.gov/getcoverednj/getstarted/compare/ https://enroll.pennie.com/hix/preeligibility#/

https://www.healthcare.gov/see-plans/#/

[3] https://www.cms.gov/data-research/statistics-trends-and-reports/marketplace-products/2023-marketplace-open-enrollment-period-public-use-files

[4] See KFF, “What the Actuarial Values in the Affordable Care Act Mean” - 2011, https://www.kff.org/wp-content/uploads/2013/01/8177.pdf

No comments:

Post a Comment